Bloomberg Technology

FalconX’s Kantorovich on Future of Crypto ETFs

FalconX Global Head of Institutional Coverage Aya Kantorovich joins Emily Chang to discuss the future of crypto ETFs as Wall Street moves closer to acceptance of crypto, how crypto is “much larger than finance” in its many different applications and the role of crypto and blockchain technology in the metaverse. ——– Like this video? Subscribe…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

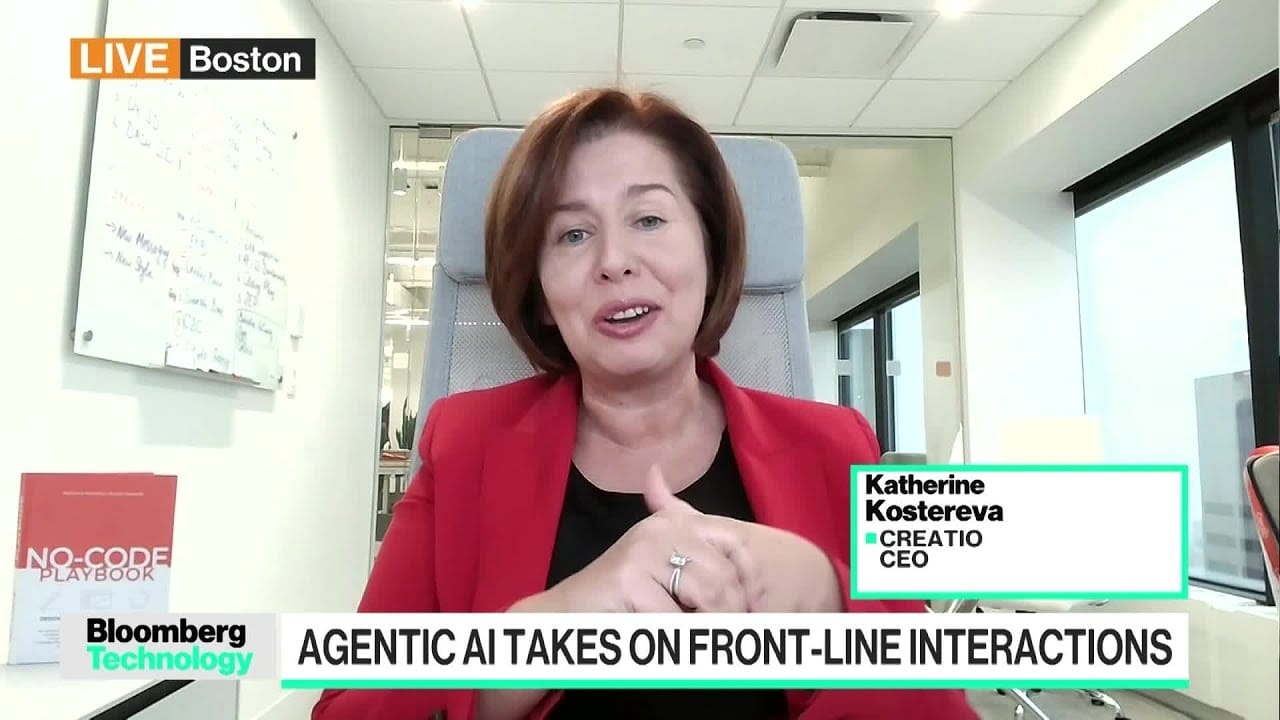

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

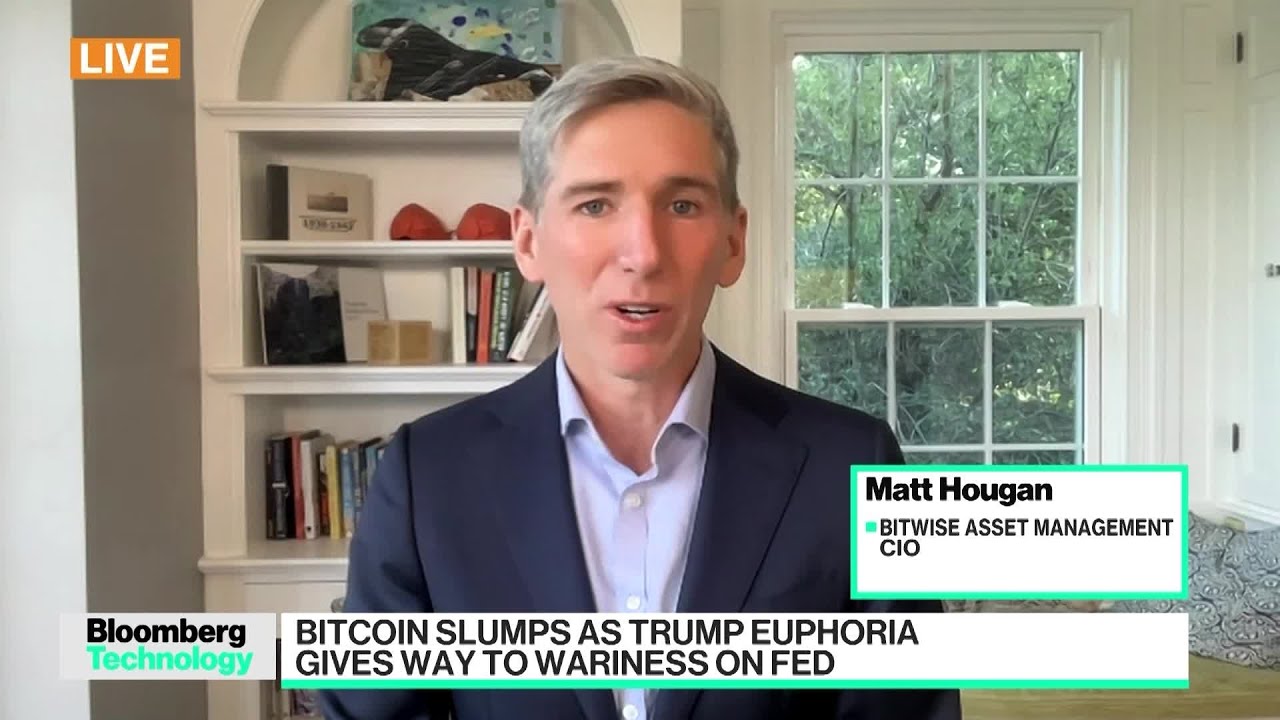

Bloomberg Technology

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

the matrix has you.

November 6, 2021 at 7:01 pm

She doesn’t know 😂

Sir Derty ✓

November 6, 2021 at 7:16 pm

yep, just hot air ads in the form of a bogus “interview”

Melisa Scalia

November 6, 2021 at 7:03 pm

<

Gyôry Klaudia

November 6, 2021 at 7:04 pm

I can’t take the pain anymore. I went ahead and reinstated my stop-loss for ETH. What a bad decision, I think this guide is everything I need right now.

Fredrik Tuominen

November 6, 2021 at 7:04 pm

You are right I’v been trading with Jaxon Matthew . in managing my Bitcoin and crypto option trade accounts..He is very genuine and trades professionally.

Sultan Maraş

November 6, 2021 at 7:05 pm

It been amazing, my entire portfolio as of today stands on 4BTC from 0.9BTC I invested. Thanks to Mr Dr. Jaxon Matthew his confidence and skills is on a maximum level.

Sir Derty ✓

November 6, 2021 at 7:17 pm

Melisa, we know you are a guy in nigeria. get a real job and

nobody falls for these.. whoever sold you this idea is a duncey bit of a person

Sir Derty ✓

November 6, 2021 at 7:17 pm

scam

get a job,

stop your spam and multiple accounts

grig

November 6, 2021 at 7:03 pm

So many barely capable people talking about tech they don’t get.

