Bloomberg Technology

Tencent Weighs Kids Games Ban After ‘Spiritual Opium’ Rebuke

Aug.03 — Chinese state-run media is branding video games as “spiritual opium.” That comment is stoking fears that online entertainment is Beijing’s next target. Bloomberg’s Shery Ahn reports on “Bloomberg Technology.”

Bloomberg Technology

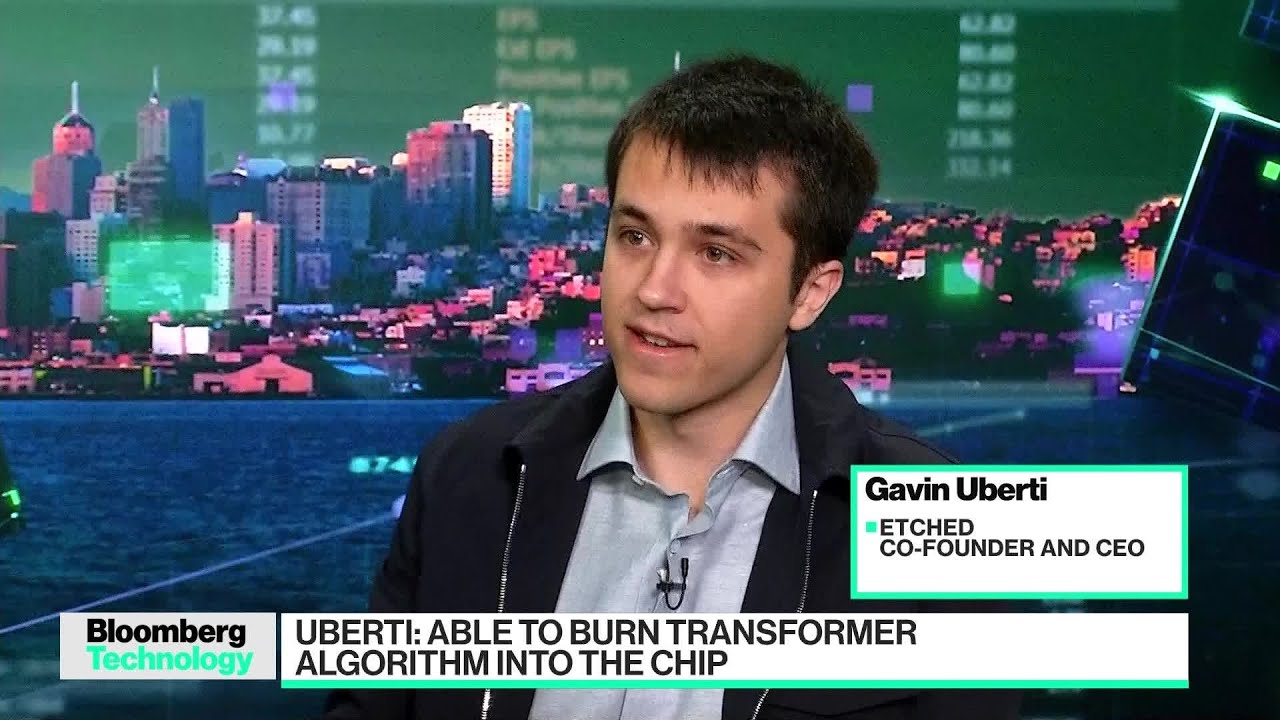

AI Chip Startup Etched Aims to Take On Nvidia

AI chip startup Etched raised $120 million to expand manufacturing of its specialized chip that it boasts will rival Nvidia’s products. Etched CEO Gavin Uberti joins Ed Ludlow on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline Hyde and Ed…

Bloomberg Technology

Will #ai end poverty or create more problems? #technology #shorts

Sam Altman sees a future where AI and universal basic income can end poverty. But in the background, his sister struggles with homelessness. In this episode of Foundering, we look at his proposal for a new social contract. Listen now: Like this video? Subscribe: … Get unlimited access to Bloomberg.com for $1.99/month for the first…

Bloomberg Technology

Nvidia’s Slide and Apple’s EU Fines | Bloomberg Technology

Bloomberg’s Ed Ludlow breaks down Nvidia sliding for a third consecutive day and wiping out $400 billion off its market cap. Plus, Apple faces billions of euros in fines over its App Store rules under the EU’s Digital Markets Act, and car sellers warn of a possible material hit from the CDK cyberattack. 08:09 Wealth…

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

Wired5 years ago

Wired5 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired5 years ago

Wired5 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired5 years ago

Wired5 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

People & Blogs2 years ago

People & Blogs2 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired5 years ago

Wired5 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

Wired5 years ago

Wired5 years agoJessica Alba & Gabrielle Union Answer the Web’s Most Searched Questions | WIRED

pawsandbreathe

August 3, 2021 at 11:51 pm

What the hell is wrong with gaming???

Ibeji Benson

August 4, 2021 at 12:02 am

they have a problem with its addiction, just answering your question not my opinion on the subject.

mrPmj00

August 3, 2021 at 11:51 pm

AMAZON:

+Yep, I bought a ton on the dip.

Amazon invested $14 billion in the last quarter alone, the same as it spent in 6 months before that. It is a do not sell stock.

…With the Delta virus coming at full speed ahead, pandemic sales will make a comeback.

Amazon is investing so much money, that no competitor will ever be able to catch up.

My strategy is if Amazon keeps going down, I buy more to average cost down..

I buy using money on the sideline, then I sell other stocks that are up, then I sell other stocks that have lost less than Amazon’s -7.5%. Most stocks that pop or

drop hard usually recover 50% soon after.

Amazon’s not going anywhere so I know that eventually it will come back.

Fidelity considers Amazon as a large growth company (probably because as big as it is, it still only has 7% of the retail market)

mrPmj00

August 3, 2021 at 11:51 pm

=Have you noticed that Wall Street Journal, Yahoo, CNBC, CNN and bloomberg hate tech (even though most of us have 401k plans that have big tech) and push crypto crap, NFT ponzi scheme, and meme/gambling stocks like AMC/gamestop/SPAC, promoting China, and scaring investors by promoting inflation?

For the fools that bought crypto in May 2021, they’ve lost -50% as of July 2021, even worse if you bought dodgecoin -80%!

+I bought FAANG stocks (Facebook, Apple, Amazon, Microsoft) …

___Disney, Wells Fargo for the recovery.

Googlebanmetoomuch 2

August 3, 2021 at 11:57 pm

Spiritual Opium!?👀☠ Sold all my shares

Samurai X

August 4, 2021 at 12:03 am

A decade ago, China cracked down on Facebook for spreading fake news. Today, China’s decision is turning out to be prescient. China’s political will to crack down on the social ills and social inequality caused by big tech and big biz will be emulated by other countries. In sharp contrast, the US is unable to rein in big tech and big biz.

Slickpete83

August 4, 2021 at 12:36 am

*Ten_cent will be Five_cents by next week* hahahaha