Bloomberg Technology

Ford Could Separate It’s EV Business from Gas Engine Operation

Bloomberg’s Ed Ludlow joins Emily Chang to discuss Ford’s possible plans to separate its electric-vehicle operation from its century-old legacy business, hoping to earn the sort of investor respect enjoyed by Tesla and other pure-play EV makers. Nothing has been settled yet, but it’s under discussion Ludlow says. He’s on “Bloomberg Technology.”

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

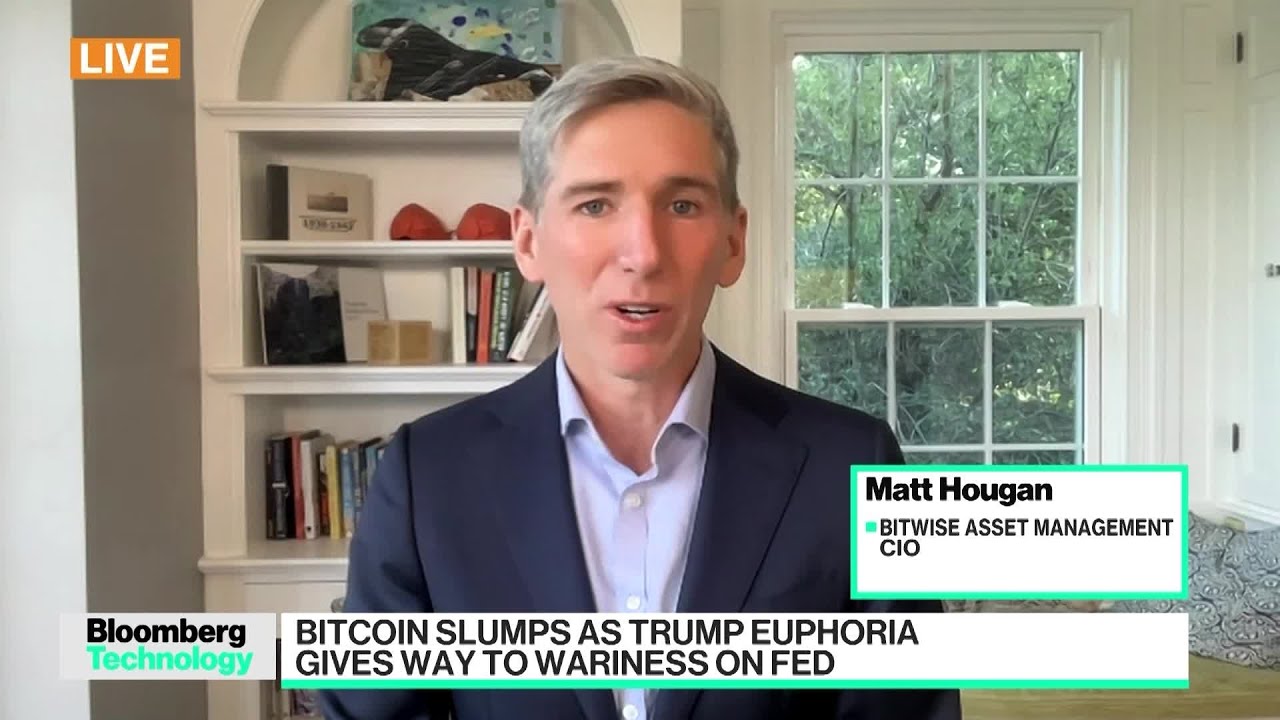

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

jc10

February 19, 2022 at 1:23 am

Horrible idea

Christopher Haig

February 19, 2022 at 1:27 am

vwccpb

Steven H.

February 19, 2022 at 1:48 am

Lmao trying to double dip without double dippping eh?

Jolly Green

February 19, 2022 at 3:09 am

Its a great idea. Sell direct like tesla

roorlek

February 19, 2022 at 4:17 am

Very good idea ipo of ev part will raise way more money being separate from the legacy ford side

The Fine Print

February 19, 2022 at 4:25 am

Time to end dealerships.

hangender

February 19, 2022 at 7:19 am

nothing but a cash grab

Ross

February 19, 2022 at 8:03 am

Obvious. Duh. EVs will cannibalize their ICEs and their managers will be highly incentivized to nuke it for the sake of their books. Spinning it off is the only way to allow the EV dept to have a chance to actually grow and compete with their own traditional ICEs. Unfortunately, they should have done this 10 years ago, when Tesla was only ~5 years ahead of them. Now they’re 15 years behind. So… good luck, but, uhh, yeah, ya’ll ain’t gettin’ me to take that moronic capital risk with my money. Sorry. I’ll just buy more TSLA (and a Tesla), not Ford.

Nick Kacures

February 19, 2022 at 10:00 am

Million dollar question?$?$ How do I buy into the electric side and wow what a way to get rid of a 100 billion+ dollar stranded asset issue of pensions, health care obligations and old plant and equipment. Unions are not going to like this!!!!

McGee, Darion

February 19, 2022 at 11:16 am

Why wasn’t this announced during earnings? My calls would have benefited from this information.

Audrey Swinston

February 19, 2022 at 3:19 pm

Interesting video!! As always, businesses/lnvestments are the easiest way to financial stability, success without being dependent on anyone..I don’t know who needs to hear this but stop saving all your money in the bank. Learn some new skills and lnvest your money if you want financial freedom.

Lisa Böhm

February 19, 2022 at 3:39 pm

Been reading through the comments and when he said Carl Davis I knew he was right! I have the best lnvesting help from Mr Carl. He’s friendly and easy to get along with in terms of lnvesting tips. It was a life changing lnvestment I was able to pay off my mortgage 😭😭

George Christopher

February 19, 2022 at 3:44 pm

A good lNF0 is what everyone needs to progress financially. Here’s an incredible one, thank you!!!

jeff

February 19, 2022 at 3:45 pm

Holy sh*t!! I’ve known Sir Carl Davis for ages, He is so wonderful and sincere, my dealings with him keeps running smoothly and swiftly without controversies. I have worked with 4 traders in the past but none is as efficient and intelligent as he is. I’m currently mining my ETH with his strategy and it’s really awesome 👍

Khúc Hòa

February 19, 2022 at 3:46 pm

Tbh, If you’ve started dealing with this Expert then your far less from making profit and I think I’m gonna start working with him rightaway

Lilian MacArthur

February 19, 2022 at 3:48 pm

My Goodness….I had a bad experience lnvesting on my own until I met Mr. Carl Davis I have made over £45O0O tradlng crypt0currencies, I even made a whooping £12,35O on my last deal with a capital of $410O . Retiring next year with no fears!!

Googlebanmetoomuch 2

February 19, 2022 at 3:19 pm

🦕

Anthony Warner

February 20, 2022 at 12:26 am

could the EV product avoid dealerships?

Len Harper

February 20, 2022 at 9:08 am

Interesting, they probably could cut out the dealerships and sell direct to customers.

D M

February 20, 2022 at 1:33 pm

Who is this “sources” dude everyone get information from?

DaddysTired22

February 21, 2022 at 1:02 am

Ford literally pays someone

To release

And re release “goals” every week so they stay relevant

Marcus Briseno

February 22, 2022 at 9:17 am

Ford should pay off debt first before investing more into the company. The more debt that gets paid off in the long run, you’ll be able to invest in the company later on. You have to be patient and make the best of it and what comes next.

Marcus Briseno

February 22, 2022 at 9:32 am

Pay debt first, then invest if you can, but debt paid off first is less stress.