Bloomberg Technology

Nvidia Stock Split is Likely: Tengler

Nancy Tengler, CEO and CIO of Laffer Tengler Investments, discusses the potential for Nvidia to split its stock as shares near new highs and the company adds $1 trillion to its market value this year. She speaks with Ed Ludlow and Caroline Hyde on “Bloomberg Technology.”

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

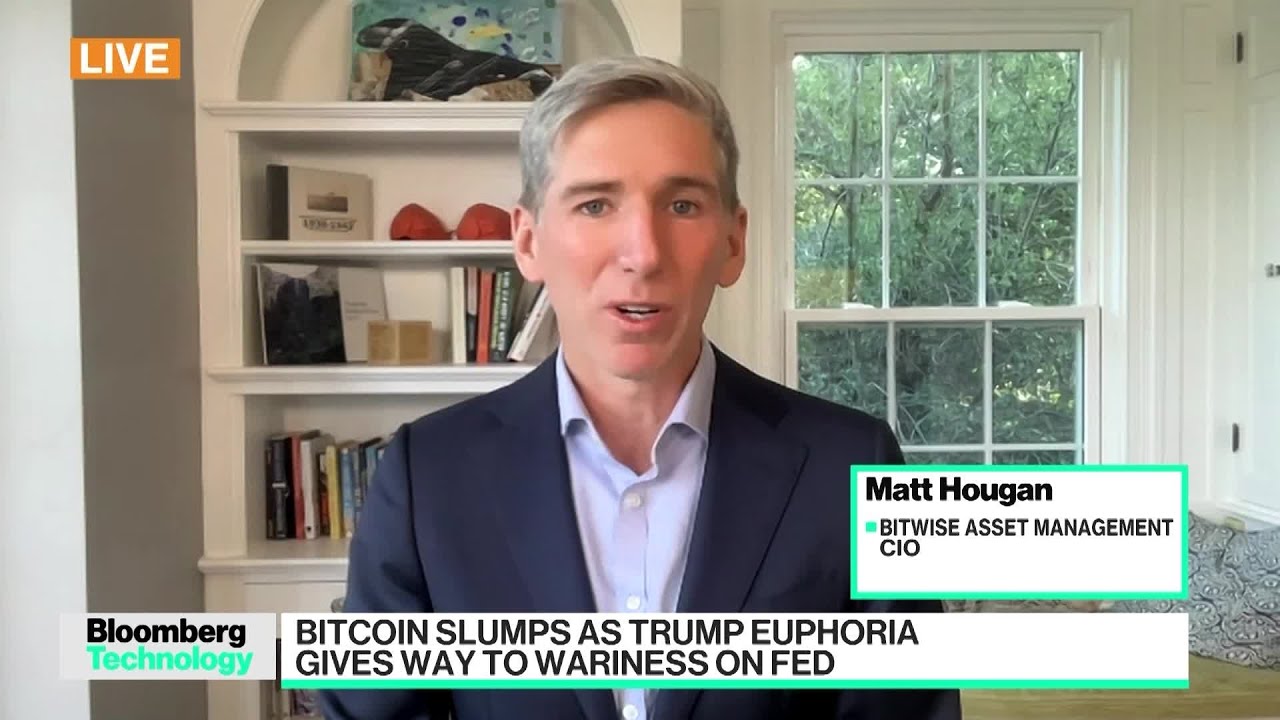

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

@davidduffy2046

March 8, 2024 at 4:15 pm

Transparency is everything when it comes to China stocks, and it just isn’t there

@ganlet20

March 8, 2024 at 4:49 pm

The big Broadcom question is how VMware’s price hike plays out

@donaldharlan3981

March 8, 2024 at 5:03 pm

😆 no won’t happen ✊

@MrJonnnnnnie

March 8, 2024 at 6:04 pm

Nvidia will be back up. We are here for the long term gains!

@josephhinkle3454

March 10, 2024 at 7:15 am

When did you buy your first shares?

