Science & Technology

The public markets are afire

Full episode here: The public markets are afire these days with Apple reaching $2 trillion in market cap, and Tesla’s stock doing all sorts of odd things. In short, stocks have only gone up for a while and that means there’s warm, nigh-stuffy temperatures around assets of all types.

CNET

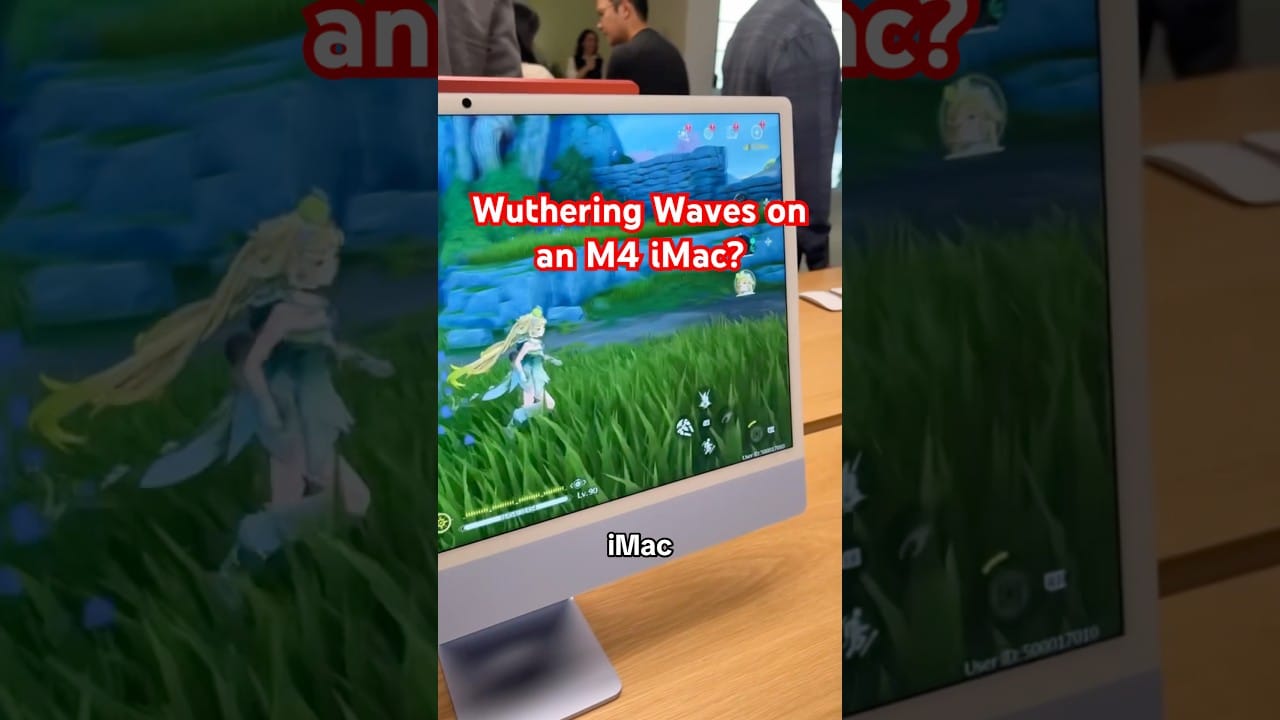

Gaming with Mac in Apple M4 Processors

Playing Control and Wuthering Waves felt pretty smooth and fluid across each device, with the ray tracing on water and lighting looking especially impressive, even on a cartoony art-style like #WuWa. #gaming #macgaming #pcgaming #apple #wutheringwaves

CNET

POV: You Have 30 Minutes

At least there was cake! #apple #pov #workhumor #journalism #socialmedia

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired5 years ago

Wired5 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired5 years ago

Wired5 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired5 years ago

Wired5 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired5 years ago

Wired5 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Neeraj Nair

August 22, 2020 at 11:47 pm

If you guys watched Tesla Daily or even looked at the shift from PE (TTM) 1000 something to PE (FWD) 200 something, you will realize why Tesla has been rising. (Context: TSLA is at $2000 as of Aug 21 2020). I think it is unfair that you folks share your opinion about Tesla without studying the company and comparing them to Yahoo. If you compare the innovation happening at Tesla to a company like Yahoo, then all the best for your future. Also, please take a look into Ark Invest’s research about Tesla.

Jadd Converted Aussie

August 23, 2020 at 12:13 am

OpenLearning ASX:OLL

is taking advantage of the work-from-home (WFH) shift to move into professional development. Its first target, Financial services.

