Bloomberg Technology

Banks Are Most Vulnerable to Crypto Revolution: Novogratz

Feb.25 — Michael Novogratz, the founder of cryptocurrency investment firm Galaxy Digital, talks about the Bitcoin revolution. and the growth of his asset management unit. He spoke to Jon Erlichman of BNN Bloomberg.

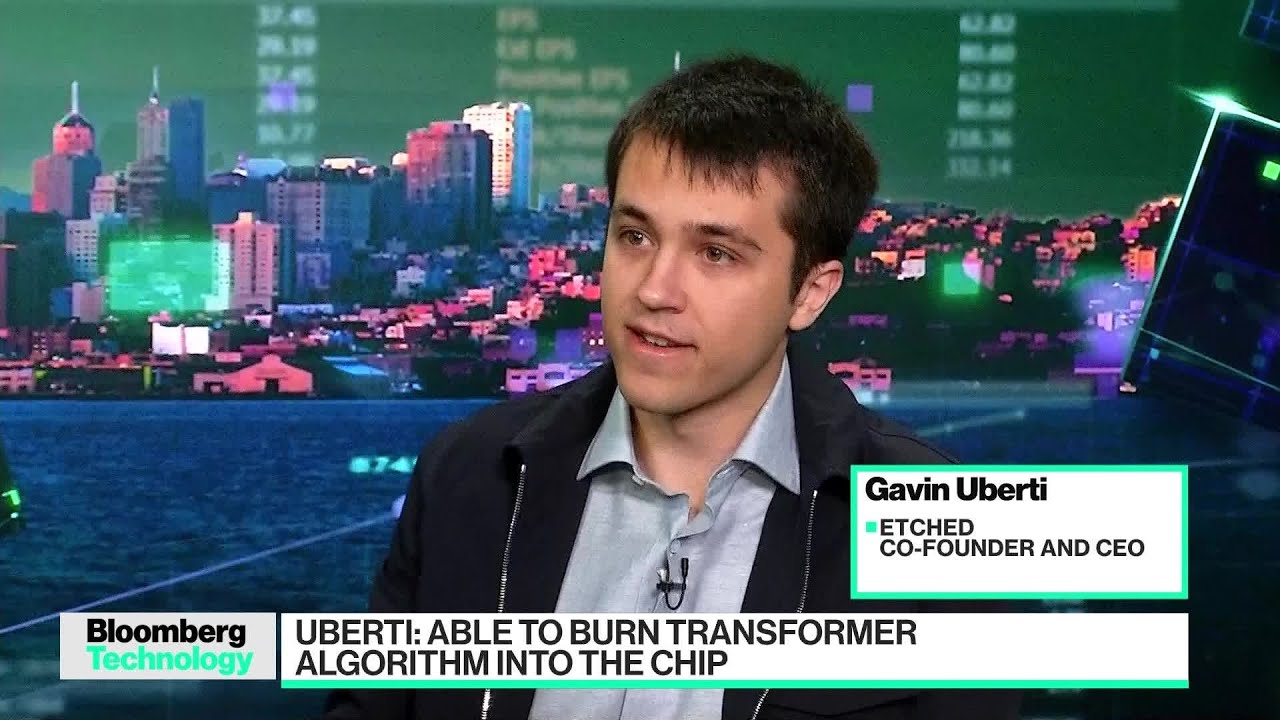

Bloomberg Technology

AI Chip Startup Etched Aims to Take On Nvidia

AI chip startup Etched raised $120 million to expand manufacturing of its specialized chip that it boasts will rival Nvidia’s products. Etched CEO Gavin Uberti joins Ed Ludlow on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline Hyde and Ed…

Bloomberg Technology

Will #ai end poverty or create more problems? #technology #shorts

Sam Altman sees a future where AI and universal basic income can end poverty. But in the background, his sister struggles with homelessness. In this episode of Foundering, we look at his proposal for a new social contract. Listen now: Like this video? Subscribe: … Get unlimited access to Bloomberg.com for $1.99/month for the first…

Bloomberg Technology

Nvidia’s Slide and Apple’s EU Fines | Bloomberg Technology

Bloomberg’s Ed Ludlow breaks down Nvidia sliding for a third consecutive day and wiping out $400 billion off its market cap. Plus, Apple faces billions of euros in fines over its App Store rules under the EU’s Digital Markets Act, and car sellers warn of a possible material hit from the CDK cyberattack. 08:09 Wealth…

