People & Blogs

Pay off your credit cards faster with these 4 easy changes | Your Money and Your Mind

Whether you want to pay off credit card debt or just prevent yourself from accruing big balances in the first place, there are some simple steps you can take to help achieve your goal, according to behavioral scientist Wendy De La Rosa. Managing your money can feel scary and complicated, but it doesn’t have to…

People & Blogs

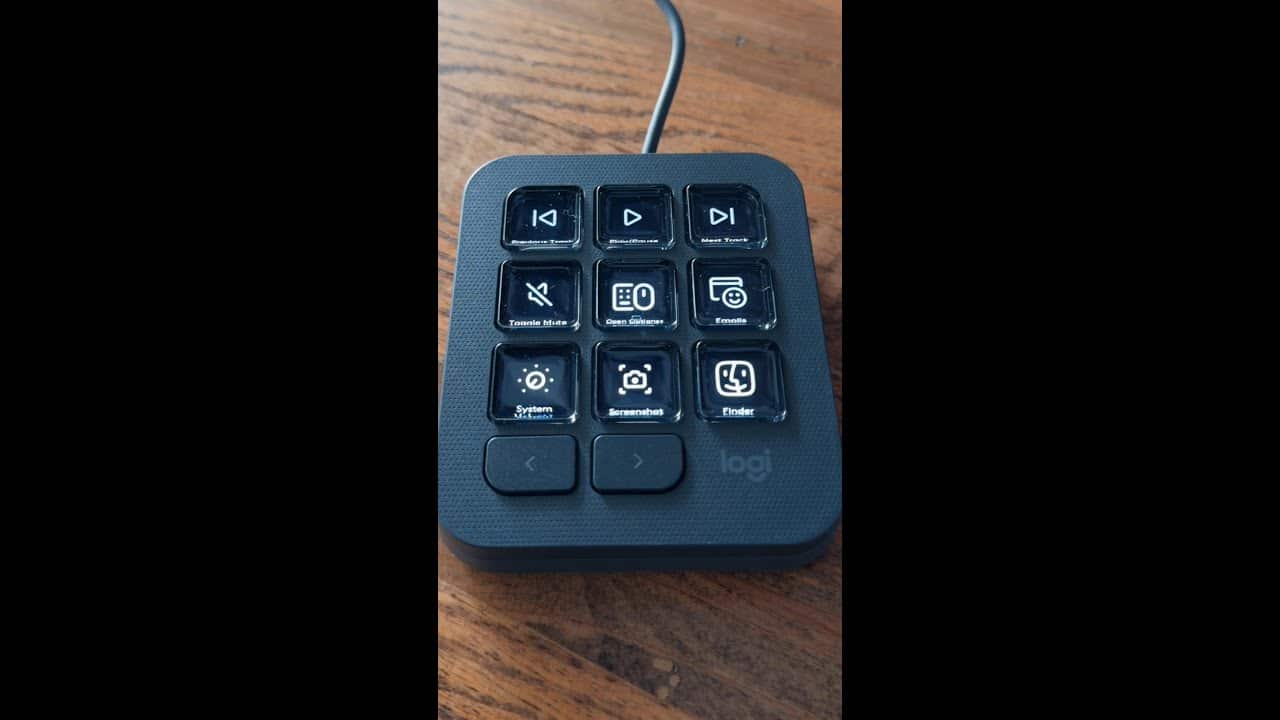

Streamline your creative workflow with the MX Creative Console by Logitech | TechCrunch

Logitech’s new $200 MX Creative Console aims to help users streamline their creative workflow with an advanced dialpad and keypad for intuitive control. (video via Yashad Kulkarni)

People & Blogs

WalkON Suit F1 For Wheelchair Users | TechCrunch

From KAIST Exoskeleton Laboratory and Angel Robotics, the WalkON Suit F1 is a “powered exoskeleton” designed to walk on its own, and allows for users to easily transfer into the suit from a wheelchair. #TechCrunch #technews #robotics #accessibility #robot

People & Blogs

Dreams · Made by Wayne Price and IN-Q with OpenAI’s Sora | TechCrunch

Wayne Price and IN-Q’s “Dreams” made with OpenAI’s text-to-video GenAI model Sora

