Bloomberg Technology

GameStop Going ‘Way Higher,’ S3 Founder Bob Sloan Says

Jan.25 — S3 Partners founder Bob Sloan says GameStop Corp. shareholders should prepare for “another round of short squeeze.” He speaks on “Bloomberg Markets: The Close.”

Bloomberg Technology

The DOJ Goes After Google Chrome | Bloomberg Technology

Bloomberg’s Caroline Hyde discusses the DOJ’s push on Google to sell off its Chrome browser over concerns of a “search” monopoly. And, Roblox aims to enhance its child safety policies with the aid of AI. Plus, SpaceX hopes for a “catch” repeat as it readies to launch its Starship rocket with President-elect Trump in attendance.…

Bloomberg Technology

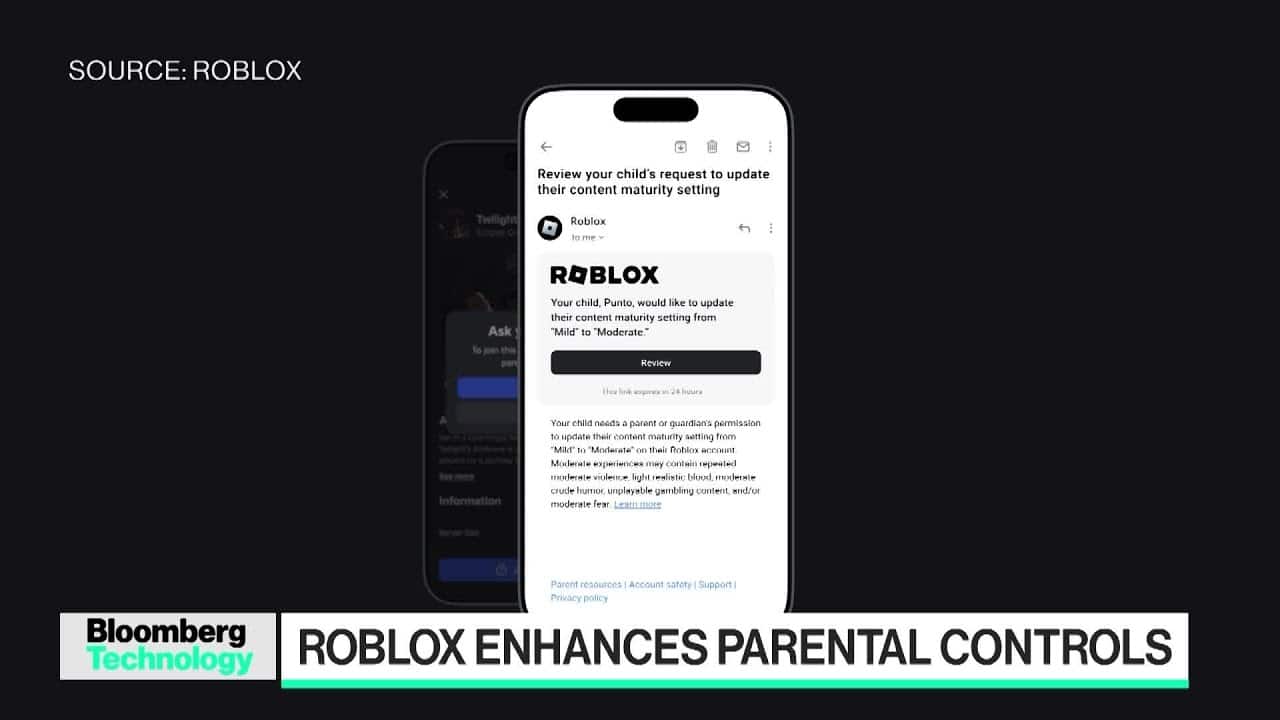

Roblox Issues New Safety Features

Matt Kaufman, chief safety officer at Roblox, joins to discuss new AI features and precautions being deployed by the popular online game as it faces increased scrutiny by parents and users. He speaks with Caroline Hyde on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

AI Governance Under a New Trump Administration

Navrina Singh, CEO of Credo AI, details the company’s latest partnership with Microsoft and the future of AI under a second Trump administration. She joins Caroline Hyde to discuss on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline Hyde and…

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired5 years ago

Wired5 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired5 years ago

Wired5 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Ani Course TV

January 25, 2021 at 11:43 pm

Let’s go Blackberry! Nearly 30% up today!

stillstyle

January 25, 2021 at 11:44 pm

No one should get harassed online, but it feels like Citron is using this as a scapegoat, getting a few mean tweets your way after you’ve insulted a community online is nothing new.

Riste Kostadinov

January 26, 2021 at 12:49 am

how can Andrew proof that someone tried to do something bad to him

Owen Cairns

January 26, 2021 at 12:52 am

the insults aren’t even the problem, it’s the absolute greed

Sweety B

January 25, 2021 at 11:45 pm

How about they investigate the fed for holding down interest rates.

Trevor Johnson

January 26, 2021 at 12:40 am

So you want a recession?

ReijiMoritsugu

January 25, 2021 at 11:46 pm

F***k it I’m jumping onto the GME train.

