Bloomberg Technology

Congress Needs to Make Big Tech ‘Stop Cheating’: Rep. Buck

Oct.09 — Rep. Ken Buck, a Republican from Colorado, discusses why he thinks the government should regulate Big Tech companies on “Bloomberg Technology.”

Bloomberg Technology

Disney’s Streaming Success, Tech Eyes More IPOs in ’25 | Bloomberg Technology

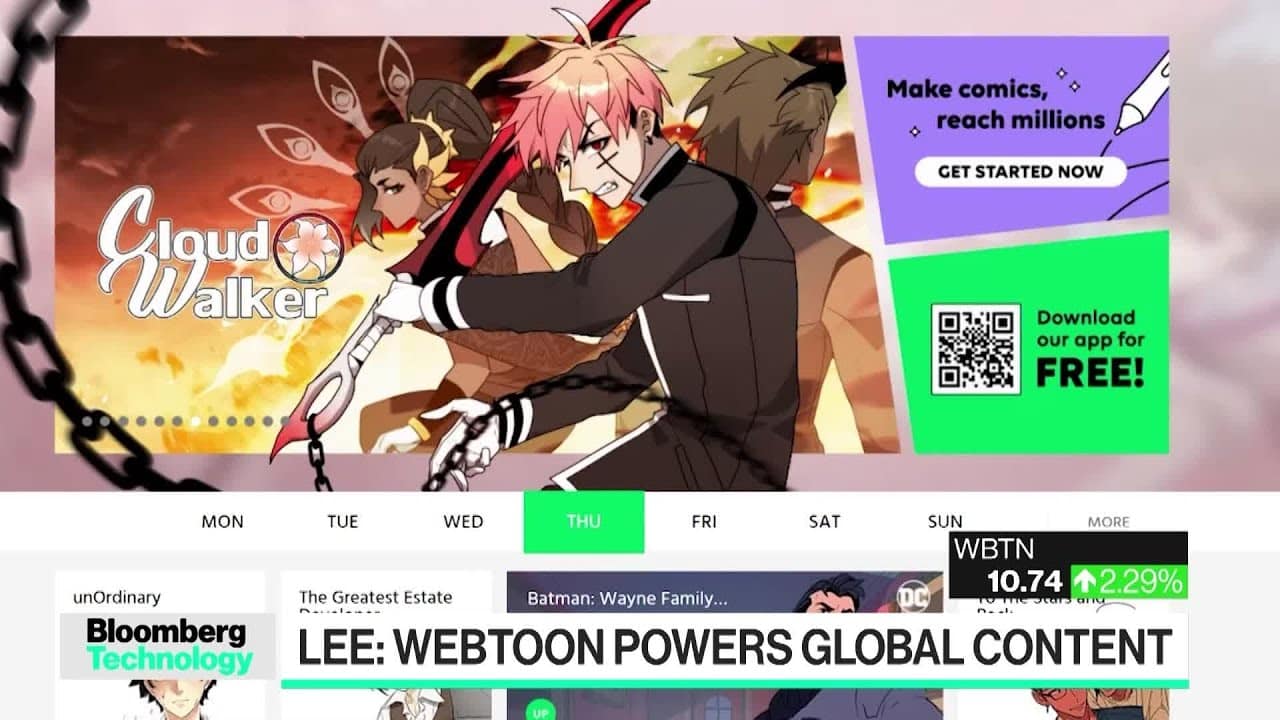

Bloomberg’s Caroline Hyde and Ed Ludlow speak with Disney CFO Hugh Johnston on the company’s latest earnings beat and future streaming ambitions. And why 2025 looks to be the year for tech IPOs. Plus, how online comic platform Webtoon is utilizing AI to help its storytellers and readers. ——– “Bloomberg Technology” is our daily news…

Bloomberg Technology

Webtoon: We’re Relatively Immune to the US Election

Webtoon CFO David Lee says the popular online-comic company is shielded from FX and revenue volatility due to US election. He joins Caroline Hyde and Ed Ludlow to discuss on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline Hyde and…

Bloomberg Technology

Disney Finally Got It Right, Says Analyst Gerber

Ross Gerber of Gerber Kawasaki says Disney is at an inflection point, saying the company is an incredible value for investors. He speaks joins Caroline Hyde and Ed Ludlow to discuss on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline…