-

Science & Technology4 years ago

Science & Technology4 years agoNitya Subramanian: Products and Protocol

-

CNET4 years ago

CNET4 years agoWays you can help Black Lives Matter movement (links, orgs, and more) 👈🏽

-

Wired6 years ago

Wired6 years agoHow This Guy Became a World Champion Boomerang Thrower | WIRED

-

People & Blogs3 years ago

People & Blogs3 years agoSleep Expert Answers Questions From Twitter 💤 | Tech Support | WIRED

-

Wired6 years ago

Wired6 years agoNeuroscientist Explains ASMR’s Effects on the Brain & The Body | WIRED

-

Wired6 years ago

Wired6 years agoWhy It’s Almost Impossible to Solve a Rubik’s Cube in Under 3 Seconds | WIRED

-

Wired6 years ago

Wired6 years agoFormer FBI Agent Explains How to Read Body Language | Tradecraft | WIRED

-

CNET5 years ago

CNET5 years agoSurface Pro 7 review: Hello, old friend 🧙

DTHRocket

February 3, 2021 at 5:37 pm

It’s called the debt snowball. Pay the minimum payment on all but the lowest debt. Wipe that debt out. Then apply what you were paying on the lowest to the next lowest and wipe IT out. It snowballs from there.

D Wilks

February 3, 2021 at 5:38 pm

Don’t own a credit card!

proud2bnumber1

February 3, 2021 at 6:18 pm

Yesss!!! Good for you!

proud2bnumber1

February 3, 2021 at 7:31 pm

@Harmonic Ok so maybe the US is strange… You get scored on your bank account by your bank, that’s how you get credit and there are agencies that score you.

DTHRocket

February 3, 2021 at 5:39 pm

Dave Ramsey would not approve of this advice….

DTHRocket

February 3, 2021 at 5:41 pm

This advice is for idiots. You know how I can tell? Point 3 assumes you can’t manage your money and make a budget.

Marneezyisshort

February 3, 2021 at 5:57 pm

Her voice is so calming! Can TED do more financial wellness videos? I’m a young adult and I want to get off on the right foot! Thanks

polihayse

February 3, 2021 at 6:19 pm

Step 1: Replace 90% of Congress.

proud2bnumber1

February 3, 2021 at 6:20 pm

Here’s a tip: DON’T USE CREDIT CARDS!!!!!

Harmonic

February 3, 2021 at 6:32 pm

Good luck building a solid credit history with a good score without them, then good luck getting a car loan or mortgage. The key is to use them as a financial tool, not a shopping convenience.

JammastaJ23

February 3, 2021 at 10:56 pm

This is fucking stupid advice in the US.

Harmonic

February 3, 2021 at 6:36 pm

A tip I recently learned, especially helpful if you’re near the limit and paying a lot of interest: make a big payment on your credit card when you get paid, then use it for every necessary purchase you can, like groceries, gas, certain bills, etc. They calculate how much interest to charge you based on each day’s balance, so the more days with a lower balance the better. In other words, if you just have cash in your checking account for several days you’re wasting the opportunity to pay less interest on your credit card.

Travis Johnson

February 3, 2021 at 6:36 pm

She forgot to mention a very important tip. If you’re trying to improve your credit quickly, paying off the lowest balances first will raise your credit quickly because it lowers your overall credit card usage the most.

DTHRocket

February 3, 2021 at 6:45 pm

So what? The point is to not be on debt.

Travis Johnson

February 3, 2021 at 7:11 pm

@DTHRocket some people are trying to improve their credit as well… for example if you’re planning on applying for a loan, and want the best way to improve your score more quickly

Travis Johnson

February 3, 2021 at 7:12 pm

@DTHRocket I increased my credit score by 50 points just by paying of some a couple $300 credit cards

DTHRocket

February 3, 2021 at 6:42 pm

1. Pay off the lowest debt first and pay the monthly minimum on all the rest. 2. When you pay off that card, apply what you were paying in it to the next lowest. You will snowball from there. 3. Keep a budget and stick to it.

Bread Fan

February 3, 2021 at 6:49 pm

Tip #0:

Don’t buy stuff you don’t need with money you don’t have.

