Bloomberg Technology

NYSE Reversal on China Stocks Symbolic, GMAG’s Iyeki Says

Jan.05 — Marc Iyeki, Global Markets Advisory Group senior consultant, discusses NYSE Group Inc.’s decision to spare three major Chinese telecommunications companies from being delisted. He speaks on “Bloomberg Markets: The Close.”

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

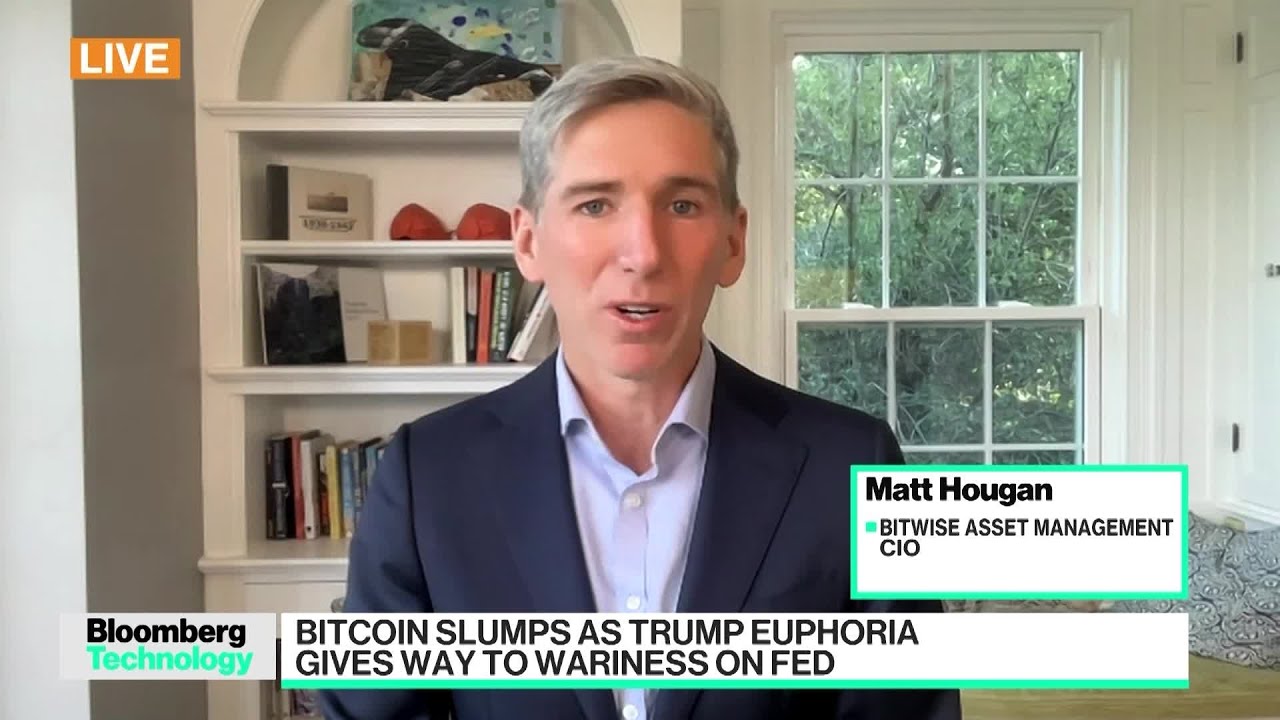

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Hey Man

January 5, 2021 at 9:53 pm

Because it’s not worth the long term damage in exchange for some short term political brownie points lol

Shawn Chou- Invest into financial freedom

January 5, 2021 at 10:30 pm

Good call

Deigo Parshe

January 5, 2021 at 10:43 pm

As the economy returns and is aided by Federal stimulus money, it could significantly aid US stock market growth. A shrinking US dollar could help the economy too by making imports more expensive and boosting US exports. Dow, Russell, S&P and Nasdaq will likely all rise to new record heights this new year but Popular Stock analyst Dr Rodrick Jonathan said the new strain of Covid 19 virus being discovered is going to put a scare into the economy and the stock market in the next 3 months so He warns new stock buyers to be careful as the picture is not clear yet and for now you can only make profit by trading your stock with a strategy instead of panic selling, for me i advice you to multiply the little you have with Rodrick’s strategy, i was able to make $60,000 with $10,000 in 3 weeks with his stock trading strategy, reach him on telegram Rodrickjonathan orWhatsApp+1(66O)474-OO3O,

Lock Mcain

January 5, 2021 at 10:51 pm

While no investment is risk-free, investing in the stock market nets an average return of 7% each year after inflation, making it an attractive investment strategy for the long term. Whether you’re new to investing or just curious about how to make the most of your money please adopt Rodrick’s strategy trading program before investing, stocks is really critical

The Renashka

January 5, 2021 at 10:58 pm

I’ve been with Rodrick a few months now and his system is quite laid back and easy to follow. We started off with a few basic strategies and very well defined rules…you follow him, you keep on smiling, you bang on the money. Well, it’s definitely worth a try!

alexi Jack

January 5, 2021 at 11:02 pm

I have tried many products in the past over the years and been stung many times. but Rodrick’s strategy is different and Dr Rodrick has been more than obliging with his passion to help you get the edge and succeed in the market, If your serious about learning, being mentored and becoming a successful trader then you need to invest in yourself and sign up for his program, no upfront payment like others.

mrpmj00

January 5, 2021 at 11:13 pm

buy AMAZON, ZOOM, FACEBOOK, NVIDIA,

I’ve created a home theater with a 150 inch screen so we don’t need to travel or

go to a commercial theater and avoid covid19, mass shooting (gun sales doubled in 2020) and exploding RVs like in Nashville.