Mike Rasmussen

January 26, 2021 at 12:30 am

To Pluto and beyond!

Rodrigo Gonzalez

January 26, 2021 at 12:35 am

Really if you jump now and hold you’ll make big tendies 🚀🚀🚀 power to the retail investors.

Hoodiegod

January 26, 2021 at 12:42 am

@Taskun56 I love the this is the way guy

Larry Pavone

January 26, 2021 at 12:43 am

YES. THIS IS HOW YOU DO IT.

Sean Parker

January 26, 2021 at 1:06 am

This is the way 🚀🧑🚀 keep ur hands and feet in the rocket ship pls

Sam Hear

January 25, 2021 at 11:46 pm

All the options

Hamza Qayyum

January 26, 2021 at 12:11 am

The person we really need to thank for all this is J. Powell 😁

NuclearNow_SolarLater

January 26, 2021 at 12:13 am

😂

TriHard

January 26, 2021 at 12:25 am

GME 🚀 BB 🚀 NOK 🚀

Larry Pavone

January 26, 2021 at 12:52 am

This isn’t one of the big 3, but it’s been shorted to oblivion and the company is proving the short’s claims false ($TRIT)

Hasnt really ran up after a 50% drop

Mike Rasmussen

January 26, 2021 at 12:26 am

Nice try but I don’t even have a pilot on my 🚀

rm 80

January 26, 2021 at 12:32 am

a lot of people are now stuck with $100-159 GME stock they can’t sell.. huge losses incoming for most WSB kids..

Trevor Johnson

January 26, 2021 at 12:43 am

I’m holding april puts that I bought Friday I’m up 75% on iv alone lmao gonna buy more more more if it continues to get squeezed 😂

Rodrigo Gonzalez

January 26, 2021 at 12:44 am

@rm 80 I know, what I meant is I hope you are ready to lose it or have the exp date out for at least 1 year or more.

rm 80

January 26, 2021 at 12:49 am

@ogarza3 i hope you’re managing your risk

Larry Pavone

January 26, 2021 at 12:54 am

It’s gonna keep squeezing you know

rm 80

January 26, 2021 at 1:06 am

@Larry Pavone in the short term, maybe.. in the longer term those holding massively overpriced stock will either cut their losses or be liquidated via margin call.. no-one, literally no-one beside WSB kids values this dying shopping mall chain at $6-10bn market cap..

William Wills

January 26, 2021 at 12:33 am

Absolutely condone any threats of violence or harm. My issue here Bob, is Mr. Left is paying an astronomical amount of interest on his bets and Melvin Capital just got bailed out to the tune of 2.75 BILLON dollars by Market Makers. My point being they have a lot to lose and I certainly hope Mr. Left comes forward with evidence of these “threats”. Furthermore, the fact that these institutions make money off of naked short calls is really the big problem here. Why this is never brought up when the regulations talk starts is mind boggling

Larry Pavone

January 26, 2021 at 12:49 am

“rules for thee not for me”

Larry Pavone

January 26, 2021 at 12:51 am

Also I think you mean “you don’t condone”

I sure don’t condone any threats

But if you condone something it means you’re ok with it

Billy Hubbard

January 26, 2021 at 12:52 am

I heard one WSB member had a pizza delivered to Left’s house. Some may say Hawaiian pizza is criminal?

Olivier Lerch

January 26, 2021 at 12:35 am

Who else uses WSB to trade 🤨 ?

Larry Pavone

January 26, 2021 at 12:49 am

I use most of the chill/meme reddit stock forums

Investing and stocks are too serious and they’re annoying but I go there sometimes

I love pennystocks wsb psb options thetagang and I’m probably forgetting some others

Owen Cairns

January 26, 2021 at 12:54 am

@Larry Pavone many people investing in GME now are just lurkers, usually they make ridulous trades but this is something else

2110xp

January 26, 2021 at 12:35 am

Lol hold gme they are on the ropes

sam11o

January 26, 2021 at 12:42 am

💎👐

Hoodiegod

January 26, 2021 at 12:44 am

He is lying this citron guy is not being threatened. People are trying to tap his pockets though

mrpmj00

January 26, 2021 at 12:47 am

buy Wells Fargo, AMAZON, FACEBOOK, NVIDIA, APPLE, TWITTER

DON’T drive at all and work remotely.

capitol riot means a covid19 petri dish; we need another lockdown.

we have Amazon Prime streaming and don’t need to travel or go to a commercial theater and avoid covid19, mass shooting (gun sales doubled in 2020), police killing nonwhites like George Floyd, and exploding RVs like in Nashville, capitol rioters

bringing pipe bombs

Billy Hubbard

January 26, 2021 at 12:50 am

There is no evidence of “intimidation and threats” other than what Left claimed in a last ditch effort to get regulators to shut down WSB. He’s losing it all. Good day sir. You lose. Also, they’re calling WSB “day traders”. Nope. 99.9% of WSB members can’t day trade. They’re regular people with a chance to get a sniff of the wealth that these billionaires have manipulated for decades.

