Bloomberg Technology

Why is Jeff Bezos selling billions in Amazon Shares?

Jeff Bezos unloaded 12 million shares of Amazon.com Inc. this week, the first time the billionaire has sold the company’s stock since 2021. The sales earned Bezos about $2 billion. Bloomberg’s Ed Ludlow reports. Read more: ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline Hyde and…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

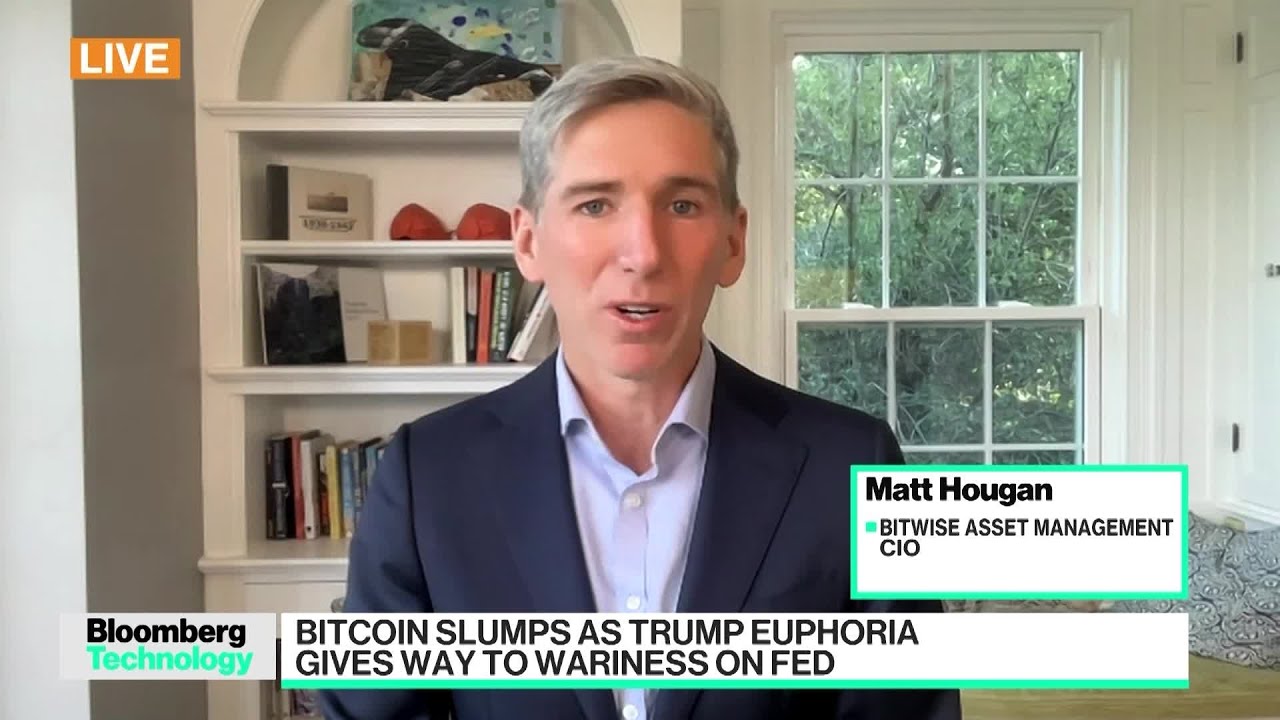

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

@abdelkaioumbouaicha

February 13, 2024 at 9:03 am

📝 Summary of Key Points:

Amazon CEO Jeff Bezos sold $2 billion worth of shares, his first sale since 2021. He plans to sell around 50 million shares of Amazon stock this year.

Bezos has sold $20 billion worth of shares across 2020 and 2021. However, this recent sale had minimal impact on Amazon’s stock, with only a 0.1% increase.

Bezos is taking advantage of the stock’s significant rise to further his philanthropic endeavors.

💡 Additional Insights and Observations:

💬 “Bezos intends to sell around 50 million shares of Amazon stock this year.”

📊 Bezos has sold $20 billion worth of shares across 2020 and 2021.

🌐 The information is based on a schedule filed with regulators in November.

📣 Concluding Remarks:

Jeff Bezos, Amazon’s CEO, recently sold $2 billion worth of shares as part of his plan to sell around 50 million shares this year. Despite his previous sales, this recent transaction had minimal impact on Amazon’s stock. Bezos is leveraging the stock’s rise to support his philanthropic endeavors.

Generated using TalkBud

@smokinpolitics4085

February 13, 2024 at 9:25 am

He doesn’t have any “philanthropic” endeavors lol 🤣🤣🤣 he simply wants money.

@Piotrek-wf

February 13, 2024 at 9:04 am

I have about 5% of my portifolio in AAPL stock, any advice on any other that I can grow my $200 k capital to a million dollars???

@MartijnReijerkerk

February 13, 2024 at 9:05 am

As a beginner, it’s essential for you to have a professional to keep you accountable. I’m guided

by Andras Bohm a widely known crypto consuitant

@Piotrek-wf

February 13, 2024 at 9:05 am

I have heard a lot of wonderful things about Andras Bohm on the news but didn’t believe it until now.

@BB-cs

February 13, 2024 at 9:05 am

I managed to grow a nest egg of around 120k to a decent 💲950k in the space of 3 months… I’m especially grateful to Andras Bohm, whose deep expertise and traditional trading acumen have been invaluable in this challenging, ever-evolving financial landscape.

@Piotrek-wf

February 13, 2024 at 9:05 am

I’m willing to make consultations to improve my situation. What is the most reliable medium to reach him please?

@BB-cs

February 13, 2024 at 9:05 am

Andras Bohm is the licensed fiduciary I use. Just research the name. You’d find necessary website to work with a correspondence to set up an appointment..

@rusty299

February 13, 2024 at 9:16 am

there’s a stock I was looking at this morning. NNDM it’s undervalued and they have tons of cash on the books and the share prices extremely reasonable

@rusty299

February 13, 2024 at 9:16 am

NNDM stock ❤

@cordovalark5295

February 13, 2024 at 9:17 am

TLDR: To continue to fund Blue Origin. As he does every year.

@gfuentes8449

February 13, 2024 at 9:37 am

probably to fund that pig of a wife

@commonsense504

February 13, 2024 at 12:21 pm

Reminds me of an interview years ago shortly after Amazon started where Bezos said to the confusion of reporters that the Amazon model was inevitably unsustainable.

@dopemusic6414

February 13, 2024 at 2:21 pm

Blue Origin

@thejeffinvade

February 13, 2024 at 2:27 pm

Overvalued.

@beeflizard5250

February 13, 2024 at 3:56 pm

Answer – his new wife wants to live gooooooood