Bloomberg Technology

Redfin CEO on Housing Market, Rising Interest Rates

Redfin CEO Glenn Kelman joins Emily Chang to talk about mortgage rates in the U.S. inching closer to 4% and its impact on the housing market. He also shares his insight on where real estate investors are buying homes in the U.S. and how out-of-towners with big budgets are fueling rapid price growth in popular…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

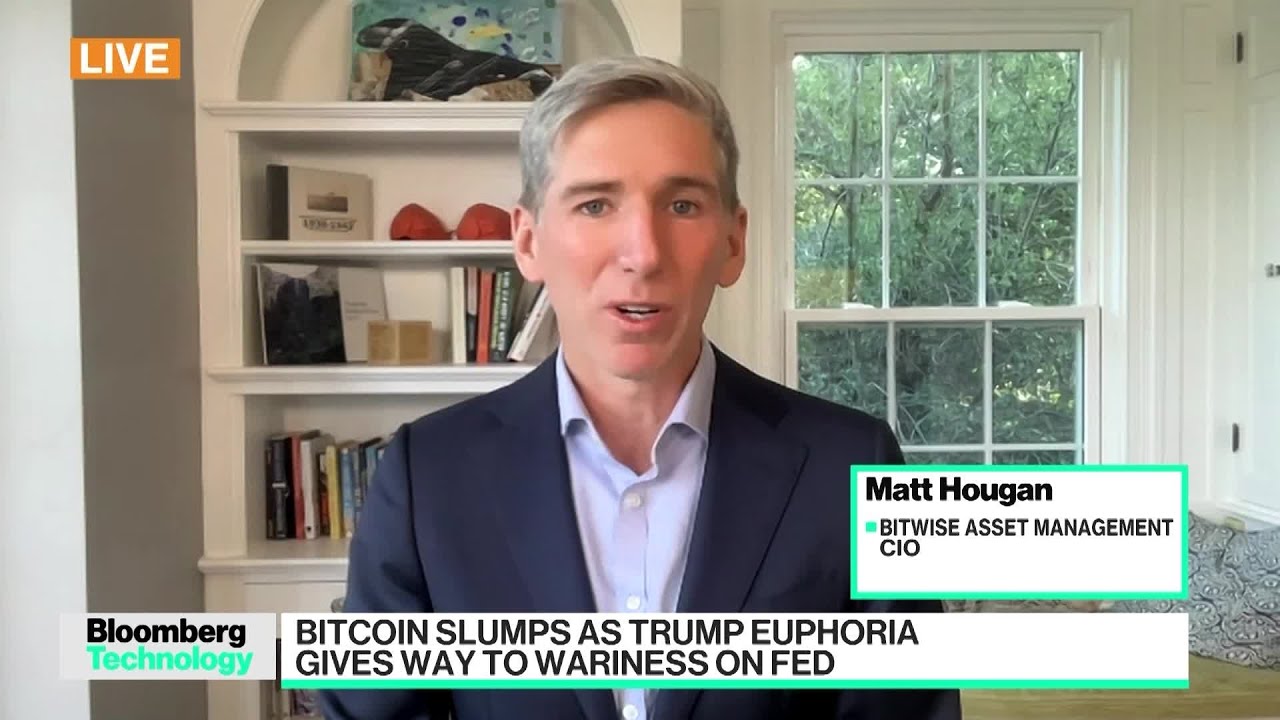

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Cristal Jorden

February 18, 2022 at 1:25 am

◦Fantastic video. I am a bit skeptic, but I know a lot of aspects about BTC. So, let’s make few things straight – BTC is an investment asset – like gold, it’s scarce, but it’s easier to acquire it and big players like pay-pal and grayscale are holding it, same with a lot of banking institutions, hedge funds and masses of people, self-host wallet btc owner whales have a hard time selling it without doing KYC and in some cases, this can wreck them financially. People lose access to their btc wallets which makes that btc frozen for all time. The Hype and FOMO is on the rise and most people only buy and hold with btc. I mean you have to understand that normal stock market fundamentals don’t apply here. It’s not a 2017 – 2018 scenario. The regulation added to BTC can actually even make it more desirable(although have a minus). Basically, anything that could stop the mooning of btc imo would be extreme regulation restrictions and also better investment opportunities discovered by btc owners. However , it’s is best advice you find a working strategy/daily signals that works well in other to accumulate and grow a very strong portfolio ahead. I have been trading with Mr Liam Bradley daily signals and strategy, him guidance makes trading less stressful and more profit despite the recent fluctuations. I was able to easily increase my portfolio in just 4weeks of trading with Bradley daily signals growing 1.5 BTC to 6.7 BTC. His daily signals are very accurate and yields a great positive return on investment and is available to give assistance to anyone who love crypto trading, *you can contact him on Telegram @ Liamtrade1. ** for inquires and profitable trading systems…

