Bloomberg Technology

M1 Finance CEO on Limiting Trading in Wake of GameStop Frenzy

Jan.29 — Brian Barnes, founder and chief executive officer of M1 Finance LLC, explains why the company decided to curtail buying of some securities in the wake of the GameStop Corp. stock volatility. He speaks with Emily Chang on “Bloomberg Technology.”

Bloomberg Technology

The DOJ Goes After Google Chrome | Bloomberg Technology

Bloomberg’s Caroline Hyde discusses the DOJ’s push on Google to sell off its Chrome browser over concerns of a “search” monopoly. And, Roblox aims to enhance its child safety policies with the aid of AI. Plus, SpaceX hopes for a “catch” repeat as it readies to launch its Starship rocket with President-elect Trump in attendance.…

Bloomberg Technology

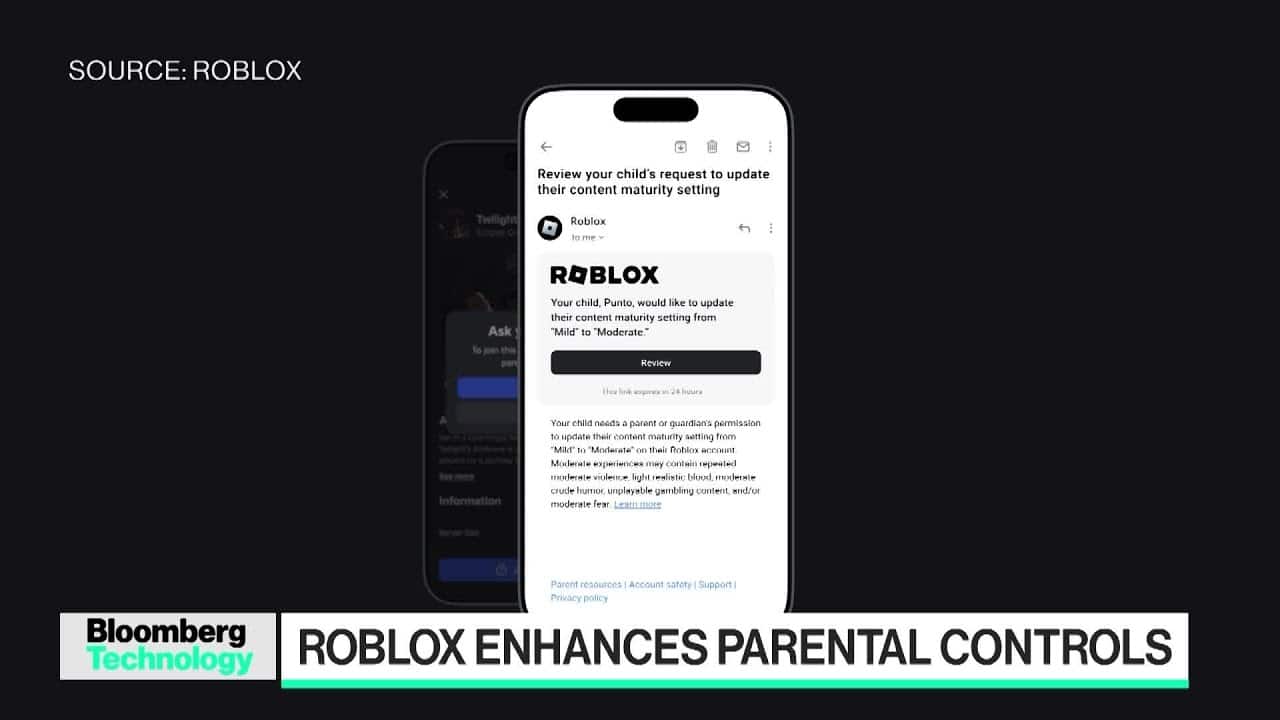

Roblox Issues New Safety Features

Matt Kaufman, chief safety officer at Roblox, joins to discuss new AI features and precautions being deployed by the popular online game as it faces increased scrutiny by parents and users. He speaks with Caroline Hyde on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

AI Governance Under a New Trump Administration

Navrina Singh, CEO of Credo AI, details the company’s latest partnership with Microsoft and the future of AI under a second Trump administration. She joins Caroline Hyde to discuss on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline Hyde and…

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired5 years ago

Wired5 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired5 years ago

Wired5 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Roman A. Oulko

January 30, 2021 at 12:26 am

Rich want to control us

Chess Dad

January 30, 2021 at 12:30 am

M1 Finance is my favorite. I am not a trader.

