Bloomberg Technology

Redfin CEO on the Cooling Housing Market

Redfin CEO Glenn Kelman joins Emily Chang to discuss how real estate platforms can navigate the new waters of a cooling housing market after the housing boom of the last few years.

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

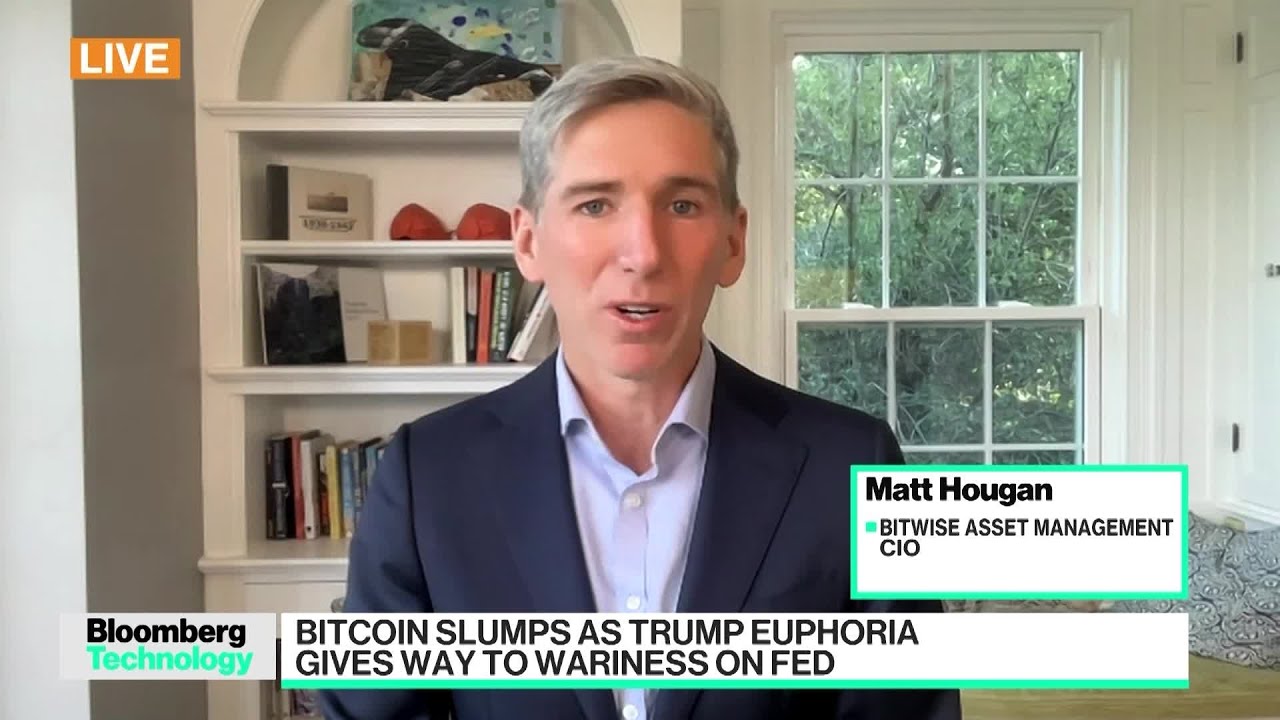

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

altyn Balyk

August 5, 2022 at 11:53 pm

❤Only for fans over 18 year⤵️ Alles sehr schön. Aber zuerst zusammen die Nummern 10 und 1. Eine warmthhh.Online Brünette und eine andere Blondine. Es wäre unfair, wennb ich 4 wählen würde

Ron Mir

August 6, 2022 at 4:54 pm

Lol. Try harder

Coahuil Tejano

August 6, 2022 at 4:54 pm

“Correction” means “BIG FUCKING LOSS”

Tete Griffiths

August 6, 2022 at 5:01 pm

He is laying because he want to tell to home buyer it’s okay buy now and you will refinance.

Sterling Paul

August 6, 2022 at 5:03 pm

Housing will crash in most areas. You can’t have 40 percent increases in one year on home prices and not even close to that in wage increases. This company will have serious trouble selling all their inventory. The crash will be severe.

Alex Solano

August 6, 2022 at 5:17 pm

Using that analogy: “It’s like you are on drugs…” was a mistake in PR. I like the guy buy sometimes being too honest can hurt your company.

GeistInDerMaschine

August 6, 2022 at 5:21 pm

So I love the “vulnerability” of this CEO, owning up accountability for the bets he made, and the people he hired ended up losing their chips but not his.

