People & Blogs

A simple 2-step plan for saving more money | Your Money and Your Mind

Saving money is like working out or eating right — it’s easier said than done. Behavioral scientist Wendy De La Rosa streamlines the process with two quick tips that can help you achieve your goals. Managing your money can feel scary and complicated, but it doesn’t have to be. In this TED series, behavioral scientist…

People & Blogs

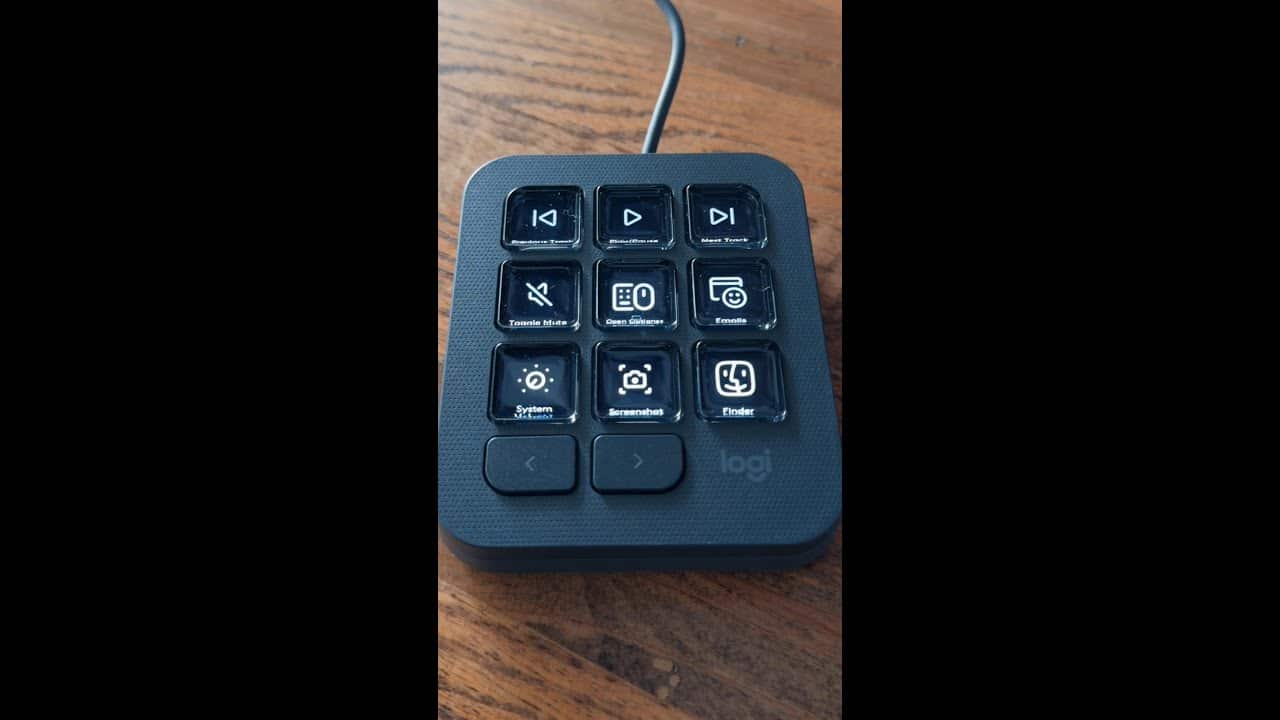

Streamline your creative workflow with the MX Creative Console by Logitech | TechCrunch

Logitech’s new $200 MX Creative Console aims to help users streamline their creative workflow with an advanced dialpad and keypad for intuitive control. (video via Yashad Kulkarni)

People & Blogs

WalkON Suit F1 For Wheelchair Users | TechCrunch

From KAIST Exoskeleton Laboratory and Angel Robotics, the WalkON Suit F1 is a “powered exoskeleton” designed to walk on its own, and allows for users to easily transfer into the suit from a wheelchair. #TechCrunch #technews #robotics #accessibility #robot

People & Blogs

Dreams · Made by Wayne Price and IN-Q with OpenAI’s Sora | TechCrunch

Wayne Price and IN-Q’s “Dreams” made with OpenAI’s text-to-video GenAI model Sora

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Prem Prem

March 3, 2021 at 3:27 am

Very Simple – Eat Oraginc Food which is not grown by Hybrid Seeds you will be able to save lot of money due to – Less Diseases, pure vegetables, pulses. When food will be grown by Natural way then Water, Air, Soil, will be clean and human will be automatically clean so buy food from Farmers Directly instead of going in Big Companies Stores they sail old stuff and worst stuff which looks nice in packets but behind the scenes it’s so worst if you see it once you will avoid to eat it so buy directly from Farmers, Live simple life less expensices less tentions – Good luck ! ……Where is actual problem man is not looking it there.

Joshfisher Fisher

March 3, 2021 at 4:15 am

Bitcoin to the moooon 💥💥

Joshfisher Fisher

March 3, 2021 at 4:18 am

I made over $11k in a week

Joshfisher Fisher

March 3, 2021 at 4:18 am

Reach Mr Peter roland for guidance on Whatsapp or email

you tou

March 3, 2021 at 4:20 am

So now ted is doing bank ads, ok

Royalsteven

March 3, 2021 at 4:23 am

Now I like pay the bills first and the rest i save on my saving account. Can’t waste personal money like that!

PrK Zoomin

March 3, 2021 at 4:53 am

A Good Quote, Only Dead Fish go with the flow.