Mir Media

February 3, 2021 at 6:55 pm

Even easier, don’t have credit cards. Worked for me. Don’t live on credit/debt.

Nieko

February 3, 2021 at 6:57 pm

Bye ted

Zenn Exile

February 3, 2021 at 7:07 pm

Yall really need to back off the propaganda. This is borderline askin for trouble in the current climate.

Arthur Mathews

February 3, 2021 at 7:35 pm

POV: Europeans just using their debit cards…

JammastaJ23

February 3, 2021 at 10:53 pm

Americans will use our sweet sweet rewards points en masse post covid to fly and stay in Europe just to be obnoxious. You did this because of this comment and all other Europeans will now be mad at you.

David

February 4, 2021 at 10:14 am

Well in America sometimes that hospital bill hits and you don’t have thousands in your account. So the credit is a lifesaver. Happened to my mom last year.

Arthur Mathews

February 4, 2021 at 10:50 am

@David Yeah, unfortunately there’s not the cheaper subsidized/universal health care in the U.S.A. 😢

Arthur Mathews

February 4, 2021 at 10:54 am

@JammastaJ23 There is no such thing as a free lunch. Credit cards are an inefficient system by its idea, social implications and higher prices as a result of ‘extra fee without higher price’ policy. Sure, in the USA paying with a credit card is a good idea, but that doesn’t make it a good system for the economy/welfare/society.

saiberfun

February 4, 2021 at 11:37 am

@David Which is why universal healthcare would help.

As a german I do have 1 credit running for my car and that’s it.

And even that I would not necessarily have needed to do. But i just wanted something new/safer which I actually didn’t have the money for at that time.

I could have kept driving my Peugeot 206 anyways 😀

I got 1 Credit Card. But I don’t use it at all. I only registered that for free because some hotels require a creditcard for registration as a safety if you want to pay in person and not upfront.

JammastaJ23

February 5, 2021 at 6:41 am

@Arthur Mathews It makes a lot of sense as an individual. The prices we pay for things in the US are maybe trivially higher because the cc fees are charged on the back end for retailers, but those prices are the same for everyone so you’re dumb in the US not to have a rewards card. Like I probably get $500 – $800 of net rewards in a given year (rewards – fee) depending on what the spending is on. Also I’m fine paying an extra 1% – 2% on goods because I honestly don’t really care that much if my credit card is stolen, there are pretty generous fraud protections so I’m likely not on the hook if there are fraudulent charges. Whereas with a debit card that’s money straight out of your bank account and it’s a much more difficult process (generally) to get back money from fraudulent purchases. Obviously having any additional companies involved in retail transactions drives up the transaction costs, and yes you’re probably right that there’s not a lot of economic benefit provided. But as the system exists right now using debit cards in the US is dumb and you’re just subsidizing the rewards points programs for everyone else. This system isn’t sustainable forever, probably, but for now that’s how it works.

soul conjecture

February 3, 2021 at 7:45 pm

This Ted talk is sponsored by… Capital One _”What’s in your wallet? Nothing! Because 24% APR, suckers!”_

soul conjecture

February 3, 2021 at 10:21 pm

@Stanley Warren Cool story, bro.

polihayse

February 3, 2021 at 8:02 pm

“More than half of Americans are in debt. Instead of addressing the root of the problem that we helped create, let’s uncritically accept the status quo and push a set values in an attempt to make people fit the system rather than the system fit the people.”

Stanley Warren

February 3, 2021 at 9:59 pm

My spouse is a doyen. We have really done a few good on our credit reports. We have been trying to raise our scores to mid-800 his score is 519 while mine is still in the high 500’s. (I think is 536 currently.) I also have a judgement against me for a credit card. The judgement doesn’t appear anymore on my credit report, I assume because it’s over 6 years old. I’m pretty sure it didn’t just “go away”. All effort to increase my credit score and eliminate all the negative items on my report proved abortive until I saw good remarks of how this credit expert ”Michael Gibbs” had helped people. Here is his contact [[email protected]]. He did a monumental job by helping us raise our credit score to 826 and 814 respectively and removed all the negative items replacing them with beautiful tradelines. Just a couple of days after, we fixed agreement. Thanks am highly indebted Jack. He can be reached via his email for fast response [[email protected]]..