Owen Cairns

January 26, 2021 at 12:53 am

Can’t stop, Won’t stop GME TO THE MOON

Russ Ramirez

January 26, 2021 at 12:59 am

maybe shitron should not have tried to bankrupt gme

Rhys Bridge

January 26, 2021 at 12:59 am

The shorts could (and should have) covered when they’d driven gamestop into the dirt. The true manipulation of the GME ticker wasn’t in January 2021, but 2017-2020. When you short a stock repeatedly (to the point over 100% of the stock is shorted and institutions own 100%+ excluding retail and free-float) something is horribly wrong.

Short selling is an infinite risk trade, and hedges and large financial institutions bet on gamestop going bankrupt. When Cohen stepped in and the situation began to reverse, retail simply saw the change in headwinds, identified a value situation (see gmedd.com) earlier than the hedges and piled in. When it became apparent that this change in valuation would ALSO cause institutional interests to haemorrhage capital as a result of their unbridled greed, it became a value play coupled with an emotive call to arms to hurt the very people that, wrongly or rightly, are perceived as looking down on the working investor, and for much of the suffering since 2008.

You can’t complain about retail ‘manipulation’ when the actions of retail is to simply buy a long position and refuse to sell it to a short position. Yes we cheer each other on, but the support of another isn’t illegal, nor is sharing your opinion. Indeed, the need for an environment supporting retail investors is needed more than ever with the level of fear, uncertainty and doubt that is being spread in an attempt to limit the damage caused to market-makers and Hedges by the GME squeeze.

Regarding Andrew Left, I do not condone what happened to Citron, wallstreetbets has 2m members from all demographics with no connection and an environment of ‘banter’. It’s not responsible for some idiots sending pizzas/threats/grindr hookups, and much of the community is annoyed and ashamed at that since it just furthers the image being painted that we’re somehow the anti-christ of the market. I do not know what has happened to him, though from the information that has been made available, the hacking appears to have been hamfisted attempts to guess his password. This is hardly indicative of a a highly co-ordinated and sophisticated attempt to hack him.

That being said, anyone with more than a passing interest and knowledge of the fundamentals know that his 5 reasons were incredibly weak, and that the timing of his tweet (stopped momentum past $45 dollars in its tracks), subsequent delay (Didn’t know about the inauguration? Come on now…. He wanted to extend the period of uncertainty and further stifle growth) were both attempts to protect his own position. It’s also remarkable that just moments after Citron’s first tweet, tens of thousand of puts were placed in a co-ordinated attempt to lower the price. If the SEC does investigate Wallstreetbets, I hope they investigate the entire GME situation, including the provenance and volumes of shorts and puts. It’d be very interesting to see what they find regarding sheer volumes of short trades in the years 2017-2021 and the timing of puts surrounding Left’s tweets.

To surmise, the overall coverage of this situation on Bloomberg, CNBC, Seeking Alpha, WSJ and other financial reporters has been incredibly top-down, and is attempting to paint the retail environment of WSB as the villains because of crass humour and emoji’s. We are simply investing long in a stock we believe in, the short squeeze is simply a bonus (and, as I’ve said before, a symptom of the overreach and greed of certain short hedges, NOT a destructive retail wave or the ‘gamification’ of the markets). If you want to speak to people who truly understand the situation, go to gmedd.com and speak to them. Rod Alzmann from that site recently did an interview on Benzinga so may be approachable. You can’t cover a battle between the market establishment and retail, and then only have establishment representatives paint the story..

Jonathan Rocha

January 26, 2021 at 1:10 am

Incredible never knew there was anybody stupid enough to waste their time and write a thesis on the youtube comment section. Good luck

Matthew Kennedy

January 26, 2021 at 1:16 am

Effort of that for just 1 like

Vintage Regis

January 26, 2021 at 1:24 am

Well said.

Vintage Regis

January 26, 2021 at 1:24 am

@Matthew Kennedy 4 likes. OWNED

Rhys Bridge

January 26, 2021 at 1:27 am

@Jonathan Rocha I’d agree with you, but there’s no point just writing a comment on reddit in the echo chamber about how misrepresented our case is and how all this media spin is grim etc etc yada yada. If this channels actually monitored by Bloomberg and they actually got uberkikz11 on for 10 minutes it might get our side into the conversation.

Russ Ramirez

January 26, 2021 at 1:04 am

putting the blame on retail investors lmfao get rekt

Kris Eaton

January 26, 2021 at 1:11 am

Dropping 10k on GME tomorrow 🚀🚀🚀🚀🚀🚀

novo ryba

January 26, 2021 at 1:12 am

Institutional short attacks destoyed my portfolio before… Time for the people to rise and bankrupt them, taking back the billions theyve stolen so we can feed our families because no one else will

Kellz K

January 26, 2021 at 1:13 am

JUMP ON BB IF GME TO HIGH FOR YOU

isaiah ursery

January 26, 2021 at 1:22 am

I’m up 1900 on my puts from 190 invested

TheRockers224

January 26, 2021 at 1:27 am

TO THE MOON! BUY IT WHILE ITS ON SALE!!!!!