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

Wired5 years ago

Wired5 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired5 years ago

Wired5 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired5 years ago

Wired5 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

People & Blogs2 years ago

People & Blogs2 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired5 years ago

Wired5 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

Wired5 years ago

Wired5 years agoJessica Alba & Gabrielle Union Answer the Web’s Most Searched Questions | WIRED

Israel Afangideh

February 25, 2021 at 11:45 pm

Novogratz is bullish

baby smile

February 25, 2021 at 11:48 pm

Banks are simply gonna outprice and outsmart everybody and make crypto their new playground.

Ken Pires

February 25, 2021 at 11:53 pm

Banks should be worried

French Fry Montana

February 25, 2021 at 11:55 pm

Mike Novogratz is sounding more and more like Gavin Newsom with his voice gargle. Mike NovoGargle💯💯💯#buybitcoin

Samurai Western

February 25, 2021 at 11:56 pm

Fuck a bank and them making money off my money as a loan for a car are house off my money give me that interest off that house loan car loan all loan made off my Maloney at your bank 🏦

David Marquez - Personal Finance & Investing

February 26, 2021 at 12:09 am

That’s why I find JP Morgan’s experimentation with crypto and blockchain very interesting. That may be the thing that ends up propelling them far above their competition.

SpeedOfDarknesss

February 26, 2021 at 12:16 am

pokemon cards have more intrisic value than bitcoin.

Katrina Fx

February 26, 2021 at 12:31 am

the year 2020 was most difficult for many traders out there, and for those that didn’t notice, the markets were crazy for the most part of the year, especially during the early outbreak of the covid19 pandemic, and it’s not a stretch to say that majority of investors were losing their shirt within that period, and i think many folks were also threading with caution when it came to investing their money in stocks, binary options, forex or even cryptocurrencies, because of these main factors. fear of taking avoidable risks (which is really good). “Unpredictability” of the market (permit me to use that word). Gambling instead of Trading. Indecision and lastly the fear of separating real from fake (which is a very tough decision to make). well this new year brings good tidings for us traders, what if i told you that there are ways to bypass all of this, trade like a PRO and earn from trading. (believe me, getting profits from your trades no matter how small is really an incredible feeling) yes you can trade and earn on your own with a Do-It-Yourself system, programmed to have a recurring price behavior that actually gives you powerful hints, with amazing accuracy, with the ability to decide where the market will go next so you can scalp it, shave it, slam it, whatever expression you’d like to use, the end point is that you basically get to rip profits off the market at the first instance of movement it gives you, This is a breakthrough discovery that will change the way you review the market and decide your course of action. i started using this program (i call it a program because it has all we need, guidance, different strategies to bank on and amazing signals.) i started using it after finding out how amazing it was and decided to share with a few of my friends and a particular lady’s story struck an impact, she started with $1600 and has made over $13200 in a few months, here’s what i love about her story, unlike me, she started small, so you know anyone can do it. she was a beginner when she did it. following my guidance, she used clear, rule-based methods that are repeatable. This isn’t high risk trading. i use controlled risk and known probabilities, so i have full control of my input and output. In fact, the methods are extremely simple. email me with your subject as “how to bypass all trade difficulties” and i’ll be sure to respond to you as soon as i can. When you do, you will learn that there is nothing complex or difficult about trading options.

[email protected]

Nikola Klisovic

February 26, 2021 at 12:34 am

Basically, there´s no need for any private banks in the world of cryptocurrencies, except maybe a central bank in each country, to handle taxes and all other state business. So if any of these banks even start with crypto, I don´t see any reason to use their services, except maybe for credits and loans. As the man said, you literally don´t need a bank account, you have your digital wallet.

ps 403547

February 26, 2021 at 12:40 am

Banks are the most vulnerable to crypto?

You might as well say meat suppliers are vulnerable to a vegetarian movement…

Rn Kn

February 26, 2021 at 12:42 am

It’s time for more analysios and nuance than these two otherwise irreconcilable positions offer. PLEASE.

rrzz3389

February 26, 2021 at 12:51 am

Tether is a bit but even if recent news

L C

February 26, 2021 at 1:06 am

USA has no initiative to use digital currency. That means death of dollars.