mrpjk99

February 18, 2022 at 1:26 am

He helped me to grow my portfolio too from 0.6btc to 4.3btc within 4 weeks.

Matt Philips

February 18, 2022 at 1:26 am

Trading is a lot like riding a roller coaster. Although it obviously is fun and exciting, there will be times when you feel scared, nervous or even powerless . When these bad times come, it’s important to not panic or give up. One excellent thing to do during these troubling times is keep your head up and work with the right strategy like I am doing now, if you don’t have a strategy, Reach out to Mr Liam Bradley for Guidance.

mary stone

February 18, 2022 at 1:27 am

Never missing out on an opportunity to grow my portfolio this year 🇺🇸🇺🇸

Mr Gaetan0007

February 18, 2022 at 1:28 am

My wife and I have been trading and earning close to $550K yearly with his strategy, he has been a blessing, we just paid our mortgage , over 7BTC still left and we are experts on our own now.

Chris Nelson

February 18, 2022 at 1:25 am

Love this guy! Lol

Seeking Freedom

February 18, 2022 at 1:27 am

How about sellers stop being greedy

Josh Binder

February 18, 2022 at 1:54 pm

I love this guy, chill school-counselor vibes

Anthony Warner

February 18, 2022 at 6:21 pm

“i’m not a loaf of bread 🥲” hahaha

JacksonRR1usa

February 18, 2022 at 2:00 pm

I live In Dayton, OH. The Market here is absolutely SICKENING!!! Barely any houses stays on the Market more than 3 days. The good ones sell in 1 day, or even just HOURS after listing!! People still paying way over asking with cash! The inventory is basically zip to none. This is Beyond out of Control!! I bet if interest rates were 6% it still wouldn’t change anything.

Hokey Wolf

February 18, 2022 at 2:27 pm

Great for those who have to sell.

BlueEyes

February 18, 2022 at 2:14 pm

I rather work in the office and do half of the work. Work from home and do twice of the work and still getting emails about not working enough. Totally different kind of stress. No more free coffees break, bathroom and so on.

Malcolm B

February 18, 2022 at 2:49 pm

@5:22 he gave the only and best answer.

Ryan Satchell

February 18, 2022 at 6:48 pm

That may have been the best shot someone has taken at zuckerburg in a while. lol

D C

February 18, 2022 at 3:15 pm

First time I have listened to this guy. Love his style.

J T

February 18, 2022 at 4:36 pm

Metaverse refuses to let me buy real estate but I’m trying. Everyone go buy metaverse now Facebook VR will be worth $$$ one day. Mark my words.

Alex Fadi Natour

February 18, 2022 at 5:08 pm

Awesome work Glenn!

Alex Fadi Natour

February 18, 2022 at 5:11 pm

Taco truck and coffee cart love it

Bubble N Champagne Studios

February 18, 2022 at 5:29 pm

This guy is sooooo funny. OMG

Doug Smith

February 18, 2022 at 5:32 pm

Very likable CEO.

Jonathan

February 18, 2022 at 5:36 pm

Maybe it looked like a tasty loaf of bread on the outside, but when you cut into it, it was full of maggots

Anthony Warner

February 18, 2022 at 6:22 pm

this guy cracks me up 😂

Bill Dinh

February 18, 2022 at 6:35 pm

I like Glen. Easy confidence because he’s got the experience to back it up.

Ryan Satchell

February 18, 2022 at 6:40 pm

I haven’t bust out laughing to a financial update video ever. This was actually funny, I like this guy now.

Moaz G

February 18, 2022 at 6:41 pm

I think I might invest in Redfin. I like this guy

Moaz G

February 18, 2022 at 6:43 pm

So now we know he’s not a loaf of bread

Caleb Belac

February 18, 2022 at 9:22 pm

how dare you not respect how he identifies. wonder bread has feelings too.

