Bloomberg Technology

Musk Should Sell $21 Billion Tesla Stake, Twitter Poll Says

Elon Musk asked on Twitter whether he should sell 10% of his stake in Tesla Inc., and a majority of his social media followers said they’d support such a sale. Su Keenan reports on “Bloomberg Daybreak: Australia.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology”…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

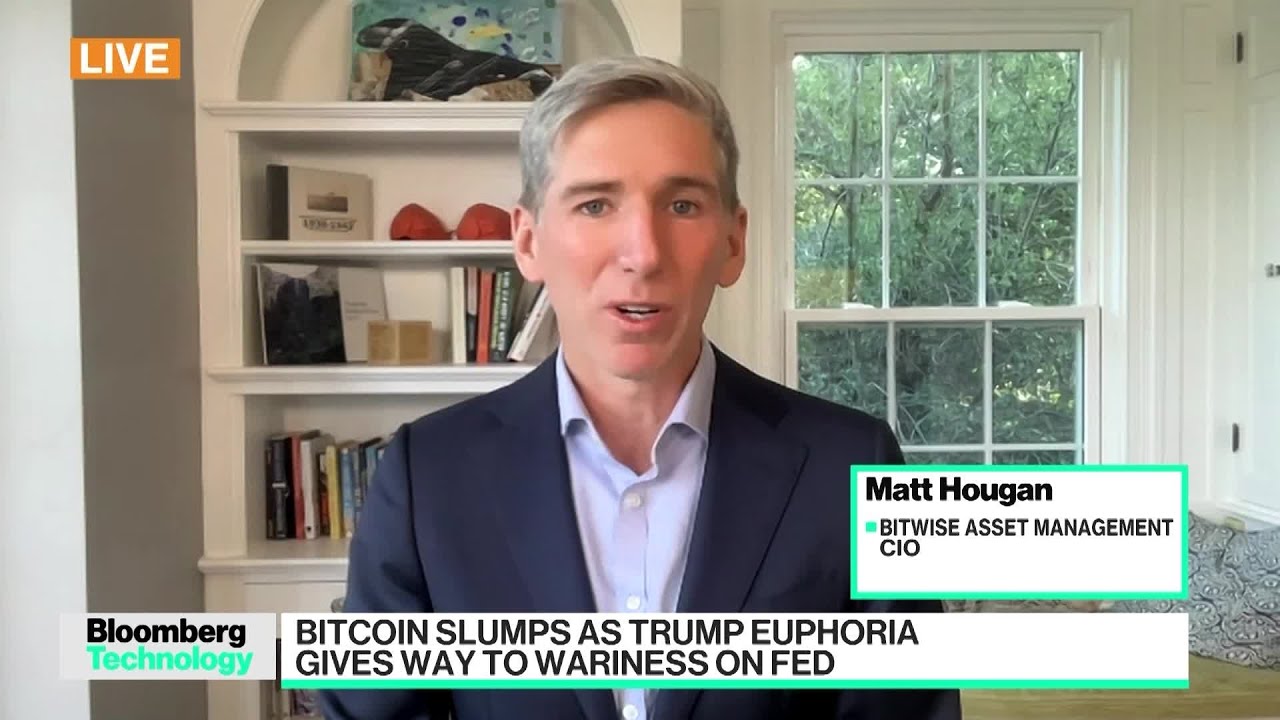

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Edgar Cardenas

November 8, 2021 at 1:03 am

$#$# Tony stark blue pen 🖊️

Slickpete83

November 8, 2021 at 1:06 am

💡💡💡 *Elon should sell 21 Billion worth of TESLA stocks and buy 420k Teslas cars and give them out to people for free, thus increasing his net worth even more by increasing Tesla sales*

Sir Derty ✓

November 8, 2021 at 1:11 am

They did a poll on that.

69.420% agree

your wife's boyfriend

November 8, 2021 at 1:21 am

that’s worse than just giving the cars away…that’s like paying extra to give away something u already own….Tesla investors…dumbest people u will ever meet…

Slickpete83

November 8, 2021 at 1:29 am

@your wife’s boyfriend *he could take order of his own 420000 Tesla cars and sell them on the used market , then using money from used Tesla sales to buy more new Tesla cars , infinite profit loop*

Sir Derty ✓

November 8, 2021 at 1:07 am

Twitter is filled with bots and polls are not legit online for years.. get a clue ladies.

Sir Derty ✓

November 8, 2021 at 1:09 am

Why are you sadsacks hiding normal comments? but you let someone post nonsense characters?

Sir Derty ✓

November 8, 2021 at 1:09 am

Stop erasing normal comments… grow up.

Sir Derty ✓

November 8, 2021 at 1:10 am

Why are you sadsacks hiding normal comments? but you let someone post nonsense characters? Twitter is filled with bots and polls are not legit online for years.. get a clue ladies.

Hutin Pui

November 8, 2021 at 1:10 am

dumped for BTC

Swornim Kc

November 8, 2021 at 1:11 am

you know what , twitter is not real place

A. Ali

November 8, 2021 at 1:16 am

what are these 2 gossip girls talking about … who sells like that in one day and tank the market of their own company …. jesus … where do they come from :::)))))) its Fin media … not Singapore housewives … 🙂

your wife's boyfriend

November 8, 2021 at 1:22 am

literally elon wants to sell so he has a bunch of bots voting to make the decision for him…u guys are retarded as fuck….

your wife's boyfriend

November 8, 2021 at 1:23 am

the supporters he has are wsb idiots…the are diamond hands…they dont sell. the voting is rigged…

Tony Nguyen

November 8, 2021 at 1:23 am

Elon is so influential, that sale could set off a broader sell-off to an already inflated bubbly market…Go Elon!

420KinK

November 8, 2021 at 1:24 am

Ive never heard of a more bullish dip