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired5 years ago

Wired5 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired5 years ago

Wired5 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired5 years ago

Wired5 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired5 years ago

Wired5 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

wrecked bote

October 10, 2020 at 12:25 am

Did you see Amber Laura? Anyways, uhm so I know what a break up looks like, it looks like Huawei. I like Huawei to an extent. The same active people are still pretty much always going to be active but the difference is that They would probably be off balance sheet subsidiaries. With significant separation. Bill said most of it was passive, has he considered the Securities in exchange commission doing any of this? I don’t know why there’s so many stocks but somehow break the rules, I actually believe it’s the house

wrecked bote

October 10, 2020 at 12:37 am

I first of all wanted to say I have a conspiracy that Amber is from Google for a lot of reasons If you didn’t know that. Anyways aside from that the one thing I wanted to bring up was that in 9/11 all the documents were deleted or at least a lot of them. It’s like the beginning of last century when there was a few very rich families It’s the same thing because everything was erased.

wrecked bote

October 10, 2020 at 12:38 am

I think that should build a lot quicker because the internet is a lot more fast-paced and accessible but still we have to build that history that was erased to avoid a low percentage

wrecked bote

October 10, 2020 at 12:42 am

I watched a lot about Henry Ford and it was almost like seeing myself learning It was weird. So I think because a lot was erased basically it’s similar to when we had the Rothschild and the Rockefellers and those small groups of very rich people just because everything was lost

wrecked bote

October 10, 2020 at 12:57 am

I’m too young to know, I was 2 when it happened. So, I don’t know but that’s how I felt because I felt heavily pushed into the markets. Like at every point it looks like “fake teaching.” Hard to explain. And if you start a new country you’d have wealth inequality, and then due to certain reasons they’d be paranoid about communism, and it happened specifically with stocks in 2001. I have absolutely no idea what they did before, the filings didn’t say SEC. Like first Enron, WorldCom, banks. Like it’s just representatives, but everyone is slowly teaching the public. That’s what I think currently.

wrecked bote

October 10, 2020 at 1:04 am

I looked into Freemasonry, which is a concrete people guild, btw guilds should replace school’s, but anyways uhm they use ideas of symbolic representation in the way I’m referring to here. Idk, I’m new honestly but that how I feel. WorldCom is Verizon

wrecked bote

October 10, 2020 at 2:27 am

The main reason I would need a short seller is because I have mistakes and I need those to be represented and that I can talk about the other person’s mistakes or whatever and the company should continue but I need that other party to say the bad things about me so that it’s more equal. I currently don’t have that and it’s a reverse merger so I specifically need a short seller.

wrecked bote

October 10, 2020 at 2:34 am

I actually also have spoken to hedge funds and they show “non-cepttive traits,” and are incompatible with the event. I am not trying to be the short seller, so when companies act like they’re a fraud heavily it shows a different type of reception.

char

October 10, 2020 at 12:54 am

Corporations rule gov in this land, don’t be confused boomer

CityGal Productions

October 10, 2020 at 12:34 pm

I HATE BOOMERS. lol We are legally Globalized and a one world order. what a bunch of liars

jemia perry

October 10, 2020 at 1:00 am

Nice 36:14 🍌🍌🍌🍌

Pollyanna Gonzales

October 10, 2020 at 1:00 am

Lovely 😍💋 💝💖❤️

Zofia Gray

October 10, 2020 at 1:24 am

Very happy 😍💋 💝💖♥️❤️

J ohan

October 10, 2020 at 2:19 am

4:30 suppressing startups? LOL. They give startups hundreds of millions to buy startups. Everyone is trying to be a startup with the hope of getting bought by FAANG. I don’t see that as suppressing startups.

mrpmj00

October 10, 2020 at 2:50 am

I bought Amazon, Apple, Nvidia, Facebook, Microsoft, Google, Wells Fargo, CRM, Lululemon, Broadcom (AVGO), Adobe

Dieter Zerressen

October 10, 2020 at 2:42 pm

I’m from Colorado: Ken Buck is a right wing POS. Don’t listen to anything he says – he violates the 9th Commandment every time he opens his mouth.

Beware Rusnya

October 12, 2020 at 12:18 am

Google (Alphabet) absolutely must be splitted into several companies. There was no such an impudent monopoly yet, ruining business and openly despising users.