Moaz G

February 18, 2022 at 6:44 pm

She’s trying really hard to twist his words to make him look bad

Erwin

February 18, 2022 at 7:06 pm

glenn was the best , i loved how his responses were genuine and he wasn’t a interviewee puppet to the media and just giving answers that fit the disturbing status quo , and nice FU to meta was the best …🤣🤣

Jeslyn Tweedie

February 18, 2022 at 8:50 pm

Boomer attitude towards metaverse lol

Jeslyn Tweedie

February 18, 2022 at 8:51 pm

I like this CEO in general though, and Redfin

Jeslyn Tweedie

February 18, 2022 at 8:51 pm

I like this guy most of the time though, and Redfin IS a great platform

Trap 71

February 18, 2022 at 9:14 pm

I think the answer right now for those renting is to pile up as much cash as possible for the next 1-5 years when this market corrects.

Numbered--Weighed--Divided

February 18, 2022 at 9:53 pm

What is the probability that this guy is lying through his teeth about the condition of Redfin?

Mark Owen

February 18, 2022 at 11:14 pm

The most level headed CEO to date.

Low Cost Credit Repair Services

February 18, 2022 at 11:33 pm

Canada said until Covid-19 goes away building materials price increases will decline They are projecting another 3 more years for the carbon dioxide to clear up.

charles mcalister Rogers

February 19, 2022 at 12:31 am

This os the guy buying fsmily homes up zillow and redfin bought so much family homes hes evil hiding behind a smiley personality. Its going to crash in prices and hes panicking pretending assets wont drop they are about to drop big time.

Mohammad Finch

February 19, 2022 at 12:41 am

Biden having three years left is exactly why you shouldn’t buy now. What’s been happening the last two years in housing is not going to continue. He is going to have to bring down inflation before the midterms. Fed will have to act. I think it will start cooling in a couple months followed by a huge crash. It is such a house of cards, it won’t take much to topple it.

Qailah Abdullah

February 19, 2022 at 12:45 am

“What fundamentally drives housing demand?” Well, since the market crashed last time the FED raised rates significantly, I would say that it’s cheap money “investor” demand.

Ellen Hendrick

February 19, 2022 at 12:46 am

The housing market is cyclical. What makes me laugh is Realtors keep saying “housing markets might flatten but they won’t go down” they clearly don’t understand how a market with supply and demand works.

Spencer Fowler

February 19, 2022 at 12:48 am

@Ellen Hendrick If you’re new to real estate investing, but nervous about the potential downside risks of owning a property in a “market crash” seek the services of Marian Elizabeth Christiana, a reputable Investment consultant who will provide you with a cash flow properties. >

Dorio Willy.

February 19, 2022 at 12:49 am

@Spencer Fowler Great! how can i get to her?

Spencer Fowler

February 19, 2022 at 12:50 am

@Dorio Willy. Explore the web for her details, and drop a message..

Un-confiscate-able Money

February 19, 2022 at 1:51 am

He sounds like a real slick salesman

Donald T

February 19, 2022 at 3:36 am

Have a feeling “they” will say oh ok 4% don’t mind hit them with 5% oh still don’t mind hit them with 7%

Su Hugo

February 19, 2022 at 4:10 am

I like this guy.

Palantir Daily

February 19, 2022 at 5:16 am

I like him

Kolativ Kumawat

February 19, 2022 at 10:48 am

Being of age and how to manage the sequence of returns in those early periods is what seems quite scary in the current market. The market is never a loser in a twenty year cycle, but the 2000s decade scenario scares me and could really disrupt my retirement. When you are no longer accumulating but withdrawing its hard to be anything but cautious.

Larry Howard

February 19, 2022 at 12:17 pm

Due due to my experience,their’s No magic in trading having a strategy that ensures profit is the best you can do and that’s not for novice, lost over $5k trading with bad strategy but with the help of an expert trader allison taylor cassey , I have recovered losses and even made more I trade Options and invest in bitcoin with herr

Hoshi Fuyo

February 19, 2022 at 12:19 pm

My first investment with Allison Taylor Cassey gave me profit of over $24,000 USdollars and ever since then she has never failed to deliver and I can even say she’s the most sincere broker I have KnowN…..