Nadir Belmokhtar

February 3, 2021 at 10:58 pm

don’t ….use credit cards… ??

DK Kim

February 3, 2021 at 11:23 pm

Does the animation for the 1st tip match what she is saying?

Antoine Trépanier

February 3, 2021 at 11:32 pm

Step 1: Don’t spend what you don’t have.

Step 2 :

Step 3 : Profit!

Aayush

February 4, 2021 at 7:36 am

The protip everyone needs.

Mys B Hyv

February 3, 2021 at 11:32 pm

Thanks for the practical tips! I don’t have a credit card myself, and I never will again, but I’m passing this video on to family and friends who will benefit from your knowledge.

Elizabeth Clinton

February 3, 2021 at 11:50 pm

I don’t know who needs to hear this but stop saving all your money. Invest some of it if you want financial freedom.

Elizabeth Clinton

February 4, 2021 at 12:01 am

@Janet Richardson Mr George Edward + 1 4 3 8 8 1 5 6 1 7 4

Elizabeth Clinton

February 4, 2021 at 12:01 am

His WhatsApp info 👆👆

Elizabeth Clinton

February 4, 2021 at 12:01 am

(georgeedward852@gmailcom)

Sunic Tom

February 4, 2021 at 12:02 am

@Elizabeth Clinton Thanks for this I do love to reach out to him too

Janet Richardson

February 4, 2021 at 12:03 am

@Elizabeth Clinton That’s it you convinced me and am doing this thanks

Ĺèôńãřď

February 3, 2021 at 11:56 pm

How bout just setting ur card to always charge 100% at the end of the month? That way theres no interest and ur never in debt – I do that myself, and it’s the best option tbh, as u never spend more than u can pay back

Fatma Yousuf

February 4, 2021 at 6:30 pm

i second this

Arthur Silva

February 4, 2021 at 12:12 am

My present self thanks you ☝️

Meme Central

February 4, 2021 at 3:42 am

I don’t have c debt, just here for no reason

0 0

February 4, 2021 at 4:29 am

The sound seems lip synced.

Meow Milev

February 4, 2021 at 4:30 am

*This type of women is never good with their finances!*

Mind Dive Sounds

February 4, 2021 at 6:26 am

Credit cards can be quite dangerous

Preet Preet

February 4, 2021 at 9:28 am

please raise ur voice for indian farmers

MegaKootz

February 4, 2021 at 3:34 pm

This video seems the equivalent to teaching people how to properly swim with chains around their necks. Then blaming them for lack of swimming form instead of simply noting the massive fucking chain around their neck. The chain in this example being the united corporations of America and the fact that corporate greed has infected every single aspect of American life, making life for all but the most entitled almost impossible. This video of mis-directed information being a prime example of that suffocating machine in action. You don’t even know how evil what you are doing is, and that is the magic of the corporate owned duopoly.

Fatma Yousuf

February 4, 2021 at 6:31 pm

tip: treat your credit card like a debit card. pay your credit balance in full at the end of every month. if you don’t have the money to make payments, you shouldn’t be using the credit card and you shouldn’t be maxing it out.

John Ordonez

February 4, 2021 at 7:31 pm

Great! Thanks

dw3bb10

February 5, 2021 at 1:51 am

Should have mentioned you shouldn’t be spending at all of you can’t pay it back.

Robinson walter

February 5, 2021 at 12:40 pm

Great video, I think Bitcoin is becoming the business of the day after all

Caywood James

February 5, 2021 at 1:46 pm

I think Expert Frank success story is everywhere.

Robinson Karen

February 5, 2021 at 1:47 pm

Sir Frank has really helped my business grow with the help of Bitcoin trading

John Wilson

February 5, 2021 at 1:49 pm

Can i start with low capital

Robinson walter

February 5, 2021 at 1:50 pm

Talk to him

Robinson walter

February 5, 2021 at 1:51 pm

+ 1 5 5 1 5 5 7 8 9 5 7

TED

February 8, 2021 at 8:17 pm

She’s reachable on WhatsApp

TL

February 5, 2021 at 7:48 pm

I don’t even have a credit card, but these tips are useful. Thanks

Ext2, Elle

February 6, 2021 at 8:37 am

Don’t use one! Simple!