Cautious X0

August 6, 2022 at 6:10 pm

Yeah. This is one of the best ways to get customers imo. Real people saying real shit

Cap Marketer

August 6, 2022 at 9:01 pm

@Cautious X0 Yeah but he’s delusional if he thinks the worst is over

Lugosi

August 6, 2022 at 5:48 pm

What’s with this dudes forehead?

J McG

August 6, 2022 at 5:55 pm

Realtors should just do what they get paid insane money to do.

Call the sign company

Pay someone else to stage or convince the owner to pay

Talk on their cell phones

Drive people around like Uber drivers

Write up agreements with standard wording from the their computers

Upload photos to MLS

Pretend they are marketing geniuses

Wait for the internet to find buyers.

Realtors are NOT qualified to project the market or what interest rates might do or anything else. They fuelled the greatest bubble in history and some of them even take credit for it. Now will they take ANY responsibility for the crash? One day soon consumers will wake up and realize they do not need fast talking people that would never make anywhere close to what they earn with their obese commissions.

Insane.

J McG

August 6, 2022 at 5:57 pm

The only “professions” that plaster their photos on billboards, signs and bus shelters are Realtors, Ambulance Chasers, Cash For Gold folks and Cash Converters.

Cautious X0

August 6, 2022 at 6:09 pm

I like this guy being honest. Definitely going to be using Redfin more often now!

Miriam S.

August 6, 2022 at 7:25 pm

hmmm his company is part of the reason why we have such inflated home prices. So please!

sanfs143

August 6, 2022 at 6:21 pm

This guy is out of his mind. Can’t wait to see the market crash to see what he’ll say than! 🤣😂

John Olagues

August 6, 2022 at 6:53 pm

The reason for much less sales of houses is the fact that far less houses are put on the market for sale. If there are very few offered for sale, then there must be less sales even if the prices are higher.

ramin Lakin

August 6, 2022 at 7:14 pm

Crash is just boiling it will be very ugly ,

DonYuJuana

August 6, 2022 at 7:34 pm

What a coincidence that he’s saying the housing market is ‘picking back up’ when his wallstreet buddies are unloading their investment properties as fast as they can. Almost like there’s collusion to screw over small time home buyers, or something. Nah, that would be highly illegal and unethical, and these mega-corporations never do that.

ahazbatt

August 6, 2022 at 7:47 pm

When will be the peak till housing prices drop until it starts going up again?

Shane Rogers

August 6, 2022 at 8:15 pm

Housing is in the biggest bubble in world history. Homes in my are are 100-200 percent higher than they were in less than 2 years. Normal is 50 percent off before you start negotiating.

A significant amount of the demand was sinister corporations, investors and flippers trying to get rich quick while fleecing americans out of home ownership. It was all fake.

No mercy on the way down.

Lalo Daniels

August 6, 2022 at 8:17 pm

That is a good CEO.

Alex Bellesia

August 6, 2022 at 9:03 pm

The face of greed, and screwing up the whole housing industry. As___le.

Tengis Tenger

August 6, 2022 at 9:21 pm

I

Like his products and honesty and energy and stock prices

Athena Renee Music

August 6, 2022 at 9:43 pm

After 5:00 is when he finally tell the truth

Patterson Thomas

August 6, 2022 at 9:50 pm

Always good to hear your thoughtful and logical analysis. I don’t care about the bullish or bearish markets. Trade a small percentage of your portfolio rather than going in and out every couple of weeks trying to time the market, trading went smooth for me as I was able to raise over 8.4 BTC when I started at 3 BTC in just a few weeks implementing Stacy Huth daily trading signals and tips.

David Lee

August 6, 2022 at 11:05 pm

I’ll agree with you because I’ve used her strategy in the past and was able to raise a total profit of 10.5 BTC in 6 weeks..

Donald Marshall

August 6, 2022 at 11:06 pm

Stacy Huth is my favourite when it comes to trading btc, she is honest and straight to the point

Elaine Valentina

August 6, 2022 at 11:09 pm

Great skills and knowledge about the market. I enjoy full profits and easy withdrawal with no complaints, trade with the best.

kelvin Edwin

August 6, 2022 at 11:11 pm

My growing love for crypto caused me to explore until I came across Mrs. Stacy (although I’m trying to avoid sensationalism) hse is by far the best. No hype for hype’s sake, but a great inspiration to trade Crypto.

