Bloomberg Technology

‘Bloomberg Technology: SVB Fallout Special’ (03/10/2023)

“Bloomberg Technology” is our daily news program focused exclusively on technology, innovation and the future of business hosted by Caroline Hyde in New York and Ed Ludlow from San Francisco. ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes of “Bloomberg Technology” with Caroline Hyde and Ed Ludlow here:…

Bloomberg Technology

Tech Leaders Approach Trump, Intel Seeks Altera Buyers | Bloomberg Technology

Bloomberg’s Caroline Hyde breaks down how President-elect Donald Trump and Elon Musk wield their political power as the government works to avoid shutting down. Plus, the Big Tech leader merry-go-round at Mar-a-Lago continues with Jeff Bezos the latest to try and influence Trump’s policies and decisions. And, private equity firms are competing for Intel’s programmable…

Bloomberg Technology

The Rise of Agentic AI

Creatio CEO and Founder Katherine Kostereva joins Caroline Hyde to discuss the rise of AI agents taking front-line interactions from customer service to sales, and to give her outlook for the space in 2025. She speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on YouTube: Watch the latest full episodes…

Bloomberg Technology

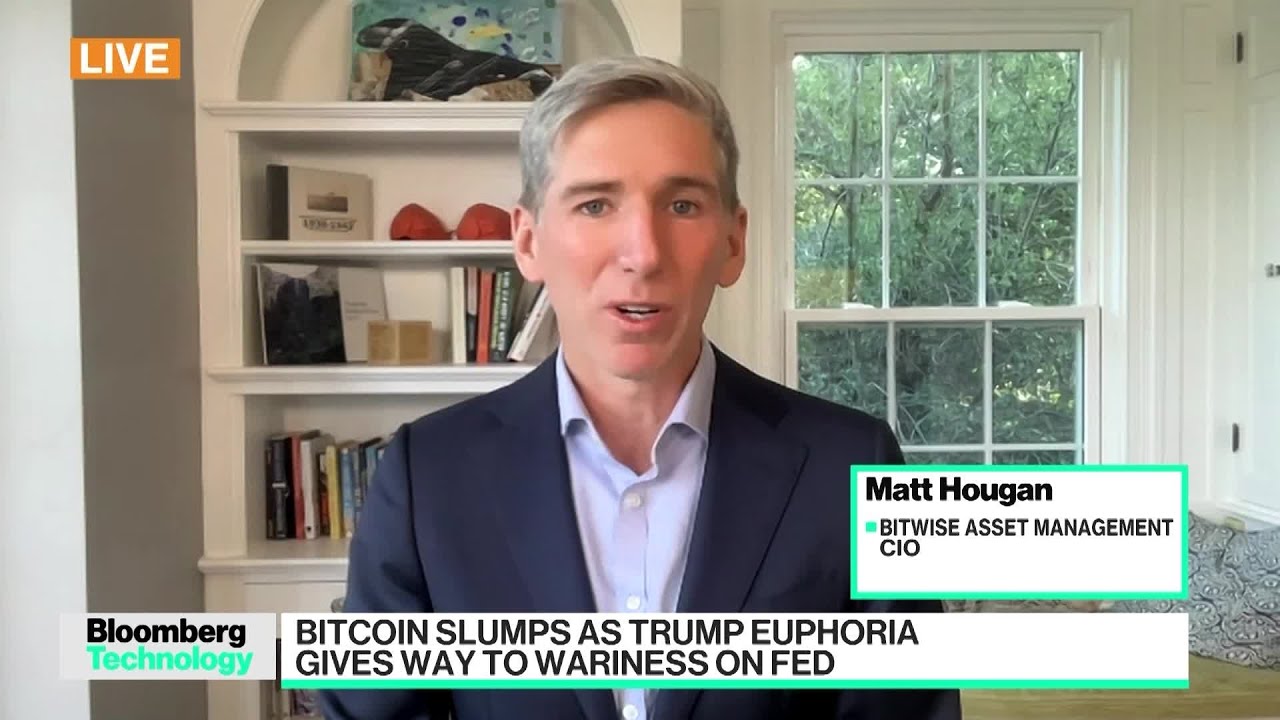

Bitcoin Slumps: Trump Euphoria Gives Way to Fed Wariness

Bitwise Asset Management CIO Matt Hougan tells Caroline Hyde why he believes the latest weakness in crypto and Bitcoin over the last few days is a “healthy pullback” which does not take away from the asset class’s overall great run this year. He speaks on “Bloomberg Technology.” ——– Like this video? Subscribe to Bloomberg Technology on…

-

Science & Technology5 years ago

Science & Technology5 years agoNitya Subramanian: Products and Protocol

-

CNET5 years ago

CNET5 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

Art Maknev

March 11, 2023 at 9:58 am

The government will bail them out on Monday.

