Bloomberg Technology

Rivian Is Banking on the Anti-Tesla Crowd for VW Venture

Bloomberg’s Max Chafkin joins Caroline Hyde and Ed Ludlow to discuss a Businessweek deep dive into Rivian and how the startup persuaded Elon-phobic car buyers to drop $70,000 on its EVs – and how it now needs to make money. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube:…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

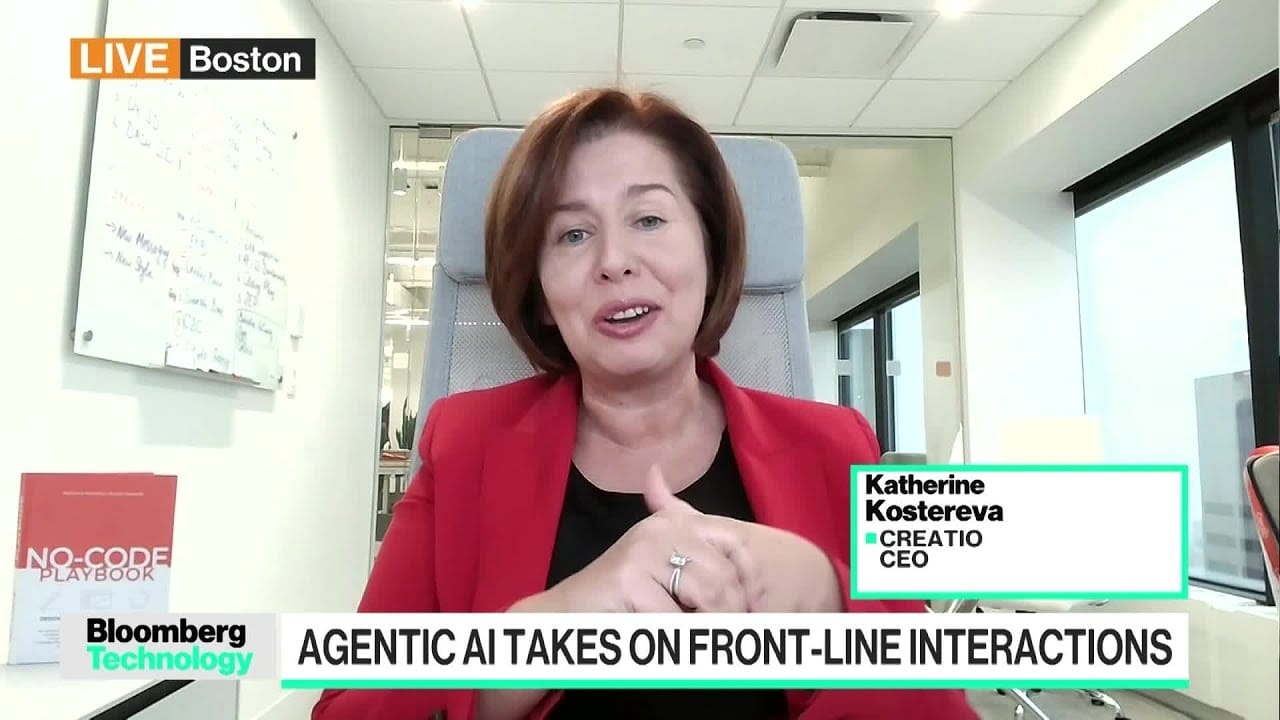

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

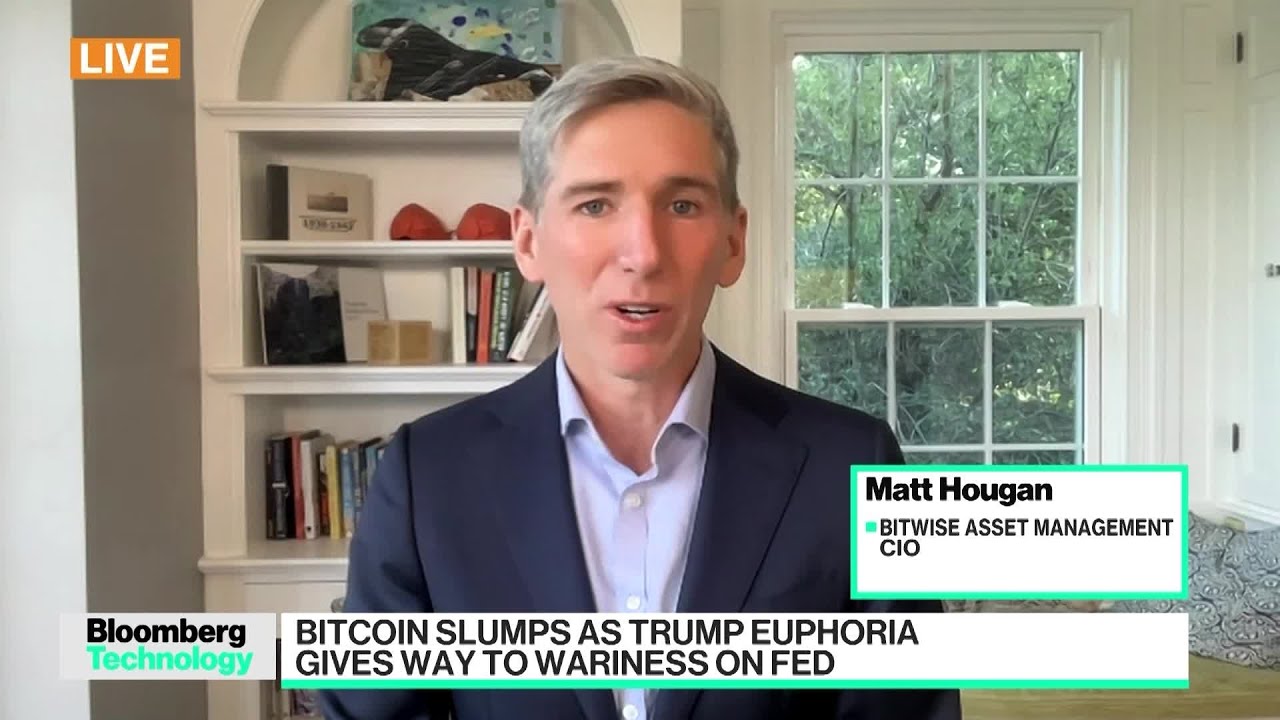

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

@Rx100Vx

July 11, 2024 at 3:38 pm

Rivian is creating its own space in the mobility space and it’s got the vehicles and brand to make it.

@andromedach

July 11, 2024 at 4:16 pm

If this is their game plan they will definitely go broke. They are losing nearly a billion dollars a quarter just to run the company and that does not count their losses per each vehicle sold which they no longer claim will be a positive number by end of year. VW infusion is only 1b initially but all other funds are not there to pad Rivian’s bank account. Rivian has less than eight billion dollars of cash available which gives them six quarters before a new funds raise will be required.

@SupportAI309

July 11, 2024 at 6:15 pm

You still don’t get it huh

@DolphinAnalyticsAI

July 11, 2024 at 7:30 pm

TESLA Game is crystal clear now… while the competition still does not have and AI vision of how to train a massive Nueral network to power the self driving future. Do they even have a data center they are building Vidoe based AI Models on? Love to hear more about TESLAS competition and how they are going to compete in an AI world of tomorrow.

@rannickcauthon1821

July 11, 2024 at 4:16 pm

Bottom line, Rivian delivers less car for more money…

@skyak4493

July 11, 2024 at 4:27 pm

I think that is all just online troll wars. The biggest threat to tesla is Elon. Rivian has a good product and plan but has a lot of expensive growing to do.

I sure as hell would rather have an R1 than a cyberturd.

@Teen-Conor

July 11, 2024 at 6:07 pm

Biggest threat is Elon? How stupid is that comment. Tesla doesn’t exist without Elon. Just because you are a leftist twat that likes censorship it doesn’t mean the market will follow your dumbass ideology.

