Bloomberg Technology

How AI Is Impacting Wealth Management

Farther is a startup focused on utilizing cutting-edge technology to advance the wealth management business. Farther co-founder and CTO Brad Genser joins Ed Ludlow and Caroline Hyde to discuss how AI is changing the game when it comes to wealth management. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

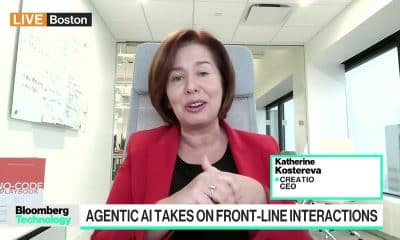

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

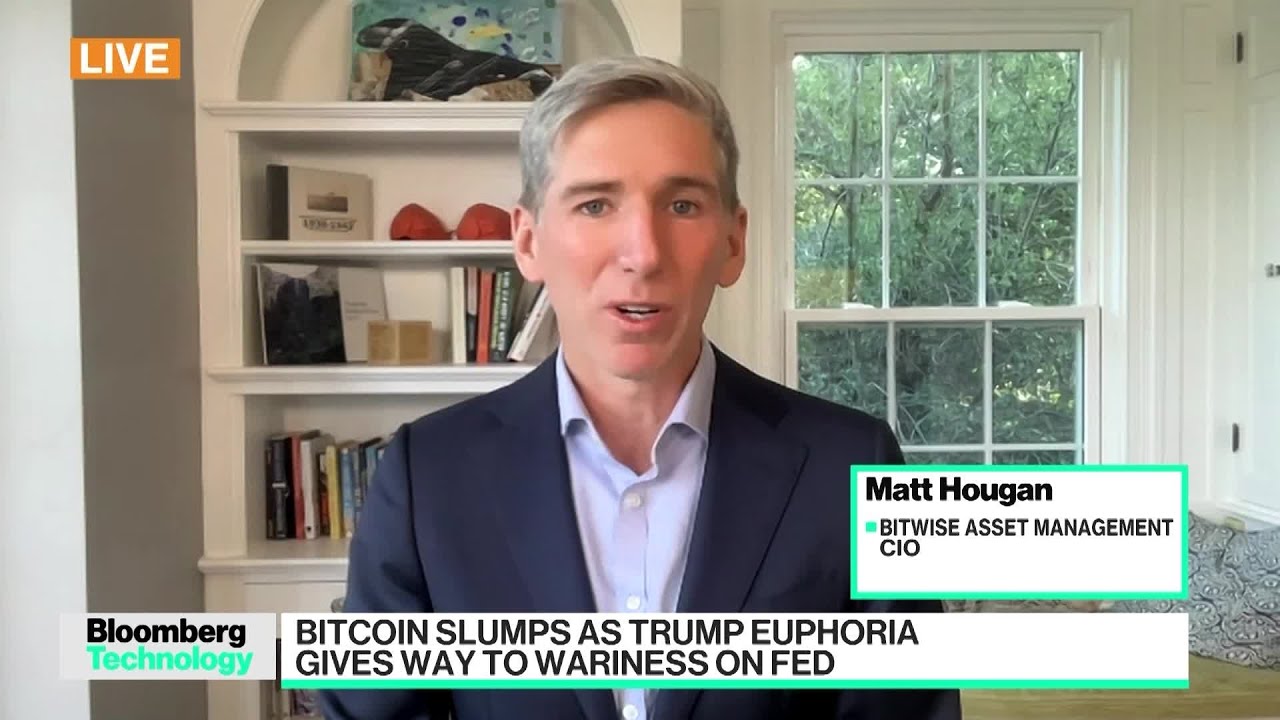

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Tyshawn Alivia

August 29, 2023 at 5:49 pm

I’ve been quite unsure about investing in this current market and at the same time I feel it’s the best time to get started on the market. i was at a seminar and the host spoke about making over $972,000 within 3 Months with a capital of $200,000. I just need creative ideas to afford my retirement.🚀🚀🚀🚀

manu powerrich

August 29, 2023 at 5:50 pm

Yes I Agree, I’ve been talking to ALEX L ORLOFF for long now, mostly because I lack the knowledge and energy to deal with these ongoing market circumstances. there are more aspects of the market than the average individual is aware of. Having an investing counselor is now the best line of action, especially for those who are close to retiring

manu powerrich

August 29, 2023 at 5:51 pm

Run a quick online research with his name.

manu powerrich

August 29, 2023 at 5:51 pm

He’s Active online through his website

Norman Oro

August 29, 2023 at 8:06 pm

This is interesting. I don’t know much about the wealth management industry, but it does seem that there’s an opportunity if you can create a service that provides highly customized wealth management at scale using artificial intelligence and really granular data. The final point in the interview was perhaps the most striking. How do you safeguard data from high-net-worth clients, much of which may be extremely sensitive? There probably isn’t much room for error in the minds of clients; and a data breach would do great harm not only to them but also of course to the firm entrusted with that information. Given that, it makes sense that it sounds like Farther is keeping that data completely in-house for the time being.

rafflesenquiries enquiries

August 29, 2023 at 8:49 pm

🎯 Key Takeaways for quick navigation:

00:01 🏦 The speaker reflects on his time at Goldman and his current endeavors in wealth management technology with “Farther.”

00:30 📊 Farther focuses on the high net worth market but believes technology can broaden its audience due to operational efficiencies.

00:58 💡 They see a huge potential ($420 trillion net worth in the US) and believe AI can help in tapping into this market.

01:28 🚫 There are concerns about regulatory oversight in the AI industry, especially from figures like Gary Gensler.

01:57 📜 Gary Gensler previously wrote about AI technology, emphasizing the importance of both protecting investors and giving more people access to the markets.

02:27 🤖 Farther believes human interaction is essential in wealth management, despite technological advancements.

03:20 🌍 The speaker reflects on his time at Goldman Sachs and highlights that AI can offer a more personalized wealth management experience.

04:16 🎯 AI allows for a deeply personalized plan that considers various individual factors like taxes, living conditions, and bank account statuses.

04:46 🛡️ Client data protection is a priority; personal data is not sent to large language models.

05:13 🤫 In wealth management, discretion is vital. Good wealth advisors must be trusted with deeply personal information, and this extends to technology too.

Made with HARPA AI