Kristy Luna

February 19, 2022 at 12:20 pm

This past month been earning $70,000 weekly having invested $13,000 and working with Allison Taylor Cassey trading signal

Stecey Morgan

February 19, 2022 at 12:21 pm

WEEKS ago, Con men took over 13 Btc from me which lead me to a point of frustration as it was my savings, I’m glad I came across Allison Taylor Cassey through a friend and in weeks she helped me recover all I lost.

Shalae Morgan

February 19, 2022 at 12:26 pm

Positive remarks is all I have read and heard about this Allison Taylor Cassey for a while now. Would try this out with my 3.2 Btc<<

GreenCar

February 19, 2022 at 12:30 pm

His fake calming voice just feels like a facade when they themselves pumped the price up by pressuring buyers to bid up !!! They f.ing caused this market to push out the first time home buyers.

kayrow

February 19, 2022 at 12:39 pm

“I’m not a loaf of bread” 🤣🤣 thanks for confirming!!! Great interview

MartinezRE1

February 19, 2022 at 2:25 pm

Housing market crash is not coming

Eric's Incognito Account

February 19, 2022 at 2:42 pm

LOLd 🙂 Great interview

Adventure Baby Boomer

February 19, 2022 at 2:53 pm

I sold and bought with Redfin. I went from a condo to a home with multiple yards. The Redfin experience was seemless. They also gave their famous “Redfin refund” at the end, which paid for part of my moving expenses. It is an awesome company!

Simon Sez

February 19, 2022 at 3:08 pm

Homes are for living in not for speculating. In the past two pandemic years home prices increased because investment companies like BlackRock, et al, bought up home inventory creating an artificial supply shortage, artificially inflating home prices

and rent equivalents. This is not the result of individual home buyer activity.

This market manipulation put homes out of reach of working class Americans.

This is a bubble that will burst when the fed unwinds QE and MBS purchases.

Str8 RE co

February 20, 2022 at 4:59 am

yet the media has yet to talk about this…. This guy wouldn’t say that as they have an iBuyer component themselves. Get #iBuyer out of the burbs, NY & CA with better government & the housing market will chill soon after. #Str8REco #Gr8rUSa

Sury Ram

February 19, 2022 at 4:21 pm

Amazing interview – makes me want to buy Redfin stocks – the guy really knows what to focus on

himynameistim

February 20, 2022 at 2:55 am

Yup

Tony Linardi

February 19, 2022 at 4:34 pm

Supply constraint??? That helps everyone qualify for a higher mortgage right! Something is not right with the industry and the reporting!

Joe Rizzuto

February 19, 2022 at 4:50 pm

“i am a loaf of bread” if this guy was ceo of a stock i owned, i would sell it too! thank god i dont have to.

Night Ridah

February 19, 2022 at 5:02 pm

Microsoft isn’t forcing people back. You choose what best works for you whether full time wfh, hybrid or full time in office. You just need to make your choice by Feb 28th

SheepMan

February 19, 2022 at 5:22 pm

I’m a first-time home buyer and it sucks. My wife and I gave up trying.

Wanderful Escape

February 19, 2022 at 5:32 pm

I’m a millennial. I’m just going to keep saving money for a better downpayment. In fact, if the market is still terrible by the time I have a sizable downpayment, I’ll just keep saving up. I’m in no rush. I’d rather not be a slave to mortgage payments and high rent. I refuse to participate in this system. So if it takes waiting and saving so that I can own something…that’s just what I’ll do. Plus, there are too many aging baby boomers hanging onto their homes at this time….so it’s a good time to wait.

peter piper

February 19, 2022 at 10:36 pm

ur doing what im doing and i say we’re geniuses

K lake

February 21, 2022 at 6:35 pm

I’m one as well but I got supper lucky with the a VA loan so I was able to buy before stuff got way out of control. What you guys are doing is the right idea

Hamidreza Akbarzadegan

February 19, 2022 at 5:40 pm

love this dude

Karl

February 19, 2022 at 5:56 pm

Butt wrinkle

Ash

February 19, 2022 at 6:59 pm

“Down 15% afterhours”

O.O

Real TV

February 19, 2022 at 7:17 pm

She didn’t bring up Exp holdings when she talked about the metaverse and they are direct competition. 🤔

RDRAFF1

February 19, 2022 at 7:19 pm

Property tax drives information. Government knows this. It’s a game they play with civilization. Keep the poverty and hunger game going!