Shashwat Sharma

March 4, 2021 at 3:49 pm

Depends on where the fish actually want to go,

If they want to go downstream for some groceries they can’t suicide because

“Only dead fish……..

Shashwat Sharma

March 4, 2021 at 3:49 pm

Would be quite inconvenient

BLTspace

March 3, 2021 at 4:59 am

99% of ppl won’t even see the Wells Fargo logo in the beginning. All the data in the world doesn’t include the cracked windshield that needs replacing or the furnace breaking in the middle of the winter. Literally one small emergency and individuals or families are starting at the bottom again. It’s an endless struggle that most ppl will never get out of. It isn’t because people can’t save properly, it’s because they’re not paid enough to begin with. I don’t even need to go into people suffering actual emergencies or healthcare bills. Videos like this are just insulting sorry.

adnan alam

March 3, 2021 at 5:12 am

1:16 gaaaaay

Sathya Narayanan

March 3, 2021 at 5:29 am

Well, I never actually saved money in my life. I just don’t spend unnecessarily. That’s the secret of my financial success.

Shashwat Sharma

March 4, 2021 at 3:53 pm

Hello there Warren, or is it Bill?

Practice and Repeat

March 3, 2021 at 5:37 am

It takes money to save it.

Pun Master

March 3, 2021 at 5:46 am

This is america, people don’t have money to save, what a fucking joke!

Billy

March 3, 2021 at 6:28 am

tldr; get a 6/7 figure education, 6 figure job, 401k, roth IRA, invest in stable things like the S&P 500… Or get the funds to buy your citizenship in a socialist country where the government actually does it’s job.

Yoshi Moshi

March 3, 2021 at 7:14 am

Don’t watch YouTube. Work more. More money.

Fuck Imperialism

March 3, 2021 at 7:32 am

Sponsored by Wells Fargo LMFAO

Dacian Kolkhuis Tanke

March 3, 2021 at 7:52 am

This being sponsored by Wells Fargo doesn’t feel right

UniQuE TV

March 3, 2021 at 7:57 am

I have some friends who struggle with money and I see the same pattern in all of them:

They don’t plan stuff. They live in the here and now and don’t think long term.

When I give them money they spend it on random stuff they don’t need because they don’t think much about their decisions.

They think: “I want X now, do I have money for X now? Yes? Ok, buy!” without thinking of better ways to spend their money or saving it, it’s sad… Idk how to help them :/

They are also very selfish, they think “I got money? Nice it’s mine now!” without thinking wether they deserve to have that money or not. They don’t complain about rich people because if they were rich they wouldn’t donate it to poorer people as well… It’s fucked up

Kiana Shirangi

March 3, 2021 at 8:01 am

I want her to keep talking,,, and I listen. There is something extremely charismatic in her voice and tone.

Roger Paul

March 3, 2021 at 1:39 pm

See sounds like JLo hot…

David Mendez Vivas

March 3, 2021 at 10:04 am

So Wells Fargo…the bank with the worse track record on fraud, client services, and basically a bunch of rats – is sponsoring this. Sounds like greenwashing to me. And most of the advice sounds condescending and not addressing the terrible inequality in the US. Shameful Wendy, Shameful.

niccolom

March 3, 2021 at 10:12 am

Her hand gesture reminds me of Obama, who using that kind of gestures to make people believe in his claims and promises, which are baseless and requires faith due to a lack of facts.

She’s not a politician.

She doesn’t have to make that kind of gestures because the thing she is talking about is logical and have proper reasoning. It bothers me that she talks like a politician instead of a teacher or advisor.

Din Subterán

March 3, 2021 at 12:00 pm

I think she’s selling insurrance? Kinda..

Алиса Далабаева

March 3, 2021 at 3:36 pm

What i do is i buy the last piece of clothing in the internet-shop at 95% discount. Sometimes the items i want are gone before i buy them. But knowing that i save for pension warms up my heart and i believe i will get even better items in future

Javier Chiappa

March 3, 2021 at 4:39 pm

1) buy hammock

2) cut a fake sun out of orange cardoard

there, you saved all that vacation money

Dima Kan

March 3, 2021 at 5:47 pm

Sometimes people forget that in order to save more money, you need to earn more money.

Leeann Elisha

March 3, 2021 at 6:38 pm

Thank you TED.

Sara Gomes

March 3, 2021 at 10:26 pm

Hello. You look a bit like Alicia Keys.😁

bear2bull

March 3, 2021 at 11:21 pm

Pundi X NPXS ^^

Kira S

March 4, 2021 at 2:29 am

I agree that having this sponsored by Wells Fargo seems like a conflict of interest. I personally have not had any problems with Wells Fargo. Our initial mortgage lender sold our mortgage to Wells Fargo and we are now about eight years into a fifteen year mortgage with no problems whatsoever. I do understand that Wells Fargo has used some extremely questionable practices in the past. At the moment, I am going by the maxim “if it ain’t broke, don’t fix it.” If it does break, that’s another story.

Surreal 69

March 4, 2021 at 2:31 am

everything depends on ur income when thinking about number of saving acct.

– First have two Saving account beside ur main account.

– Put away enough but not to hinder ur living expense which cause u to go into ur savings.

– everytime u get a income tax/extra money from somewhere, divide it up and place it within ur accounts. Keep doing this infinite.

– when u get a raise, build ur saving amount up 👆 ex. 200 saving, u get a raise add partial to that and now u saving 225 a month

HAPPY VLOGS

March 4, 2021 at 1:34 pm

Thanks 🙏🙏🙏🙏

TheMrfrodough

March 4, 2021 at 4:34 pm

Citation needed for said “study”.