Bloomberg Technology

IMAX Sees Pent Up Consumer Demand

IMAX CEO Richard Gelfond, discusses the 3Q sales surge, and releasing movies in theatres and streaming services. He speaks with Alix Steel and Francine Lacqua on “Bloomberg Markets.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Emily Chang here: Get the latest in tech…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

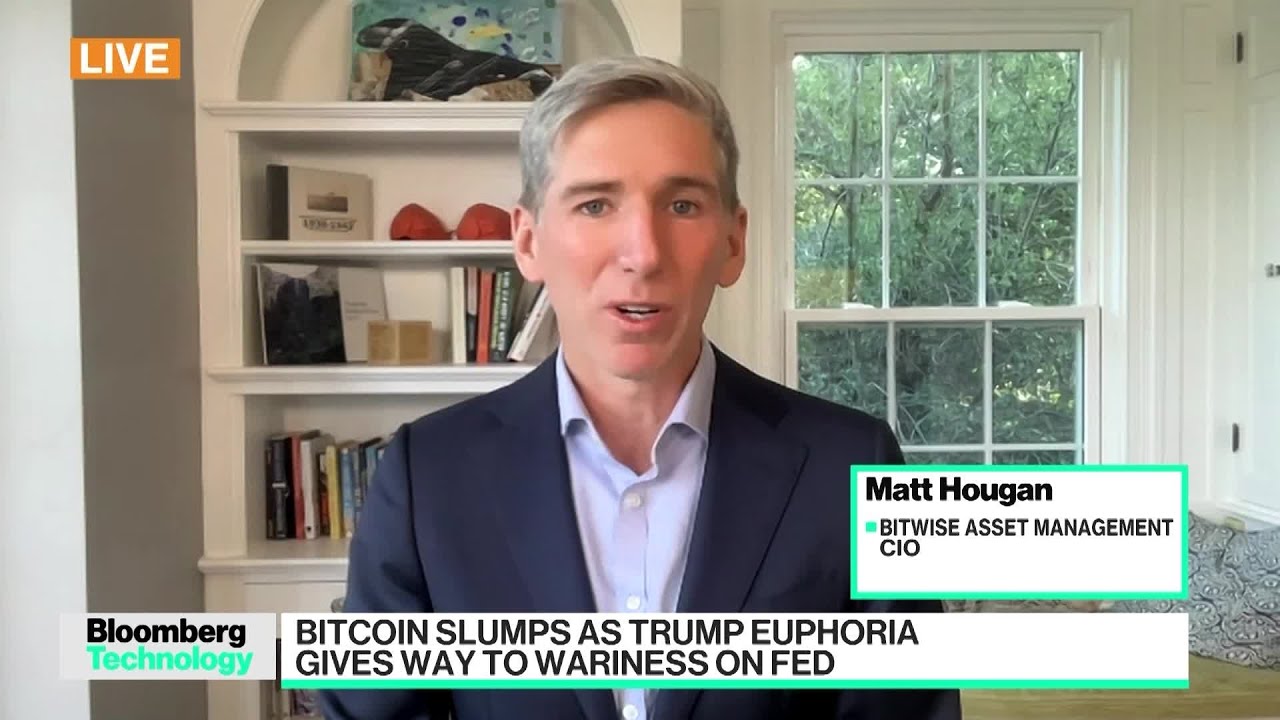

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

RoyceMaa

October 29, 2021 at 6:28 pm

<

RoyceMaa

October 29, 2021 at 6:37 pm

Sming44 Te-le-gr-am………..

Bryanna Jazmyne

October 29, 2021 at 6:41 pm

Even in a challenging situation Stewart Ming keeps positive attitudes we appreciate his reliability.

Kristofer Lamont

October 29, 2021 at 6:42 pm

Wow, amazing to see others who trade with Mr Stewart Ming, I’m currently on my 5th trade with him and my portfolio has grown tremendously

Melanie Kiefer

October 29, 2021 at 6:42 pm

i’ve grown so much over the past year and much is thanks to you and your efforts to get me there. I can’t wait to see where this next year will take me thanks for being such a great leader thanks Stewart Ming

eugene noubosse

October 29, 2021 at 6:44 pm

The Reason why I trade with Stewart Ming is because they are always accurate and helps even when the market is crashing

Fyn Edrei

October 29, 2021 at 6:28 pm

<

Fyn Edrei

October 29, 2021 at 6:37 pm

Sming44 Te-le-gr-am………..

Ariane Nicio

October 29, 2021 at 6:42 pm

Wow, amazing to see others who trade with Mr Stewart Ming, I’m currently on my 5th trade with him and my portfolio has grown tremendously

Roxanne leaH

October 29, 2021 at 6:42 pm

i’ve grown so much over the past year and much is thanks to you and your efforts to get me there. I can’t wait to see where this next year will take me thanks for being such a great leader thanks Stewart Ming

Ouss

October 29, 2021 at 6:32 pm

The Dune voice in IMAX 🔥🔥🔥

Kelsey Lloyd

October 29, 2021 at 7:04 pm

ɴɪᴄᴇ