@AshleyKeith-vw7ws

July 11, 2024 at 6:12 pm

The distress for banks was a farce; what we have experienced in the past 2 years is a result of a system that has worked incredibly well. The Fed just had to tighten credit to cool the economy.

@ChloeCarter-kd7gz

July 11, 2024 at 6:14 pm

What about the Fed lending program for banks that was said to ease financial tensions after the domino effect from Signature and Silicon Valley bank?

@AshleyKeith-vw7ws

July 11, 2024 at 6:19 pm

Yeah, that sufficed, but what really helped the economy was rising immigration that helped even out the mismatch between open jobs and people looking for work.

@EricaWaters-lr6zw

July 11, 2024 at 6:21 pm

I agree. Rising productivity is manna for central banks, allowing faster growth without inflation because each hour of work yields more goods and services at the same cost.

@HRMColoniallifeinsurance

July 11, 2024 at 6:22 pm

I’m indifferent. All I really do care about is what assets and securities will drive the Santa Rally? It is upon us, folks. I have a $100k portfolio, and I have a friend who has grown theirs to over 30% with the recent rallies. He is up 4% this month alone!

@AshleyKeith-vw7ws

July 11, 2024 at 6:22 pm

I might sell to the tune, but not without the approval of my broker as usual since 2022. With eyes and ears on Wall Street, I have raked in 140% on a managed portfolio currently worth $315k run under a hedge fund by Desiree Ruth Hoffman.

@DolphinAnalyticsAI

July 11, 2024 at 7:21 pm

I hope some of the lagging inefficient competition can catch up to TESLA. I think there is a ton of services that TESLA will be able to offer to help these guys get off the ground and become self sufficient profitable and most importantly SCALABALE EV manufacturing business. I think TESLA’s massive EXPERIENCE/AI/DATA advantage can be leveraged as a Service for some of these struggling companies to compete. Everybody wins. Thankfully TESLA has open sourced its Charging Network, but i think they will offer much more in the future… they want and need the competition… I hope they can learn to cooperate to have a bright future… while TESLA has a grand plan in progress for the Energy business as a whole… seems like these less mature companies are focusing on how to become profital just to survive.