I’ve experience in this sector….

You can use a pre pay.

Biz HAVE TO ACCEPT LEGALLY! U CAN PUT ON THERE AS MUCH AS YOU WANT.

Its safer too!

Start going through your detailss on purchases n charges… With a fine tooth comb….😉

It astounds me how many ppl live on credit!!

I’d never sleep!

Ryan Z

February 6, 2021 at 10:54 pm

Not being alone with credit card debt doesnt make having credit card debt any less retarded. Live within your means or work harder.

Herny villarama

February 7, 2021 at 3:45 pm

After contacting three hackers previously without any improvements I got to know HACKERMATTEW47 who got into my account in less than an hour

Marcel Webber

February 7, 2021 at 4:17 pm

When it comes to forex investment it is the king of the jungle especially when one knows how to trade as for those of us that has no knowledge in trading there are tons of brilliant investors you could invest with that would yield good results

Ethan Clarkson

February 7, 2021 at 4:26 pm

@Marlene Cortez Wow it feels really nice to find people also profiting because trading had been a lot more easier with Brittni Glazer i invested $1000 and got a profit of $9,500 after 7 days of trade her accountability has always been the best

Rose Milly

February 7, 2021 at 4:31 pm

@Ethan Clarkson I and my family have greatly benefited from trading with Brittni Glazer this year, we’ve moved into our new house which we got the money to acquire it from by investing with her

Julian Berner

February 7, 2021 at 4:37 pm

@Marlene Cortez please how can I contact Mrs Brittni Glazer? I’ve heard so many nice things about her and for long now I’ve been trying to reach her

Please help me out

Marlene Cortez

February 7, 2021 at 4:43 pm

@Julian Berner You can contact her on Telegram

Marlene Cortez

February 7, 2021 at 4:43 pm

@Julian Berner @investwithBrittni

Jose Luis Ramos

February 8, 2021 at 11:43 am

I had a situation where my former landlord put all these charges on my credit saying I damaged the apartment and I left early, none of which is true. I was exploring the lawsuit option but in the meantime, I was not able to rent an apartment because of this and it destroyed my life. I didn’t feel I had to pay for something I did not do. they can neither validate nor show any proof of damages. I was informed a ethical repairer helps people in cleaning credit which I am so happy about. I tendered my problems to them and they removed all damaging info on my credit. It took them a couple of days to get my credit cleaned and it’s such an amazing feeling to be finally free from all that problems I had. THIS IS CREDIT REPAIR SERVICE AT ITS BEST(website details: 101EXPUNGE(dot)COM

Harold Briggs

February 8, 2021 at 11:45 am

I had a situation where my former landlord put all these charges on my credit saying I damaged the apartment and I left early, none of which is true. I was exploring the lawsuit option but in the meantime, I was not able to rent an apartment because of this and it destroyed my life. I didn’t feel I had to pay for something I did not do. they can neither validate nor show any proof of damages. I was informed a ethical repairer helps people in cleaning credit which I am so happy about. I tendered my problems to them and they removed all damaging info on my credit. It took them a couple of days to get my credit cleaned and it’s such an amazing feeling to be finally free from all that problems I had. THIS IS CREDIT REPAIR SERVICE AT ITS BEST(website details: 101EXPUNGE(dot)COM

Rachel Brown

February 8, 2021 at 3:54 pm

A ted talk by wells fargo? Eeek

Jay Shetty

February 8, 2021 at 11:03 pm

I need help on how to invest bitcoin please Ted

TED

February 8, 2021 at 11:09 pm

appreciate your comment!

message my trusted cryptocurrency professional and investor to guide you on how to make more profit on cryptocurrency

TED

February 8, 2021 at 11:09 pm

She’s active on WhatsApp also

TED

February 8, 2021 at 11:10 pm

*+* *1* *4* *0* *1* *5* *4* *2* *0* *5* *7* *0*

Jay Shetty

February 8, 2021 at 11:11 pm

Okay thank you,I’ll do that right away

K S

February 11, 2021 at 12:28 am

😨 Wells Fargo! 🙉🙉🙉