💰 Instant $740 Daily With Olivia

March 11, 2023 at 10:22 am

You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something⋆your gut, destiny, life, karma, whatever. This approach has never let me down, and it has made all the difference in my life. ⋆Steve Jobs

Carpenter

March 11, 2023 at 10:28 am

Under federal law, all of a depositor’s accounts at an insured depository institution, including all noninterest-bearing transaction accounts, will be eligible for insurance by the Federal Deposit Insurance Corporation up to the standard maximum deposit insurance amount ($250,000), for each deposit insurance ownership. Course if you have loans through SVB, then you no longer need to pay.

Bharati Chaudhari

March 11, 2023 at 10:56 am

Nice

thomasucc

March 11, 2023 at 10:58 am

Get the taxpayers to pay

小渾渾

March 11, 2023 at 10:59 am

It will be taken over by a big bank ~ my guess

Michael Dunton

March 11, 2023 at 11:02 am

Watch for bailouts next week. The whole idea of the deposit insurance limit will be at stake.

Nibiru

March 11, 2023 at 5:22 pm

bailouts or bailins…we will have to watch and see.

Harvey Post

March 11, 2023 at 11:52 am

I didn’t feel that one coming but I knew to evil to b true…WAC

Suman Reddy

March 11, 2023 at 12:04 pm

Be safe to all the Arjuns out there. Be safe to all the Arjuns out there…Be brave in name and safe…Great interview.

ᴡʜᴀᴛꜱ"ᴀᴘᴘ"ᴍᴇ+𝟏𝟕𝟐𝟎𝟕𝟎𝟐𝟓𝟗𝟏𝟕

March 11, 2023 at 12:55 pm

👆👆⬆⬆📩📩📤

Suman Reddy

March 11, 2023 at 12:16 pm

Did you all know that the name Liam means strong willed warrior and protector and the Irish name Saoirse means freedom and liberty…

Rod

March 11, 2023 at 12:20 pm

Not your keys not your crypto. Never store your assets on an exchange. Much like never keep all your money in a bank (always keep physical cash/valuables).

Andres Valenzuela

March 11, 2023 at 1:08 pm

trust takes years to earn and lost in a day. people will act accordingly.

winterheat2

March 11, 2023 at 1:18 pm

41:35 imagine having a software engineering interview with sound quality that is even worse than this for an hour

Kab Ak

March 11, 2023 at 1:48 pm

Majority lenders will be from H1 visa IT people from India probably, without having a green card they are given all sorts of loans from buying properties to taking business loans and guess what majority of that money will be funded to facist govt RSS terrorist organization in India. Time to wake up currupt corporate and politicians to get them Jon’s visas here in US without any background check who and what they are, what harm can do to companies and other institutions in US. Hardworking honest American people don’t deserve this nonsense

Kab Ak

March 11, 2023 at 1:56 pm

Majority lenders will be from H1 visa IT people from India probably, without having a green card they are given all sorts of loans from buying properties to taking business loans and guess what majority of that money will be funded to facist govt RSS terrorist organization in India. Time to wake up common people check the currupt corporate and politicians who got them here on this visas here in US without any background check on them who and what they are, what harm they can do to companies and other institutions in US

Linda Brown

March 11, 2023 at 2:21 pm

Beauty fades stupid Is forever. All in podcast for understandable info and a new puppy

Joseph Snyder

March 11, 2023 at 3:00 pm

Bank accounts insured to 250 k which covers 95% percent of depositors

Trend Catalyst Traders

March 11, 2023 at 4:46 pm

thank you

Nibiru

March 11, 2023 at 5:16 pm

This was no accident. This was planned, behind closed doors, from the very beginning. This money did not simply disappear, it was simply transferred into the bank accounts of the global elites. Get ready folks…you ain’t seen nothin’ yet.