@derekwillstard3613

March 8, 2024 at 6:21 pm

Every time she mentions “record high” my stock go down 5% wtf 🤬

@janosik150

March 8, 2024 at 6:52 pm

AI is a serious danger to humanity, especially because it is implemented into military and can be easily manipulated into wars

@dylanwillis5165

March 8, 2024 at 8:47 pm

Best reason to invest in it, you can’t lose. Either it takes off, does the world well and you profit. OR it ends the world and you won’t care about your portfolio then anyways 😛

@janosik150

March 8, 2024 at 9:11 pm

@@dylanwillis5165 AI will be only used to produce false information or facts to gain profits and create wars. This is the way of humans on this planet. Very little will be used for good.

@briantep458

March 8, 2024 at 9:29 pm

amazingly insightful, im sure no one has thought of this

@MattH3ew-rm3ir

March 9, 2024 at 4:25 am

Humans have will smith, we will be fine

@stephenmcallister2169

March 9, 2024 at 11:39 am

@@MattH3ew-rm3irkeep my AI robots out your mutha f’ing mouth!

@RIQ-zg9xm

March 8, 2024 at 6:56 pm

How does a stock split impact current investors of NVIDIA. What are the pros and cons of a stock split?

@VamshiGarikapati

March 8, 2024 at 7:56 pm

impact is usually positive as it psychologically entices new buyers to get into a seemingly “lower” market value price even though the overall market cap is still the same

@themusic6808

March 8, 2024 at 8:20 pm

As a companies share price rises its trading volume ultimately decreases and liquidity as well, which can slow growth. A stock split increases liquidity and new investment, and ultimately can rekindle new growth in the stock as most investors don’t have 800 dollars to buy a single share but would be likely feel better about buying 8 shares for 100 dollars (even though it changes nothing about the market cap or valuation of the company post split). It’s really a tool used to keep new investment in a rapidly growing company, and existing shareholders end up benefiting immensely if they can participate in a few splits as their share count multiplies by the split so do their gains as the stock price rises after every split. This is why someone who bought Microsoft at their IPO now would have a cost base of 0.10 cents a share (they really IPO’d around 25) because they split so many times in the 1980’s and 90’s as they did something close to a 50,000% return.

@RIQ-zg9xm

March 8, 2024 at 8:29 pm

@@themusic6808 Thank you

@RIQ-zg9xm

March 8, 2024 at 8:55 pm

@@VamshiGarikapati thanks

@briantep458

March 8, 2024 at 9:31 pm

its bullish, it will drive more retail “dumb money” investors in

@codyjames821

March 8, 2024 at 8:27 pm

ASTML for the win.

@stevenseibel9216

March 8, 2024 at 10:59 pm

They’re asking for a split because they wanna keep it going long enough. But also to bring in people who shop at Walmart so they can unload onto them at the top. Stay safe guys

@mypostyart8989

March 9, 2024 at 2:21 am

I hope so I have 500,000 shares right now

@eh288

March 9, 2024 at 11:06 am

You wish!

@matthewallman3500

March 9, 2024 at 12:48 pm

Lol

@MattH3ew-rm3ir

March 9, 2024 at 4:26 am

Beep Boop 🤖 Beep

@dan-cj1rr

March 9, 2024 at 9:45 am

HOLD THE STOCK FUARKKKKKKKKKK TO THE MOONNNN DIAMOND HANDS

@alan_drees

March 9, 2024 at 9:58 am

Very positive video. I have about $300K to invest with a goal of generating passive income of $30K/yr or $2500/mo, where would I put it in?

@naimcgrath1401

March 9, 2024 at 11:26 am

How do you know?

@edwardsavela

March 9, 2024 at 2:48 pm

Not buying any China stocks. Too many good opportunities elsewhere. Why invest with an autocratic communist country? I am into India, the fastest growing economy in the free world. And Japan. $EPI, $DXJ.

@Malcolmdeeb

March 9, 2024 at 2:49 pm

Such a grating accent.

@ElpidiosantarinDelrosario

March 10, 2024 at 12:48 am

The more blessings are coming the more people we can help

@MiaEngelmann3

March 10, 2024 at 4:45 am

I’ve purchased numerous stocks in individual firms. Because there are so many stocks that will skyrocket in the long run, it is currently safe to buy in on ETF and ride it out. Due to fud, I sold out early, but then retraced my ways and re-invested $350,000 with a financial advisor who manages my account. I received an 82% return last year and will see where it goes this year.