InvestMore

February 19, 2022 at 8:07 pm

Wow. Such an ignorant CEO when it comes to Metaverse property. Rude in his response too.

He is 100% annoyed that the metaverse will be a big competitor to his physical home-selling business.

If his company does not adapt, they will be destroyed- just like Blockbuster v Netflix, taxis v Uber/Lyft, etc.

This man reminds me of when Jamie Dimon said that bitcoin was worthless several years back, and now they have cryptocurrency-focused employees.

This man and company Lost my respect in this interview.

Glad I never owned Any shares of this company.

himynameistim

February 20, 2022 at 2:59 am

LOL, metaverse will be forgotten in 3 years.

Kerry Murphy

February 20, 2022 at 12:43 am

Housing only goes up!

S Adams

February 20, 2022 at 6:00 am

Totally agree! Redfin is a GOOD company for its customers and employees. When it focuses on doing good business, it’s stock will go up. In fact, this is the good time to buy Redfin stocks.

KayxRblxx

February 20, 2022 at 7:00 am

I would love to work for this guy.

David Currie

February 20, 2022 at 10:37 am

Wow (at Glenn), really, really love your business attitude!

Shannon Phelp

February 20, 2022 at 2:49 pm

Being of age and how to manage the sequence of returns in those early periods is what seems quite scary in the current market. The market is never a loser in a twenty year cycle, but the 2000s decade scenario scares me and could really disrupt my retirement. When you are no longer accumulating but withdrawing its hard to be anything but cautious.

Jinan Khoury

February 20, 2022 at 2:52 pm

I appreciate your approach to teaching. I’ve been quite unsure about investing in this current market and at the same time I feel it’s the best time to get started on the market, heard some guy speaking of making over $300k from a $180k capital since the pandemic and I’m driven to ask what skillset and strategy can generate such profit

Lena Emily

February 20, 2022 at 2:53 pm

For new investors, getting started can feel overwhelming. Risks loom large, and complicated, unfamiliar financial jargon can be intimidating.

Adrian Rodriguez

February 20, 2022 at 3:40 pm

Crash baby! Boomers go to a nursing home or condo 🙌 FBI wake up and crack down on mtg fraud, FED raise rates and reverse QE most of this crap is your fault.

Skylar Situ

February 20, 2022 at 4:35 pm

Did she just compare “virtual” real estate to actual physical real estate ??????? DUMBBBASSSS

Hamilton Cartagena

February 20, 2022 at 8:45 pm

Not true he just saying, to keep putting money in his pocket. There is a house crisis and its like a bubble they want it to keep getting bigger and bigger so when it pops they got enough money out of people so they end up keeping the money and the properties….

The end is near…

LARK

February 20, 2022 at 11:16 pm

I💟Glenn Kelman

Chase

February 20, 2022 at 11:55 pm

Wait till the fed does 10 rate increases this year and a lot of buyers will be priced out. We will have a correction

Yaonan Zhao

February 21, 2022 at 1:19 pm

Not this year tho. Consumer will be more eager to buy a house before rate hikes. I see housing price continuing increase

Ella Padilla

February 21, 2022 at 3:46 am

Bla, bla, bla GREEDY PEOPLE. You all no taking a penny when you die.

Brigith Bautista

February 21, 2022 at 3:58 am

I’m a nurse. Can’t work from home. Can’t afford a home close to my job. This is very frustrating 😓 In addition to how this pandemic has treated us nurse.

The House Carnival

February 21, 2022 at 5:52 pm

Virtual Property 🤣🤣🤣 y’all better pay for real property first cause that virtual property going to disappear when you late with that internet bill.

Sport Cards Brass Trains VideoGames

February 21, 2022 at 6:07 pm

baby boomer population is huge and they will all be dying in the next 10 to 20 years. tons of them are homeowners.

Julia Smith

February 22, 2022 at 12:13 am

We need an immigration tax on homes. New immigrants with PR cards need to pay tax on homes bc they are the ones causing locals to be able to not afford it

Julia Smith

February 22, 2022 at 12:14 am

YOU WILL OWN NOTHING AND BE HAPPY 🙂