Jason Joseph

March 11, 2023 at 6:15 pm

Fantastic show, looking forward to the relaunch in the new 12:00pm time slot.

Dare Gug

March 11, 2023 at 6:41 pm

Can you say less and tell views less

Such mis information

It a complete diversion

Russia has claimed Victory over NATO

Zonda Feek

March 11, 2023 at 6:50 pm

Love Bloomberg, hate many of their hosts tone of voice! They seriously managed to have the most annoying voices in the industry 🤷🏽♂️

Tom Brown

March 11, 2023 at 8:16 pm

LOL Biggest 6 banks are safe. Umm… where did I hear that before..??. Oh yeah 2008. BTW Stephanie go look at BAC books before u open ur mouth.

steeltormentors

March 12, 2023 at 11:25 am

12:55 takes the cake

“Cash deposhits”

Tonnya Wanner

March 12, 2023 at 11:51 am

Your full of crap. Banks are going bye bye. We’re crashing the whole corrupt system. Under the actor pedo Jo.😁

Mehdi Taba

March 12, 2023 at 12:16 pm

They don’t talk about the reasons.

Larry Miller

March 12, 2023 at 12:22 pm

The American banking system is really safe and well capitalized,” she said. “It’s resilient.” explains Janet Yelen…

The exact same sentence was said for the radios as we collapsed into a depression.

Seems like a good time for someone to explain exactly what is going on and how it came to this, WITHOUT worrying about offending one group over another.

Pfffft, who am I kidding. This’ll go over like COVID and Fauci. At least we know what a woman is

Native Advisors

March 12, 2023 at 12:46 pm

NO BAILOUT FOR SVB. The American banking system seems like it is teetering badly.

NOTE: It is time for a new financial ecosystem to emerge for investors and the banking public. Decentralized financial services and backing by a tribal government – with complete and real insurance levels – is needed now.

American Indian tribes could offer this within weeks. Where are the banking and investment innovators? #investment #like #banking #insurance #venturecapital #investing #financialservices

David Peng

March 12, 2023 at 12:47 pm

Can I ask a very basic, but surprisingly nobody mentioned question, why so many VCs choose SVB and FRB, not choose bigger national banks (such as Chase, BOA, Citi, etc), or smaller banks (such as credit unions), what kind of service are so unique and attractive, can not understand at this moment.

Morten

March 12, 2023 at 2:12 pm

It’s probably the other way around: banks offering terms based on their preference and understanding of clients businesses. Lots of banks don’t like anything without perceived assured returns. Hence all the low interest bonds that are now down double digits in selling value because the Fed interest rate is up.

Austin E. Delacruz, Jr.

March 12, 2023 at 12:55 pm

WHAT IF MAJORITY OF AMERICANS WITHDRAW ALL THEIR BANK SAVINGS TOMORROW, 3/13/2023?

If a large number of Americans were to withdraw all of their savings from banks at once, it could potentially have significant implications for the banking system and the broader economy.

Banks use customer deposits to fund loans and investments, so a sudden and significant decrease in deposits could limit their ability to lend money and finance economic activity. This could lead to a contraction in credit markets, reduced investment, and slower economic growth.

Furthermore, if everyone were to withdraw all their savings at the same time, there may not be enough physical cash to meet the demand, which could lead to long lines at banks and ATMs, and potentially even a cash shortage.

It’s important to note, however, that it’s unlikely that a large number of Americans would suddenly withdraw all of their savings at once. Even during times of economic uncertainty, many people rely on their savings for emergencies and daily expenses and may not have the means to withdraw all of their funds at once.

In any case, it’s important to be cautious and informed when making decisions about your finances, and to consider the potential risks and consequences of any actions you take.

WHAT IF AMERICANS LOSE THEIR TRUST ON BANKS?

In general, people’s confidence in banks can be influenced by a variety of factors, such as economic conditions, bank policies, and regulatory oversight. If there is a perception that a bank is in financial trouble or is engaging in risky behavior, it could undermine people’s trust in that bank and potentially the banking system as a whole.