Breadley

January 30, 2021 at 12:41 am

They eating themselves with all this finger pointing

JT

February 1, 2021 at 12:34 am

They’re all saying the same thing though.

Harry Rees Finance

January 30, 2021 at 12:50 am

it’s the free market, people should be able to buy and sell as they please. seems like M1’s hand was forced here though, so can’t put any blame on them

Quiet Jagung

January 30, 2021 at 2:34 am

Here is a simple and honest explanation of the facts.

CNBC, Bloomberg and other MSM are trying to spin the facts and confuse the viewers.

Quiet Jagung

January 30, 2021 at 2:43 am

Can high trade in one stock really cause liquidity problem or is it just one more excuse to protect the short sellers?

Doctor Poopypantz

January 30, 2021 at 7:42 pm

Yes, it really can, and Robinhood is in the midst of a meltdown right now. The list of restricted stocks on that platform isn’t just limited to WSB-targeted, heavily shorted stocks anymore. It now includes everything from Starbucks to General Motors, with market caps far too big for the kind of dramatic price action seen in GME. Ripple effects from this ridiculous fiasco. Clients leaving them by the thousands doesn’t help their capitalization problems.

Robinhood deserves to fail as a result of this. Gamestop stock has been a topic for a while now. If RH could foresee this issue and did nothing about it, then they were in on it, and if they couldn’t foresee it, they’re too oblivious to be in business.

JT

February 1, 2021 at 12:34 am

@Doctor Poopypantz no one could foresee this event.

Owen Molloy

January 30, 2021 at 6:19 am

Lying through his teeth

Kyle Zawacki

January 30, 2021 at 8:20 pm

He isn’t though. Clearing houses are a necessary backend component.

taladuga picpwaspwat

January 31, 2021 at 4:43 am

@Kyle Zawacki but say i had gamestop stock… And their decision to restrict allowing buying of Gamestop stock cost me money, because that decision led to 58% crash in the value of Gamestop stock….

Are these platforms going to pay me the loses I incurred due to their decision? Are they?

If not, doesn’t that constitute financial fraud???

The Casual Front

January 30, 2021 at 12:02 pm

There’s a huge gap in the market for a brokerage that doesn’t screw its own customers

Doctor Poopypantz

January 30, 2021 at 7:19 pm

Schwab restricted some stuff, mostly margin stuff, and other option stuff. But there was no restriction on cash buys.

Doonga G

January 30, 2021 at 1:26 pm

He loved every minute of it lol

Juan-Pablo Veizaga

January 30, 2021 at 3:08 pm

All of a sudden its due to the market dynamics that there are now concerns in margins and options because they didnt have the funds to cover. Sounds like a flaw in the system – screw the short sellers. Even out the DECADES of the greedy rich. Power to the people!

mrpmj00

January 30, 2021 at 8:57 pm

SHORT SQUEEZE IS TERRIBLE! it’s called PUMP AND DUMP! I’M A RETAIL INVESTOR AND THIS CAUSED MY PORTFOLIO TO DROP BIG TIME!

STOP IT!!!!

buy Wells Fargo, AMAZON, FACEBOOK, NVIDIA, APPLE, MICROSOFT, NETFLIX

DON’T drive at all and work remotely.

capitol riot means a covid19 petri dish; we need another lockdown. we have Amazon Prime streaming and don’t need to travel

or go to a commercial theater and avoid covid19, mass shooting (gun sales doubled in 2020),

taladuga picpwaspwat

January 31, 2021 at 4:40 am

So who pays the people who lost money due to Robinhood decision to restrict buying of Gamestop stock?? It lost 58% after Robinhood’s move…

Doesn’t that constitute fraud??

I just want to know who is going to jail.

Omar Jimenez

January 31, 2021 at 2:06 pm

Started interview off strong but then stumbled at the end there. Either way I actually like M1.

Built for long term investing which, generally speaking, will remain relatively unaffected but the market frenzy. Yet I still got an email from them explaining what’s going in the market and their decisions. They seem to have better communication with their users

johnb blezer

January 31, 2021 at 11:28 pm

So when the wrong people win, we can’t let that happen?