OpenLearning ASX:$OLL

& Australian Trade and Investment Commision Deal

OpenLearning=ASX:$OLL

Quarterly activities report.

This below is just a little of my research on why online learning is needed, becoming more in demand and the way education is going.

Massive online open courses see exponential growth during COVID-19 pandemic

The potential of online learning for adults: Early lessons from the COVID-19 crisis

A New Pedagogy is Emerging… and Online Learning is a Key Contributing Factor

Facts and Stats That Reveal The Power Of eLearning

Online Learning Market Size is Projected to Grow CAGR 10.85% by 2025 – Valuates Reports

Georgia Teachers’ Back-To-School Rap About Virtual Learning Goes Viral

UNC-Chapel Hill begins testing as coronavirus cases spike, while N.C. State switches to virtual classes

Cal State was one of the first universities to put its fall semester online.

COVID-19 outbreaks in children complicate school reopening plans

Initial evidence suggested that children did not easily spread the virus, but new studies are challenging that view.

This below is just a small example of how kids and young adults are being affected by the coronavirus.

Coronavirus infections in Florida children surge 137 percent in a month

Kids are bigger coronavirus spreaders than many doctors realized

Coronavirus infections are rising in children, CDC says

Confirmed Coronavirus Cases in U.S. Children Rose By 90% in About Four Weeks This Summer, Bringing the Total to Over 380,000

Jacob Eardley-Wilmot

August 23, 2020 at 12:29 am

Given that Bitcoin has been in a strong uptrend, traders have consistently purchased dips to the 20-day exponential moving average ($11,570) because they believe that the rally will resume and the price would not dip to these levels again. However, Bitcoin’s weak rebound off the 20-day EMA on Aug. 20 suggests that the bulls are not confident that the uptrend will resume, hence, they are not buying aggressively at this support. The negative divergence on the relative strength index suggests that the momentum has weakened. If the price breaks and sustains below the 20-day EMA, the traders are likely to wait for the BTC/USD pair to find support at lower levels, before buying. On a drop below the 20-day EMA, the decline can extend to the $11,100–10,900 support zone. Contrary to this assumption, if the pair rebounds off the 20-day EMA, the bulls will make another attempt to push the price above the $12,113.50–$12,460 resistance zone. If they succeed, the uptrend is likely to resume. My only advice for investors/newbies is to take advantage of Louis Mattson’s program, a Pro trader who is helping investors AND newbies accumulate more bitcoin through his amazing trading strategy. With his program i made 4 BTC in less than 16 days of day trading with 0.8 btc. His shareware works. You can reach him via email mattsonlouis41 at gmail dot com or via telegram for faster communication at Lmattson42 for more insight on his program.

Mercedes Arnette

August 23, 2020 at 12:49 am

I told my partner that Louis is indeed the best now with his guidance and magical daily signals..

Kevin J. Mason

August 23, 2020 at 12:57 am

I am from Manchester and here in my neighborhood they value and respect Louis Mattson because his strategy gave them back their lost during the ‘Black Thursday’ on March 12th, 2020 when crypto market crash from $7900 to $4300

Rebekka Bjørgum

August 23, 2020 at 1:02 am

He is very sound in analysis and his service delivery is top notch. I am so grateful to him for his assistance which has made me a much better and profiting trader

Larry Hepner

August 23, 2020 at 1:14 am

I am new into the crypto market and have been looking for someone trustworthy i can listen to. Thanks for sharing

Archie Lindeman

August 23, 2020 at 1:23 am

Best TA and FA guy i know.. I have only been using Louis signal for 2 week and 4 days now and my portfolio has increased from 0.5 btc to 1.2btc.

Sabine Lowe

August 23, 2020 at 1:37 am

Louis was referred to me by my customer and his daily signal are 100% viable

Pat Barnes

August 23, 2020 at 1:44 am

The course that Louis teaches is very comprehensive, extremely enjoyable and equips the modern day trader for success. There are no other programs that compete.

Roosevelt Latham

August 23, 2020 at 1:50 am

I have been making more than six times of my portfolio every week since i embraced the Louis program. Yes, his signals are 100%.

Chip Fernandez

August 23, 2020 at 5:09 am

APPL and many other stocks are simply rising simply due to monetary inflation. If Fed prints TRILLIONS with minimal low interest rates….it’s all a mirage.

EXACTLY where is the profit coming from? (And don’t say stock buy backs)

Shubham Kumar

August 23, 2020 at 12:31 pm

I think I watch these clips because of Natasha. Simping is a disease Lmao!

Bobby Richardson

August 24, 2020 at 3:17 pm

Tesla’s advanced technology and high efficiency is what’s giving them incredible demand. Don’t look at the dollar signs, examine the technology.