That being said, it’s worth noting that banks in the United States are subject to regulatory oversight and are required to hold a certain amount of capital to protect against losses. Additionally, the FDIC insures deposits up to a certain amount, which can help to mitigate the risk of bank failures.

Overall, the level of confidence that Americans have in banks may vary depending on a range of factors and individual experiences.

WHAT IS THE MAXIMUM AMOUNT THE FDIC PAY FOR EACH ACCOUNT?

The Federal Deposit Insurance Corporation (FDIC) insures deposits up to $250,000 per depositor, per insured bank. This means that if an insured bank were to fail, each depositor’s account would be covered up to $250,000, including principal and accrued interest.

It’s worth noting that the $250,000 limit applies to each depositor’s accounts at a given bank, so if you have multiple accounts at the same bank, they are added together, and the total amount insured is up to $250,000. Additionally, if you have accounts at different banks, each bank is separately insured up to $250,000 per depositor.

The FDIC provides a comprehensive guide to deposit insurance on their website, which includes information about what types of accounts are covered and how to maximize your insurance coverage. If you have specific questions about your FDIC insurance coverage, it’s a good idea to consult with a financial advisor or contact the FDIC directly.

HYPOTHETICALLY, WHAT IF THE SAVINGS WORTH $45M, HOW MUCH WILL THE FDIC REIMBURSE THE LOSES?

If an individual had a savings account worth $45 million at an FDIC-insured bank that failed, the FDIC would only insure up to $250,000 of the total amount. This means that the depositor would be reimbursed up to $250,000 and would lose the remaining amount that exceeded the insurance limit.

It’s worth noting that there are ways to potentially increase the amount of FDIC insurance coverage for large deposits, such as by spreading the funds across multiple accounts or by using different ownership categories. However, it’s important to consult with a financial advisor or contact the FDIC directly to understand the rules and limitations of deposit insurance.

In any case, it’s generally recommended to spread large deposits across multiple FDIC-insured banks to maximize FDIC insurance coverage and reduce the risk of losses due to bank failures.

Pain211

March 12, 2023 at 1:12 pm

SVB bought $117B in bonds before the Fed began increasing rates. The value of most of those bonds SVB purchased has fallen of a cliff due to the fact that bond values decrease as interest rates increase resulting in huge investment losses. Their clients reacted to the investment losses by taking their money and banking somewhere else. SVB failed because those in charge made extremely bad investments. The free market is working as intended.

Joseph Lisack

March 12, 2023 at 4:13 pm

Yes..this is the real story…but main street media won’t cover. Terrible terrible management decisions. Mismatched assets and liabilities. Gets u every time

Burevestnik

March 12, 2023 at 1:49 pm

this is THE sexiest woman alive.

Burevestnik

March 12, 2023 at 1:53 pm

nobody is talking about those hight paid ceos and other marva. nobody needs that marva now we have ChatGPT. ChatGPT can talk sweeter than any ceo out there. Let’s save some money and FIRE all CEOs, all CIOs, all “executives’ (read marva) out there. who the heck needs all those smooth criminals?!

Morten

March 12, 2023 at 2:17 pm

Is it just me or is there a domino effect from FTX and crypto shocks (loads of deposits leaving crypto exchanges) to Silvergate bank (which held a lot of the crypto exchange deposits and put them in treasuries) and now SVB? So a run on crypto exchanges forcing a run on a bank for the crypto exchanges (both to get back actual dollars), scaring the shit out of SVB depositors? Yeah, I might keep staying out of Crypto.

stellar

March 12, 2023 at 2:32 pm

Mrs lennox the bitcoin trader is legit and her method works like magic I keep on earning every single week with her new strategy

Oliver Williams

March 12, 2023 at 7:36 pm

I’m not here to converse for her but to testify just for what I’m sure of, she’s trust worthy and best option ever seen

Sometimes I wonder if she’s used magic power trade

Clayton Malcom

March 12, 2023 at 7:45 pm

I’veI’m not here to converse for her but to testify just for what I’m sure of, she’s trust worthy and best option ever seen

Sometimes I wonder if she’s used magic power trade never heard or seen any of her clients complain of Lost….I think she’s just too perfect She has made success easier than we thought