@user-it7sk1ti7k

March 10, 2024 at 4:46 am

that’s quite impressive, you surely made a good bit of money. I myself invested in warren’s BRK-A stock quite pricey but totally worth it.

@user-ij3ol9wf1e

March 10, 2024 at 4:47 am

I just started a few months back, I’m going for long term, I’m still trying to wrap my head around it, who’s this advisor you work with ?

@markanton-nh8ed412

March 10, 2024 at 4:51 am

Please can you leave the info of your lnvestment advisor here? I’m in dire need for one.

@user-ij3ol9wf1e

March 10, 2024 at 4:52 am

STEPHANIE KOPP MEEKS she is whom i work with look her up..

@markanton-nh8ed412

March 10, 2024 at 4:53 am

thanks for sharing this, I am in conversations with your advisor, and she really has substance, having interviewed her properly and reviewed her model, I am hoping she takes me on quite seriously too

@user-de4xs6ot9t

March 10, 2024 at 11:04 am

There has been considerable discussion regarding a October rally and the potential for certain stocks to experience substantial growth during this season. Unfortunately, I don’t have specific information on which stocks might be involved. However, I recently sold my home in the Boca Grande area and are considering investing a lump sum in the stock market before any potential rebound. It is challenging to determine whether this is an opportune time to buy, as market conditions can be unpredictable

@AndrewMike-nh4oo

March 10, 2024 at 11:05 am

It took me five years to realize the futility of trying to predict market movements solely based on chart analysis. The unpredictability of the market made it clear that such predictions are unreliable. The absence of a mentor during that period resulted in five years of painful experiences. However, I eventually learned to align myself with the direction the market wanted to go and adopt a simpler, disciplined approach.

@EleanoreHarcus04

March 10, 2024 at 11:06 am

The reality is that nobody possesses all the answers. It is essential to establish your own process, effectively manage risk, and remain committed to your plan regardless of the circumstances. This requires a willingness to learn from mistakes and constantly improve your approach.

@JenniferJoseph-es3ws065

March 10, 2024 at 11:07 am

It may be beneficial to consult with a financial advisor who can provide personalized guidance based on your individual circumstances and goals.

@JamesSalivan11

March 10, 2024 at 11:08 am

I think this is something I should do, but I’ve been stalling for a long time now. I don’t really know which firm to work with; I feel they are all the same but it seems you’ve got it all worked out with the firm you work with so i surely wouldn’t mind a recommendation.

@JenniferJoseph-es3ws065

March 10, 2024 at 11:09 am

STEPHINE KOPP MEEKS she is whom i work with look her

@PaulBowen-kl6mj

March 10, 2024 at 3:19 pm

I think it’s important to stick to stocks that are immune to economic policies. I’m looking at NVIDIA and other AI stocks. It seems AI is the trajectory most companies are taking, including even established FAANG companies. Maybe there are other recommendations?

@GaryKennedy-ky3du

March 10, 2024 at 3:23 pm

I bought into NVIDIA around September because my financial advisor recommended it to me. She said the company is selling shovels in a gold rush. It accounted for almost 80% of my market return this year.

@SteveRussell-yh1gt

March 10, 2024 at 3:23 pm

@@GaryKennedy-ky3du That’s a great analogy and I love the insight. Professionals could make a really big difference in investing, and I think everyone should have one. There are aspects of market trends that are difficult for the untrained eyes to see.

@umarharuna7162

March 10, 2024 at 3:24 pm

@@SteveRussell-yh1gt One of my goals is to employ the service of one this year. I’ve seen some off LinkedIn but wasn’t able to get a response. Would you recommend who it is you work with?

@SteveRussell-yh1gt

March 10, 2024 at 3:24 pm

@@umarharuna7162 ‘Alice Marie Coraggio’ is the licensed advisor I use. Just research the name. You’ll find the necessary details to work with a correspondence to set up an appointment.

@umarharuna7162

March 10, 2024 at 3:25 pm

@@SteveRussell-yh1gt Thank you for this Pointer. It was easy to find your handler, She seems very proficient and flexible.