Sir Derty ✓

November 6, 2021 at 7:16 pm

Exactly.. this is another prime example.

Its almost as if bloomberg is just selling tv time at this point to anyone who buys a “interview”

Sir Derty ✓

November 6, 2021 at 7:14 pm

Complete nonsense.

Ali-W7 Ananza

November 6, 2021 at 8:19 pm

falconx to the moon

Sir Derty ✓

November 6, 2021 at 10:17 pm

no.

Tasha McDonald

November 6, 2021 at 10:31 pm

Hi everyone, I’m actually looking for a good trade that can help me trade and make profit but is very hard to see a trusted one. Any idea?

Henry Mark

November 6, 2021 at 11:44 pm

@Akshat Shrivastava It’s not necessarily about ignorance, some has the mind of investing but afraid to meet, trade and invest with wrong and unprofessional brokers

Akshat Shrivastava

November 6, 2021 at 11:46 pm

@Henry Mark yeah

Hudson Jones

November 6, 2021 at 11:48 pm

@Henry Mark My first investment with Mr Clinton mark gave me upto $ 73,000 and that has made me invest without the fear of losing, I got four of my friends involved with him already.

Eric Doom

November 6, 2021 at 11:50 pm

Wow I can’t believe you guys are discussing about Mr Clinton Mark he is now currently managing my account I just made my second withdrawal trading with him. I can’t wait another two weeks to cashout again.

Samson Daniel

November 6, 2021 at 11:52 pm

I’m very glad I stumbled on this today writing to him now. Really hope he can help me

ardf_ca

November 7, 2021 at 5:17 am

Why would you imvest into ETF and paid a management fee when you can invest into crypto directly, plus you can place your own crypto into wallet in the future. Am I missing something with this ETF nonsense?

vastcold

November 7, 2021 at 6:21 pm

FALCX TO THE FCKING MOONS BOYS!!!! EZ NEXT 1000x GEM in BSC

Thirdai_

November 7, 2021 at 8:31 pm

Santa Coin to the moon! 🚀🚀