MANSIR AYUBA

March 12, 2023 at 7:50 pm

She’s not like other brokers that will star telling you stories and excuses why they trade didn’t go well after collecting your money

Johnny Grady

March 12, 2023 at 7:56 pm

A friend that I referred to her just received $7,050 profit after 10 days of investing….I became jealous.. lol

Bisola Fatai

March 12, 2023 at 9:26 pm

My first experience with her gave me the assurance that has made me to invest without fear of loosing

She’s awesome

We love you 🥰

MegaJohnf1

March 12, 2023 at 4:10 pm

Now you realize why the US govt steals other countries gold…because they mismanage their own system…

Rich Ditlevsen

March 12, 2023 at 4:44 pm

Everyone I know cleared most of their money out of the banks.

GoFucY0rSelf

March 12, 2023 at 4:57 pm

Oh but wait. Hasn’t THIS channel been talking about how great our economy is recovering over the las few month? Remember, almost definite soft landing and maybe no landing? JFC, you clowns should just go ahead and hire Jim Cramer and make him your lead financial adviser.

Thanh Ma

March 12, 2023 at 5:23 pm

People’s never learn lessons history from the past . This what happen you allows criminals to steals your moneys for them to living hight life styles . Keep investment in criminal than don’t cry when they gambles all your moneys . And they not going to prisons. When they dealing your investment they talk like they doing over 100 mph . But when they hit the walls they all ran and hide and denying they never did anything wrongs . This people’s need to go to Prisons periods, no more strategic ideas . They all smart with the mouths . But in the end is your moneys . If they wins 10% they kept 9.5% and only get 000.5% in return only . All this Caca talk is trying to invest some more untils you hanging your self for being greedy listening everything this criminals tell you . Untils than this criminal need to be accountability they need to be in prisons . Is not their moneys is your moneys they gambles with and you only get less than a penny for every dollars

John Russelman

March 12, 2023 at 5:56 pm

Clearly this issue is do to uninsured assets of businesses being underinsured to 250,000.00 per client. Why not appoint 25 banks with a 5 million dollar backstop each that cater to these startups?

Melina Mark

March 12, 2023 at 6:25 pm

Making money is an action. Keeping money is behavior. Growing money is knowledge I found out a week ago after getting $10,000 return on my $2000 investment in 7 days.

mark herry

March 12, 2023 at 7:15 pm

she’s active on telegram

mark herry

March 12, 2023 at 7:15 pm

@jessycrux

……………………. 👈

Williams Simth

March 12, 2023 at 7:17 pm

I just sent her a message now. With all the recommendations I’ve seen here, I’ll definitely give it a try.

Blayke Will

March 12, 2023 at 7:19 pm

I’m glad to see Mrs. Jessy Crux mentioned here, my spouse recommended her to Me after investing $4000 and she has really helped us financially in times of COVID -19 lockdown here in Australia 🇦🇺

Alicia Martin

March 12, 2023 at 7:20 pm

Mrs Jessy Crux is the best recommending her to all beginners who wants to recover losses like i did.

Joe alonzo

March 12, 2023 at 6:55 pm

👩🍳“I think that the system, that the administration has pushed many of these banks into more concerned about global warming than they do about shareholder return. And these banks are badly run because everybody is focused on diversity and all of the woke issues and not concentrating on the one thing they should, which is shareholder returns. Instead of protecting the shareholders and their employees, they are more concerned about the social policies. And I think it’s probably a badly run bank. They’ve been there for a lot of years. It’s pathetic that so many people lost money that won’t get it back.”👨🌾

Samoasoa _

March 12, 2023 at 8:03 pm

No one dared to call out the boomerang effect of Chip Act. The smart money knew this is coming as VC had stopped all their deposits.

Jay M

March 12, 2023 at 8:07 pm

Why not give all depositors an equal percentage haircut based on their balance over the insured amount before the bank run leading to its demise? This make those in bad banks think twice before running. It will also make depositors think twice before putting money in such banks.

Truthsabre7

March 12, 2023 at 9:15 pm

Where were the regulators?

Truthsabre7

March 12, 2023 at 9:16 pm

Why are they going to be made whole? Didn’t they know that the money over 250 was not insured? F*** them