Mi Mirabel

August 6, 2022 at 11:14 pm

I invested with Stacy Huth too, she understands every beginner’s intention and fixes you to a trading plan that matches your capacity.

Allen A

August 6, 2022 at 10:36 pm

this guy is so honest about things. Really great interview.

sbkpilot11

August 7, 2022 at 12:09 am

Stock market has not recovered… what is this guy talking about? It’s still almost 15% under

mikopaq

August 7, 2022 at 12:42 am

Everything is great we’re laying off workers

Rahzel Washington

August 7, 2022 at 1:03 am

Gotta like this CEO’s honesty. Makes me want to buy redfin

Harry Chu

August 7, 2022 at 12:44 pm

He has lost 75% of his net worth through his stock. That is enough to humble anyone.

Eric_gartner01 twitter

August 7, 2022 at 11:01 pm

⤴️🔝I was able to avoid the huge dump situation with little percentage loss debited from my portfolio cause I let ERIC GARTNER handle the whole situation PROFESSIONALLY like he claimed

Rong Liu

August 7, 2022 at 2:06 am

Glenn is thoughtful and relatable. Not like the robotic CEOs that reads a script.

DSC800

August 7, 2022 at 6:53 am

Here in California ave home prices are almost 8x average wages and almost 20x average annual rental value. Historically these ratios are at their highs and, be it a big pop, or a slow decline, housing needs to deflate 15, 20, maybe 25%.

Franklin Hopkins Jr

August 7, 2022 at 10:11 am

This is why I don’t work for someone. They can fire you…

Slim

August 7, 2022 at 12:17 pm

I thought Redfin went bankrupt!

Senior Housing Analyst

August 7, 2022 at 12:18 pm

*Raleigh, NC Housing Prices Crater 21% YOY As Debt Crippled Speculators Panic And Inventory Soars Across The Carolinas*

Slim

August 7, 2022 at 12:19 pm

I won’t touch this stock with a bargepole!

True Persona

August 7, 2022 at 12:23 pm

NO NEED TO WORRY, WITH SO MUCH FIAT LIQUIDITY, IN TENS OF TRILLIONS, PUMPED INTO THE SYSTEM BY THE US GOVERNMENT AND FED, THE HOUSING MARKET IS JUST GONNA STAGFLATE MEANING THE INCOME AND HOME PRICES WILL REMAIN THE SAME FOR A VERY VERY LOOOOOONG TIME.

sentient AI

August 7, 2022 at 1:40 pm

Clearly he has no idea what he’s doing. Hire-fire-hire-fire, get ready for more layoffs

Brendyn Braithwaite.

August 7, 2022 at 3:27 pm

If there weren’t so many disgusting pathetically greedy humans we wouldn’t have issues like this.. the be real if we just did away with money and all unessential shit we could live peacefully and equally but humans will never be smart enough to figure that one out.. but since we have those disgusting humans we have people willing to take advantage of broken systems and basically rape other people just so they can get ahead.. sounds like history repeating itself STILL to this day but it’s just humans in general being very human.. and pathetic and actually very stupid considering how smart we can be for things we WANT over things we NEED…

Brendyn Braithwaite.

August 7, 2022 at 3:29 pm

We all know money is the root of all so called evil.. but would we ever get rid of it and just all do our share in the essential things? Ya right

A G Lunsfjord

August 7, 2022 at 3:32 pm

Short

Rob Lynch

August 7, 2022 at 3:43 pm

Greed highly got us into the last crash and the same now. Houses are even more higher than at the last crash. We never learn. NO SYMPATHY FOR THOSE WHO DIDN’T LEARN!!!

Frank White

August 7, 2022 at 3:49 pm

Mark will crash soon

Biden and democrats destroyed America

RATES are going UP and UP and UP

Henryk Sienkaniec

August 7, 2022 at 3:52 pm

More bullshit , totally false narrative about housing as pile of gold as investment

The costumers are idiots to relay on their ( expertise opinion)

We don’t need those crooks , who charge you almost 10 % commission

Zero value for the costumers, where is my government?

P S

August 7, 2022 at 8:24 pm

uhhhhh we’re in a recession

Pzystem bitang

August 7, 2022 at 10:55 pm

Mr CEO you laid off so many people ..did you get a paycut as well???I hardly dough that!!!!!!!! People like you still getting big money and working people getting fired!!!!!!

Spring Roll

August 7, 2022 at 11:09 pm

Kudos to the CEO, very passionate about his Company.