Bloomberg Technology

Didi to Delist from U.S. Stock Market

Race Capital’s Edith Yeung joins Emily Chang to discuss Didi’s delisting only 6 months after its IPO, following the latest Chinese tech crackdown intending to close a loophole used by Chinese tech firms for foreign IPOs, and how this will affect U.S. investment in Chinese companies.

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

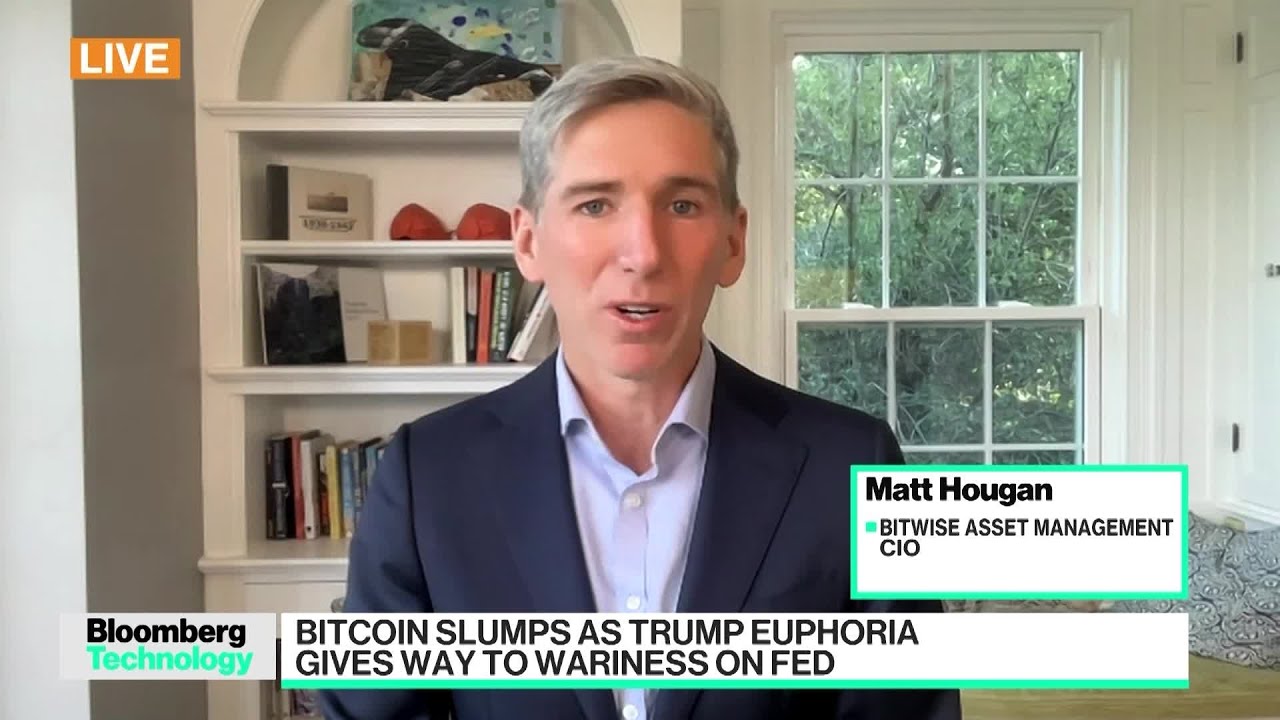

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Shirley michael

December 4, 2021 at 1:09 am

Shirley michael

December 4, 2021 at 1:10 am

Ramliang44 VlA Te le gr am….📧📧

Shirley michael

December 4, 2021 at 1:10 am

Ramliang44<<<<*<<

Shirley

December 4, 2021 at 1:09 am

Shirley

December 4, 2021 at 1:10 am

Ramliang44 VlA Te le gr am….📧📧

Shirley

December 4, 2021 at 1:10 am

Ramliang44<<<<*<<

Christianah Rose

December 4, 2021 at 1:26 am

Nice content

Christianah Rose

December 4, 2021 at 1:28 am

Christianah Rose

December 4, 2021 at 1:28 am

Bobbymickael

T elegram

Winnie

December 4, 2021 at 1:27 am

Anyone can advice what is the criteria and condition from SEC to approve didi to be delisted and protection framework for investors?

YouTube Sucks

December 4, 2021 at 1:28 am

Silence your dammm phone

Arindam Das

December 4, 2021 at 1:29 am

how can didi gets listed in HK, It’s not profitable

hh 06

December 4, 2021 at 4:51 am

They can’t. HK has more stringent IPO rules than the US

AJ

December 4, 2021 at 5:38 am

@hh 06 hkg listens to ccp

Winifred Bilson

December 5, 2021 at 12:30 am

Are you having trouble trading on Forex

hh 06

December 5, 2021 at 2:25 am

@AJ So? Do you have pay federal taxes after done with state taxes?

Keng He

December 4, 2021 at 1:56 am

Because us gov want to steal china market data

Jay MCC

December 4, 2021 at 3:40 am

great business analysis

daa liu

December 4, 2021 at 4:19 am

what is that sad coming from, stupid comments

Ken Yup

December 4, 2021 at 5:17 am

Why there’re many times that phone rings beeping in this video, WTH

Chanahying Chan

December 4, 2021 at 9:03 am

delist all chinese chinese stock from US and let them relist in Hangseng.Shanghai even Singapore

Winifred Bilson

December 5, 2021 at 12:29 am

Do you trade alone

leigh heinz

December 4, 2021 at 10:30 am

lol

John W

December 4, 2021 at 3:06 pm

Saying she invest in crypto just completely made her comments irrelevant

Tam Ngoc Nguyen

December 4, 2021 at 11:42 pm

Komunist claws reach stock markets now??

Eddy 德

December 5, 2021 at 3:51 am

With CCP in charge, HK will listen to China. Didi will get listed in Hk.