Bloomberg Technology

Rivian Ready to Go Public Valued at $53 Billion

Rivian Automotive Inc., the electric truck maker backed by Amazon.com Inc., plans to raise as much as $8.4 billion in an initial public offering that could give it a value of as much as $53 billion. Ed Ludlow reports on “Bloomberg The Open.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

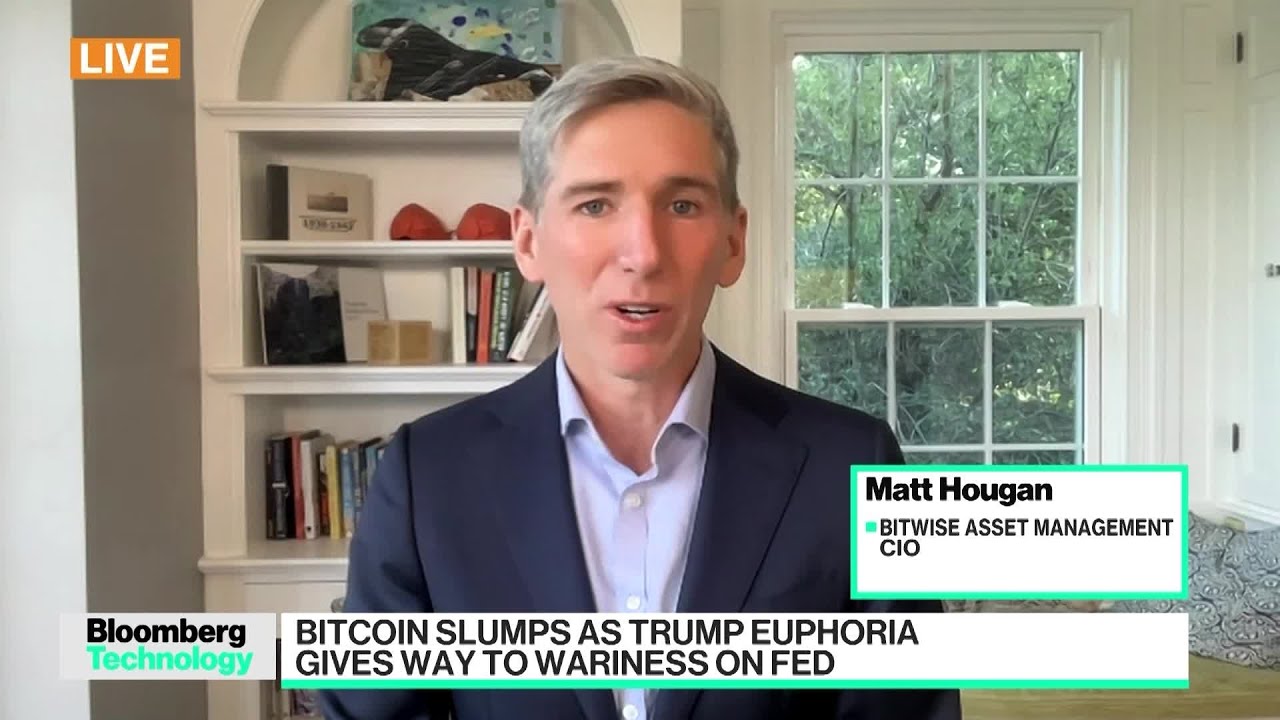

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Edgar Cardenas

November 5, 2021 at 7:18 pm

$#$ Forbes owner blue pen 🖊️ boss Tony stark

lewisgv

November 6, 2021 at 12:09 am

Tesla no.1

Kevin Pasala

November 6, 2021 at 3:33 am

For sure. But if this company is only 40 percent of Tesla that’s 400 dollars a share eventually. If it’s worth 65 that’s a 400 percent return.

Conner G

November 6, 2021 at 4:52 am

Yea yea we get it

Thad L M

November 6, 2021 at 11:10 pm

@Conner G Tesla is the next Tesla….

Prabakaran Perumal

November 6, 2021 at 4:01 am

I am still unable to understand valuation like 50 billion or 60 billion for zero revenues.

Mark Plott

November 6, 2021 at 6:56 am

Short sellers are going to TANK the Rivian IPO to $0/share.

Arise Training Program

November 6, 2021 at 10:12 am

Boooooooo ridiculous eval. You’re not special, you need to validate you can manufacture at scale and be profitable

Cybrtrk

November 6, 2021 at 1:09 pm

Not a single vehicle delivered to a customer… what a mockery of human emotion to invest in EV transition.